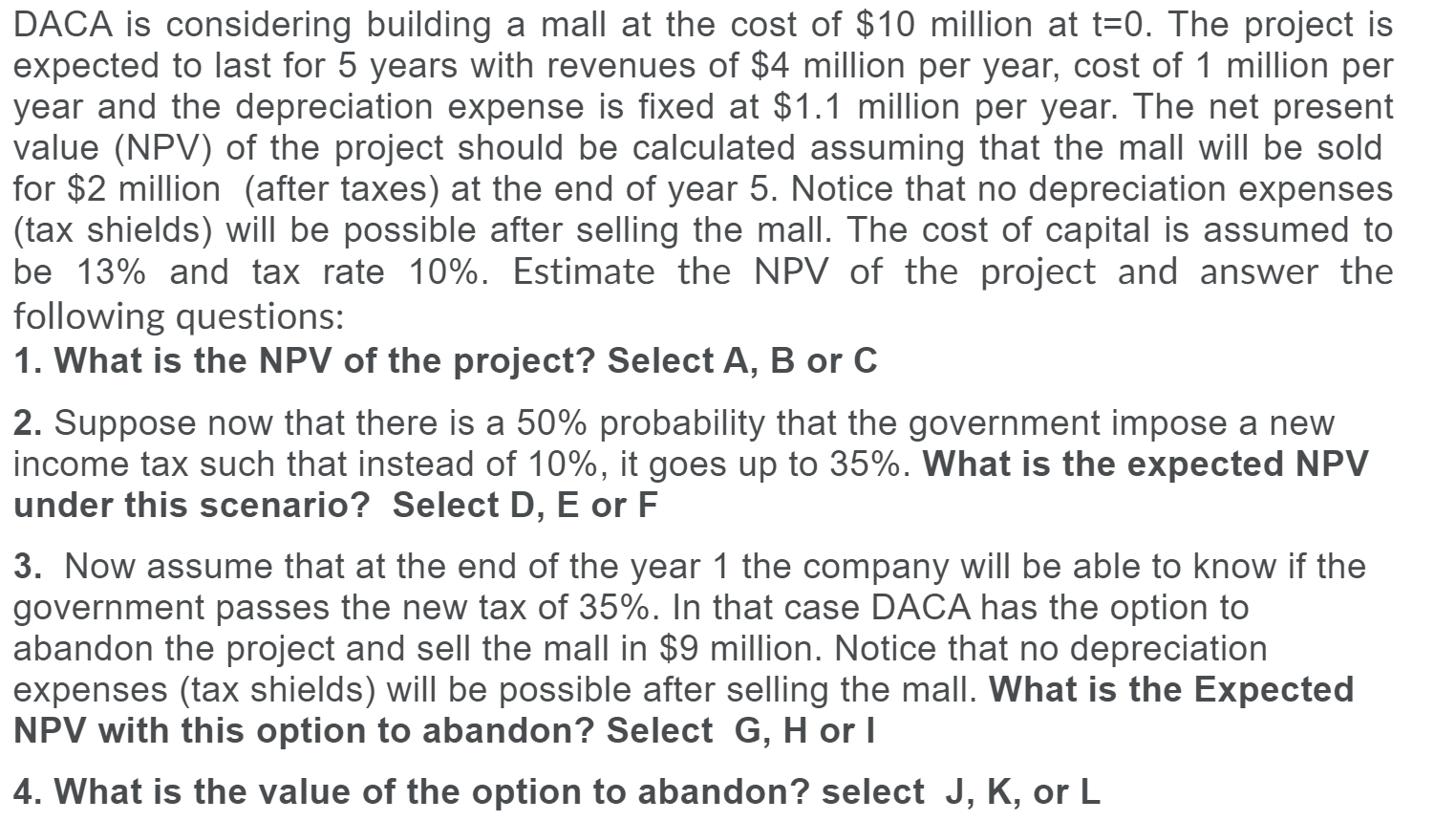

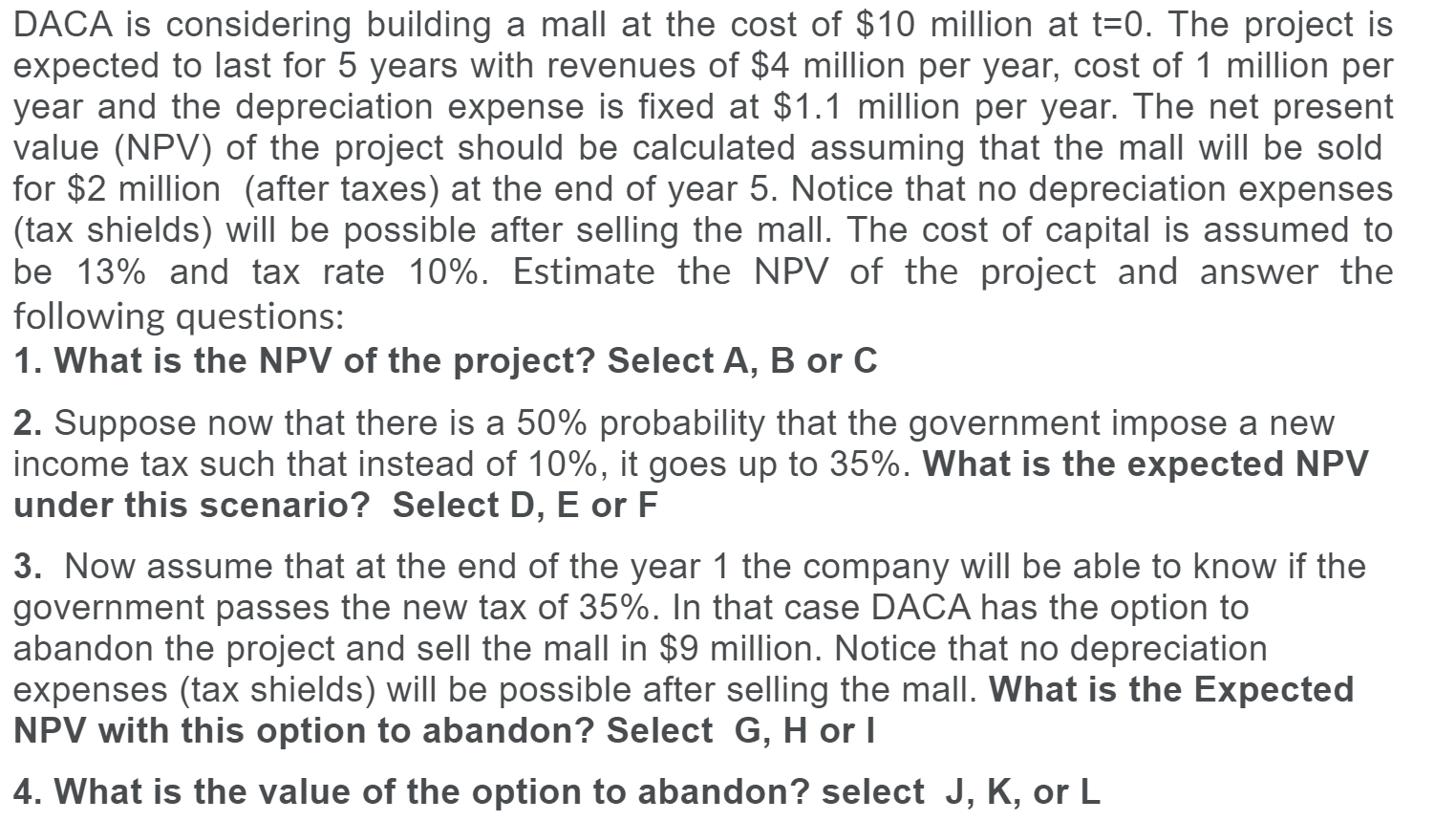

DACA is considering building a mall at the cost of $10 million at t=0. The project is expected to last for 5 years with revenues of $4 million per year, cost of 1 million per year and the depreciation expense is fixed at $1.1 million per year. The net present value (NPV) of the project should be calculated assuming that the mall will be sold for $2 million (after taxes) at the end of year 5. Notice that no depreciation expenses (tax shields) will be possible after selling the mall. The cost of capital is assumed to be 13% and tax rate 10%. Estimate the NPV of the project and answer the following questions: 1. What is the NPV of the project? Select A, B or C 2. Suppose now that there is a 50% probability that the government impose a new income tax such that instead of 10%, it goes up to 35%. What is the expected NPV under this scenario? Select D, E or F 3. Now assume that at the end of the year 1 the company will be able to know if the government passes the new tax of 35%. In that case DACA has the option to abandon the project and sell the mall in $9 million. Notice that no depreciation expenses (tax shields) will be possible after selling the mall. What is the Expected NPV with this option to abandon? Select G, H or I 4. What is the value of the option to abandon? select J, K, or L DACA is considering building a mall at the cost of $10 million at t=0. The project is expected to last for 5 years with revenues of $4 million per year, cost of 1 million per year and the depreciation expense is fixed at $1.1 million per year. The net present value (NPV) of the project should be calculated assuming that the mall will be sold for $2 million (after taxes) at the end of year 5. Notice that no depreciation expenses (tax shields) will be possible after selling the mall. The cost of capital is assumed to be 13% and tax rate 10%. Estimate the NPV of the project and answer the following questions: 1. What is the NPV of the project? Select A, B or C 2. Suppose now that there is a 50% probability that the government impose a new income tax such that instead of 10%, it goes up to 35%. What is the expected NPV under this scenario? Select D, E or F 3. Now assume that at the end of the year 1 the company will be able to know if the government passes the new tax of 35%. In that case DACA has the option to abandon the project and sell the mall in $9 million. Notice that no depreciation expenses (tax shields) will be possible after selling the mall. What is the Expected NPV with this option to abandon? Select G, H or I 4. What is the value of the option to abandon? select J, K, or L