Answered step by step

Verified Expert Solution

Question

1 Approved Answer

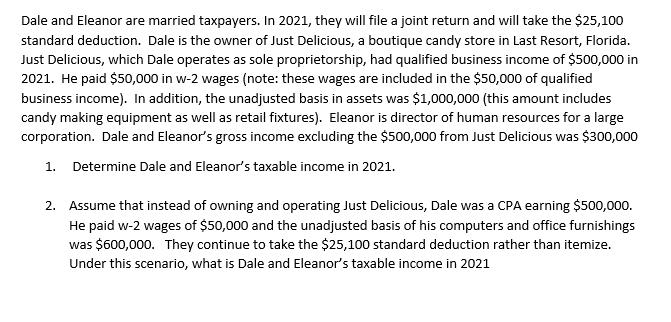

Dale and Eleanor are married taxpayers. In 2021, they will file a joint return and will take the $25,100 standard deduction. Dale is the

Dale and Eleanor are married taxpayers. In 2021, they will file a joint return and will take the $25,100 standard deduction. Dale is the owner of Just Delicious, a boutique candy store in Last Resort, Florida. Just Delicious, which Dale operates as sole proprietorship, had qualified business income of $500,000 in 2021. He paid $50,000 in w-2 wages (note: these wages are included in the $50,000 of qualified business income). In addition, the unadjusted basis in assets was $1,000,000 (this amount includes candy making equipment as well as retail fixtures). Eleanor is director of human resources for a large corporation. Dale and Eleanor's gross income excluding the $500,000 from Just Delicious was $300,000 1. Determine Dale and Eleanor's taxable income in 2021. 2. Assume that instead of owning and operating Just Delicious, Dale was a CPA earning $500,00o. He paid w-2 wages of $50,000 and the unadjusted basis of his computers and office furnishings was $600,000. They continue to take the $25,100 standard deduction rather than itemize. Under this scenario, what is Dale and Eleanor's taxable income in 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 It is assumed that depreciation on computer and ff ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started