Answered step by step

Verified Expert Solution

Question

1 Approved Answer

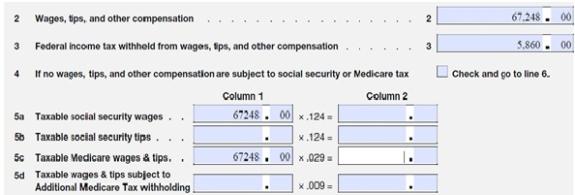

Daigneault Designs has the following amounts listed on their Form 941: What amounts belong in Column 2, Lines 5a and 5c? A) $4,169.38 and $1,950.19,respectively

Daigneault Designs has the following amounts listed on their Form 941:

What amounts belong in Column 2, Lines 5a and 5c?

A) $4,169.38 and $1,950.19,respectively

B) $4,169.28 and $975.19,respectively

C) $8,338.75 and $1,950.19,respectively

D) $8,338.75 and $975.19,respectively

2 Wages, tips, and other compensation 67.248 3 Federal income tax withheld from wages, sps, and other compensation 5,860 3 4 f no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line 6. Column 1 Column 2 Sa Taxable social security wages. 67248. 00 x.124 * Taxable social security tips. 5c Taxable Medicare wages & tips. 5d Taxable wages & tips subject to x.124 = 67248. 00 x .029 = Additional Medicare Tax withholding x.009.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Column 1 Column 2 5a Taxable social ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started