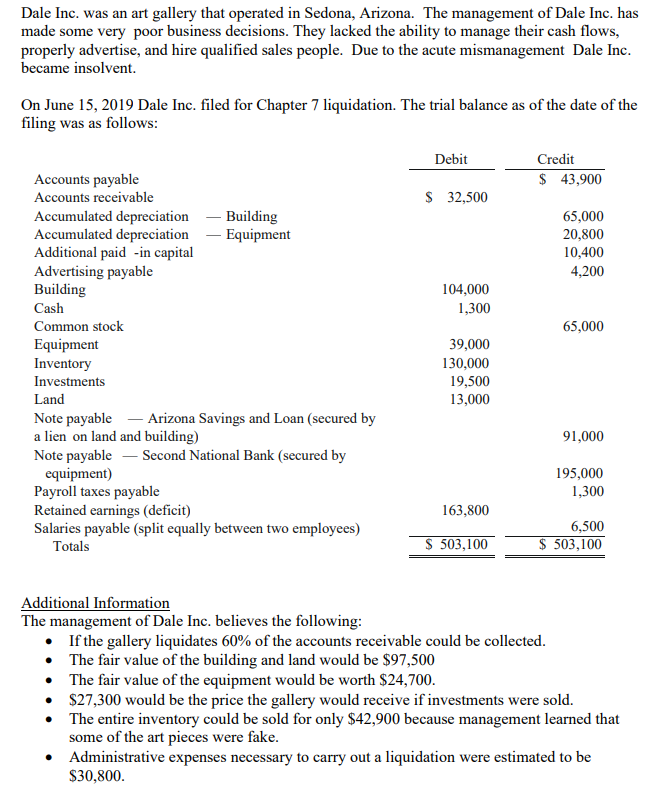

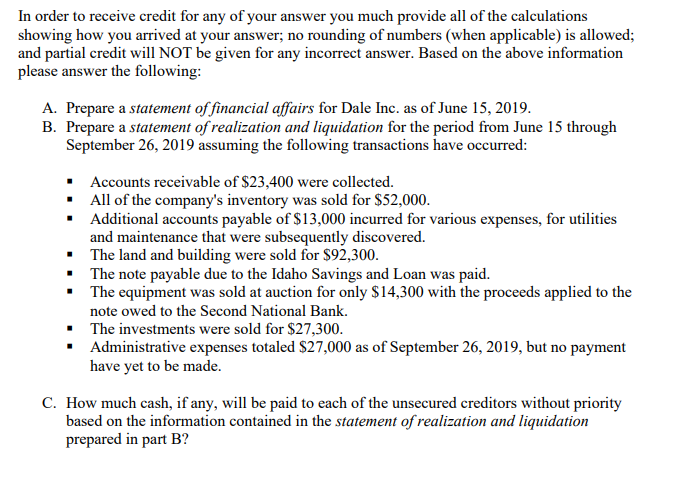

Dale Inc. was an art gallery that operated in Sedona, Arizona. The management of Dale Inc. has made some very poor business decisions. They lacked the ability to manage their cash flows, properly advertise, and hire qualified sales people. Due to the acute mismanagement Dale Inc. became insolvent. On June 15, 2019 Dale Inc. filed for Chapter 7 liquidation. The trial balance as of the date of the filing was as follows: Debit Credit $ 43,900 $ 32,500 65,000 20,800 10,400 4,200 104,000 1,300 65,000 Accounts payable Accounts receivable Accumulated depreciation - Building Accumulated depreciation - Equipment Additional paid -in capital Advertising payable Building Cash Common stock Equipment Inventory Investments Land Note payable Arizona Savings and Loan (secured by a lien on land and building) Note payable Second National Bank (secured by equipment) Payroll taxes payable Retained earnings (deficit) Salaries payable (split equally between two employees) Totals 39,000 130,000 19,500 13,000 91,000 195,000 1,300 163,800 6,500 $ 503,100 S 503,100 Additional Information The management of Dale Inc. believes the following: If the gallery liquidates 60% of the accounts receivable could be collected. The fair value of the building and land would be $97,500 The fair value of the equipment would be worth $24,700. $27,300 would be the price the gallery would receive if investments were sold. The entire inventory could be sold for only $42,900 because management learned that some of the art pieces were fake. Administrative expenses necessary to carry out a liquidation were estimated to be $30,800. In order to receive credit for any of your answer you much provide all of the calculations showing how you arrived at your answer; no rounding of numbers (when applicable) is allowed; and partial credit will NOT be given for any incorrect answer. Based on the above information please answer the following: A. Prepare a statement of financial affairs for Dale Inc. as of June 15, 2019. B. Prepare a statement of realization and liquidation for the period from June 15 through September 26, 2019 assuming the following transactions have occurred: Accounts receivable of $23,400 were collected. All of the company's inventory was sold for $52,000. . Additional accounts payable of $13,000 incurred for various expenses, for utilities and maintenance that were subsequently discovered. The land and building were sold for $92,300. . The note payable due to the Idaho Savings and Loan was paid. The equipment was sold at auction for only $14,300 with the proceeds applied to the note owed to the Second National Bank. The investments were sold for $27,300. Administrative expenses totaled $27,000 as of September 26, 2019, but no payment have yet to be made. C. How much cash, if any, will be paid to each of the unsecured creditors without priority based on the information contained in the statement of