Dales Hot Rods

Dale Tallon is an automotive enthusiast. He has over 25 years of experience working as a mechanic for the dealership of a large car manufacturer in Thunder Bay. Dale also gained experience doing minor bodywork and painting.

Recently, Dale decided to retire from the car dealership and pursue his interest in restoring classic American muscle cars. Accordingly, Dale started Dales Hot Rods (DHR). Dale leased an industrial building and converted it into a repair and body shop. The buildings land has a small parking lot that is used to showcase the restored vehicles that are for sale.

Generally, Dale selects the classic muscle car that DHR will be restored and then places them for sale to the general public in the lot. Dale also posts his vehicles to various internet sales sites, frequents car shows, and uses the classifieds of local newspapers to market his inventory. DHR also takes custom requests, whereby, an individual can request the car to be restored.

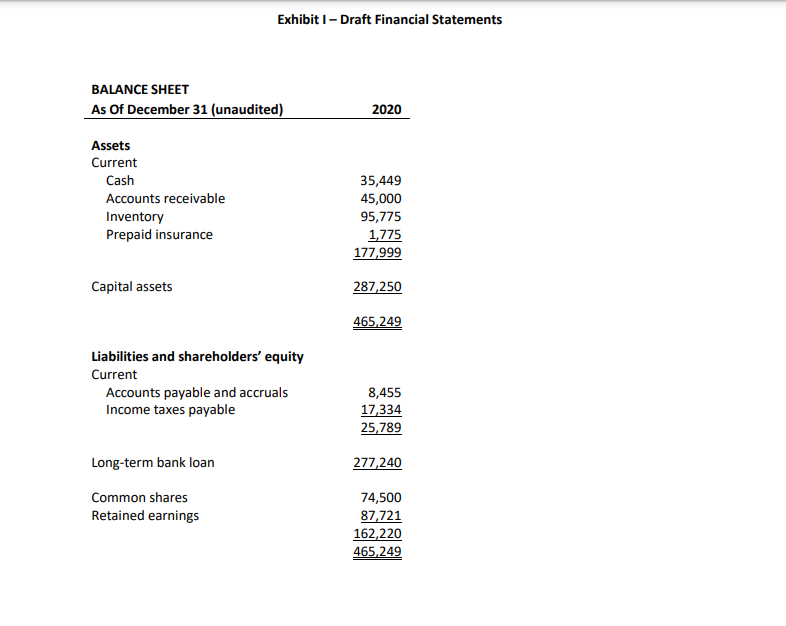

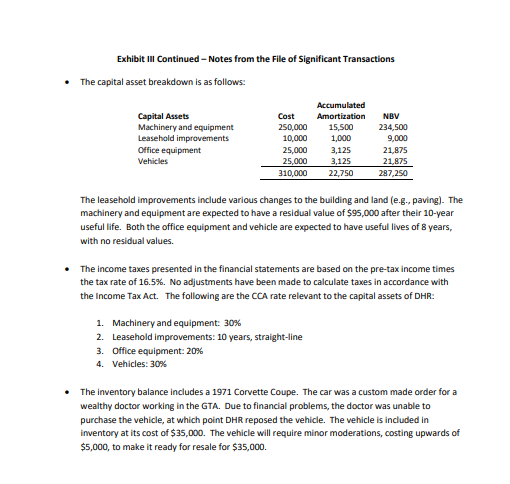

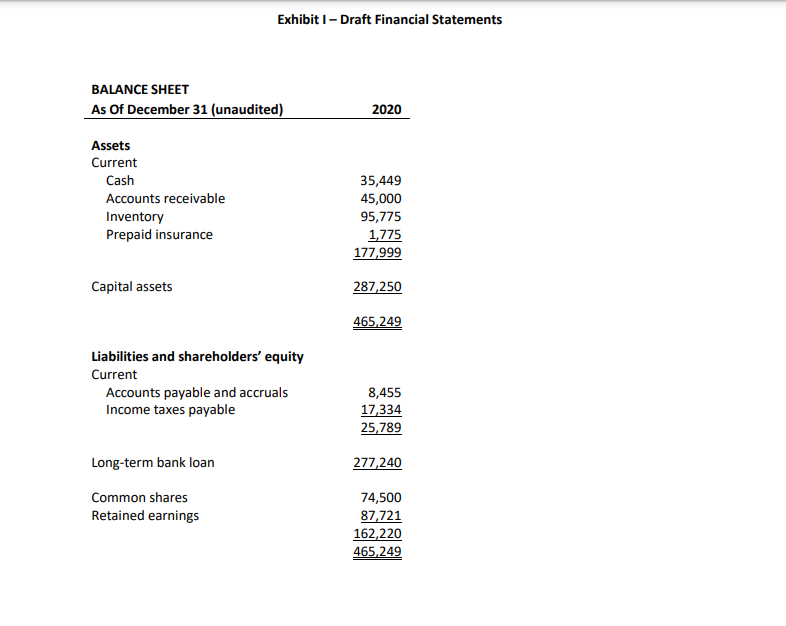

DHR has a December 31, 2020 year-end, and just completed their first year of operations. Dale had a friend help him compile financial statements for the year-end (draft financial statements can be found in Exhibit I). DHRs bank requires the preparation of annual audited financial statements (detail of the loan agreement can be found in Exhibit II) and the auditors are scheduled to commence year-end work on January 18, 2021.

