Question

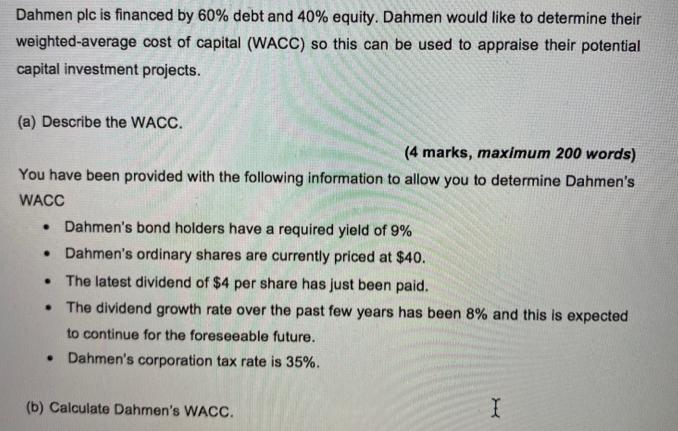

Dahmen plc is financed by 60% debt and 40% equity. Dahmen would like to determine their weighted-average cost of capital (WACC) so this can

Dahmen plc is financed by 60% debt and 40% equity. Dahmen would like to determine their weighted-average cost of capital (WACC) so this can be used to appraise their potential capital investment projects. (a) Describe the WACC. (4 marks, maximum 200 words) You have been provided with the following information to allow you to determine Dahmen's WACC Dahmen's bond holders have a required yield of 9% Dahmen's ordinary shares are currently priced at $40. The latest dividend of $4 per share has just been paid. The dividend growth rate over the past few years has been 8% and this is expected to continue for the foreseeable future. Dahmen's corporation tax rate is 35%. (b) Calculate Dahmen's WACC. I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene F. Brigham, Michael C. Ehrhardt

16th edition

1337902608, 978-1337902601

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App