realization and liquidation prepared in part B? Dale Inc. was an art gallery that operated in Sedona, Arizona. The management of Dale Inc. has made some very poor business decisions. They lacked the ability to manage their cash flows, properly advertise, and hire qualified sales people. Due to the acute mismanagement Dale Inc. became insolvent. On June 15, 2019 Dale Inc. filed for Chapter 7 liquidation. The trial balance as of the date of the filing was as follows: Debit Credit $ 43,900 $ 32,500 65,000 20,800 10,400 4,200 104,000 1,300 65,000 Accounts payable Accounts receivable Accumulated depreciation - Building Accumulated depreciation - Equipment Additional paid -in capital Advertising payable Building Cash Common stock Equipment Inventory Investments Land Note payable Arizona Savings and Loan (secured by a lien on land and building) Note payable Second National Bank (secured by equipment) Payroll taxes payable Retained earnings (deficit) Salaries payable (split equally between two employees) Totals 39,000 130,000 19,500 13,000 91,000 195,000 1,300 163,800 6,500 $ 503,100 S 503,100 Additional Information The management of Dale Inc. believes the following: If the gallery liquidates 60% of the accounts receivable could be collected. The fair value of the building and land would be $97,500 The fair value of the equipment would be worth $24,700. $27,300 would be the price the gallery would receive if investments were sold. The entire inventory could be sold for only $42,900 because management learned that some of the art pieces were fake. Administrative expenses necessary to carry out a liquidation were estimated to be $30,800. In order to receive credit for any of your answer you much provide all of the calculations showing how you arrived at your answer; no rounding of numbers (when applicable) is allowed; and partial credit will NOT be given for any incorrect answer. Based on the above information please answer the following: A. Prepare a statement of financial affairs for Dale Inc. as of June 15, 2019. B. Prepare a statement of realization and liquidation for the period from June 15 through September 26, 2019 assuming the following transactions have occurred: Accounts receivable of $23,400 were collected. All of the company's inventory was sold for $52,000. . Additional accounts payable of $13,000 incurred for various expenses, for utilities and maintenance that were subsequently discovered. The land and building were sold for $92,300. . The note payable due to the Idaho Savings and Loan was paid. The equipment was sold at auction for only $14,300 with the proceeds applied to the note owed to the Second National Bank. The investments were sold for $27,300. Administrative expenses totaled $27,000 as of September 26, 2019, but no payment have yet to be made. C. How much cash, if any, will be paid to each of the unsecured creditors without priority based on the information contained in the statement of realization and liquidation prepared in part B