Realizing that DHR needs accounting assistance, Dale has hired you, CPA, as a consultant on December 24, 2020. Your first task is to review the draft financial statements and provide any recommendations to comply with IFRS. Also, Dale required some assistance in preparing a Statement of Cash Flow. Dale has provided you with a file for review which outlines all of the significant transactions that have taken place during the year (Exhibit III).

Aside from the year-end statements, Dale would also like to know whether he will be able to pay any dividends in the current year. He has drawn a minimal salary and is hoping to supplement his income by paying a $35,000 dividend with the current cash balance.

Finally, Dale has asked you to provide some advice regarding the additional controls or procedures that could be implemented to improve the day to day operations of the company.

Required Dale has asked you to prepare a report that discusses all of the material accounting issues (i.e., identify the issues, discuss the implications, offer alternative treatments, and provide a recommendation). Revised financial statements should be included in the report. The report should also address Dales other concerns. Provide journal entries, where appropriate.

Exhibit II

Bank Loan Agreement Thunder Bay Credit Union has provided a $300,000 loan to help finance working capital and capital assets. The following are the terms and conditions of the loan.

Security: the bank secures its loan with the first claim against inventory and accounts receivable.

Repayment: The loan is to be repaid over 10 years, with blended monthly payments.

Interest rate: The rate of interest is 6%.

Covenants: DHR must comply with the following covenants: o The current ratio must not be below 2:1 o The debt to equity ratio must not exceed 3:1. Debt is defined as both current and longterm liabilities. A violation of either covenant will result in the loan becoming payable upon demand.

Financial Statements: Audited financial statements are to be presented no later than 60 days after year-end. Financial statements must be prepared with IFRS.

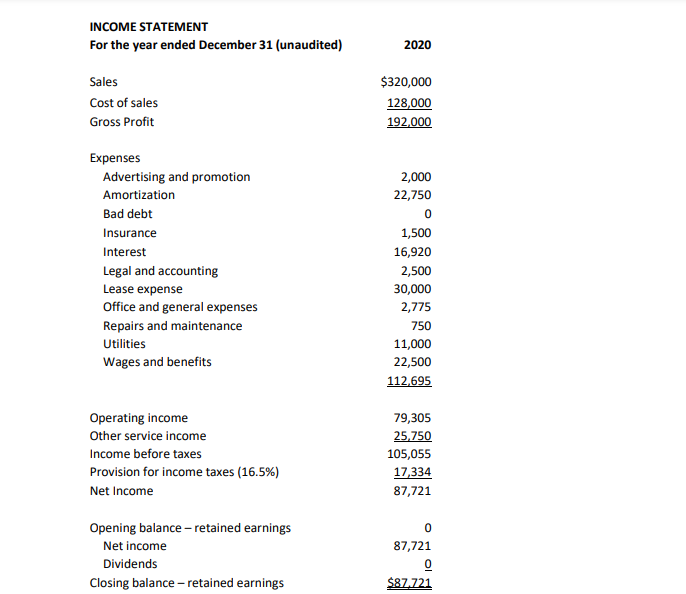

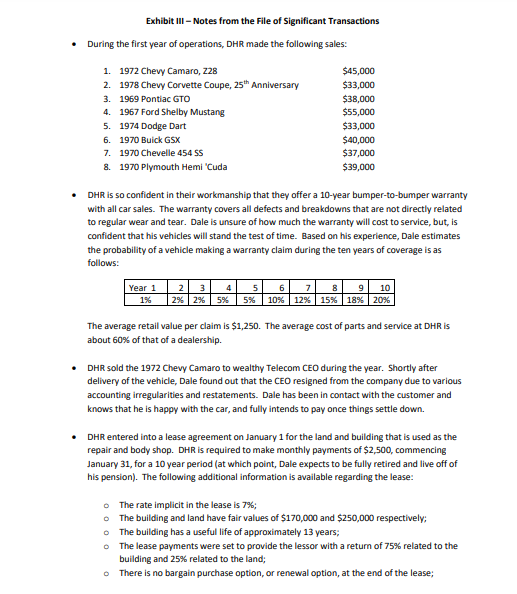

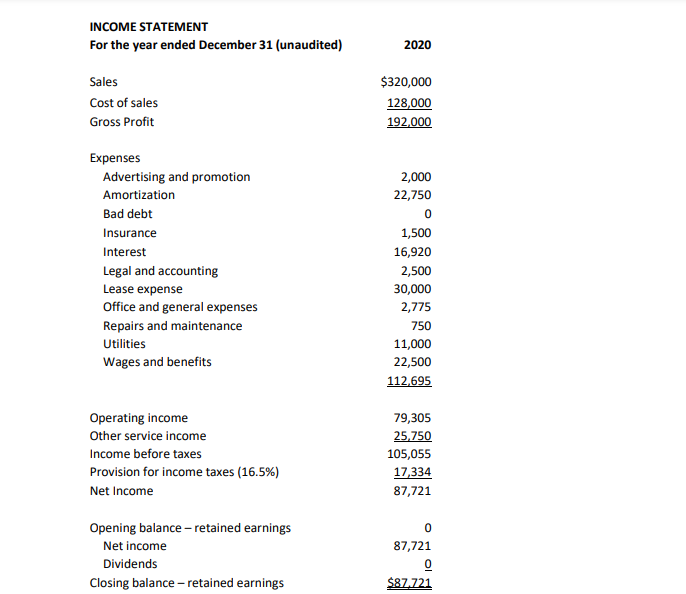

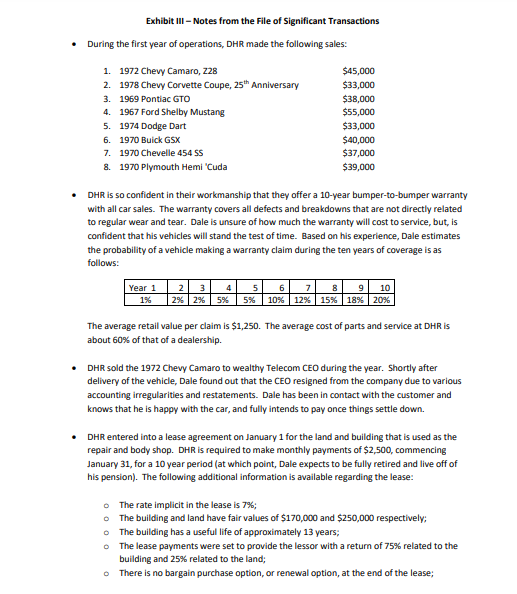

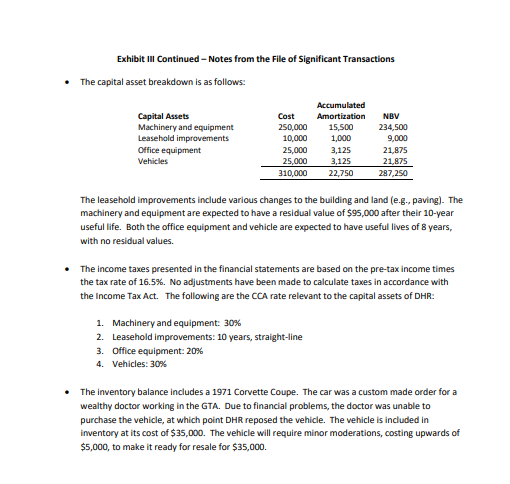

Exhibit 1 - Draft Financial Statements BALANCE SHEET As of December 31 (unaudited) 2020 Assets Current Cash Accounts receivable Inventory Prepaid insurance 35,449 45,000 95,775 1.775 177,999 Capital assets 287,250 465,249 Liabilities and shareholders' equity Current Accounts payable and accruals Income taxes payable 8,455 17,334 25,789 Long-term bank loan 277,240 Common shares Retained earnings 74,500 87,721 162,220 465,249 INCOME STATEMENT For the year ended December 31 (unaudited) 2020 Sales Cost of sales Gross Profit $320,000 128,000 192,000 Expenses Advertising and promotion Amortization Bad debt Insurance Interest Legal and accounting Lease expense Office and general expenses Repairs and maintenance Utilities Wages and benefits 2,000 22,750 0 1,500 16,920 2,500 30,000 2,775 750 11,000 22,500 112,695 Operating income Other service income Income before taxes Provision for income taxes (16.5%) Net Income 79,305 25,750 105,055 17,334 87,721 Opening balance - retained earnings Net income Dividends Closing balance - retained earnings 0 87,721 0 $87.721 Exhibit III - Notes from the File of Significant Transactions . During the first year of operations, DHR made the following sales: 1. 1972 Chevy Camaro, 228 $45,000 2. 1978 Chevy Corvette Coupe, 25th Anniversary $33,000 3. 1969 Pontiac GTO $38,000 4. 1967 Ford Shelby Mustang $55,000 5. 1974 Dodge Dart $33,000 6. 1970 Buick GSX $40,000 7. 1970 Chevelle 454 SS $37,000 8. 1970 Plymouth Hemi 'Cuda $39,000 DHR is so confident in their workmanship that they offer a 10-year bumper-to-bumper warranty with all car sales. The warranty covers all defects and breakdowns that are not directly related to regular wear and tear. Dale is unsure of how much the warranty will cost to service, but, is confident that his vehicles will stand the test of time. Based on his experience, Dale estimates the probability of a vehicle making a warranty claim during the ten years of coverage is as follows: Year 1 1% 2 3 45 2% 2% 5% 5% 6 9 10 10% 12% 15% 18% 20% The average retail value per claim is $1,250. The average cost of parts and service at DHR is about 60% of that of a dealership DHR sold the 1972 Chevy Camaro to wealthy Telecom CEO during the year. Shortly after delivery of the vehicle, Dale found out that the CEO resigned from the company due to various accounting irregularities and restatements. Dale has been in contact with the customer and knows that he is happy with the car, and fully intends to pay once things settle down. DHR entered into a lease agreement on January 1 for the land and building that is used as the repair and body shop. DHR is required to make monthly payments of $2,500, commencing January 31, for a 10 year period (at which point, Dale expects to be fully retired and live off of his pension). The following additional information is available regarding the lease: The rate implicit in the lease is 7% The building and land have fair values of $170,000 and $250,000 respectively; The building has a useful life of approximately 13 years; The lease payments were set to provide the lessor with a return of 75% related to the building and 25% related to the land; There is no bargain purchase option, or renewal option, at the end of the lease; Exhibit II Continued - Notes from the File of Significant Transactions The capital asset breakdown is as follows: Capital Assets Machinery and equipment Leasehold improvements Office equipment Vehicles Cost 250,000 10,000 25,000 25,000 310,000 Accumulated Amortization 15,500 1,000 3,125 3,125 22,750 NBV 234,500 9,000 21.875 21,875 287,250 The leasehold improvements include various changes to the building and land (e.g., paving). The machinery and equipment are expected to have a residual value of $95,000 after their 10-year useful life. Both the office equipment and vehicle are expected to have useful lives of 8 years, with no residual values. The income taxes presented in the financial statements are based on the pre-tax income times the tax rate of 16.5%. No adjustments have been made to calculate taxes in accordance with the Income Tax Act. The following are the CCA rate relevant to the capital assets of DHR: 1. Machinery and equipment: 30% 2. Leasehold improvements: 10 years, straight-line 3. Office equipment: 20% 4. Vehicles: 30% The inventory balance includes a 1971 Corvette Coupe. The car was a custom made order for a wealthy doctor working in the GTA. Due to financial problems, the doctor was unable to purchase the vehicle, at which point DHR reposed the vehicle. The vehicle is included in inventory at its cost of $35,000. The vehicle will require minor moderations, costing upwards of $5,000, to make it ready for resale for $35,000. Exhibit 1 - Draft Financial Statements BALANCE SHEET As of December 31 (unaudited) 2020 Assets Current Cash Accounts receivable Inventory Prepaid insurance 35,449 45,000 95,775 1.775 177,999 Capital assets 287,250 465,249 Liabilities and shareholders' equity Current Accounts payable and accruals Income taxes payable 8,455 17,334 25,789 Long-term bank loan 277,240 Common shares Retained earnings 74,500 87,721 162,220 465,249 INCOME STATEMENT For the year ended December 31 (unaudited) 2020 Sales Cost of sales Gross Profit $320,000 128,000 192,000 Expenses Advertising and promotion Amortization Bad debt Insurance Interest Legal and accounting Lease expense Office and general expenses Repairs and maintenance Utilities Wages and benefits 2,000 22,750 0 1,500 16,920 2,500 30,000 2,775 750 11,000 22,500 112,695 Operating income Other service income Income before taxes Provision for income taxes (16.5%) Net Income 79,305 25,750 105,055 17,334 87,721 Opening balance - retained earnings Net income Dividends Closing balance - retained earnings 0 87,721 0 $87.721 Exhibit III - Notes from the File of Significant Transactions . During the first year of operations, DHR made the following sales: 1. 1972 Chevy Camaro, 228 $45,000 2. 1978 Chevy Corvette Coupe, 25th Anniversary $33,000 3. 1969 Pontiac GTO $38,000 4. 1967 Ford Shelby Mustang $55,000 5. 1974 Dodge Dart $33,000 6. 1970 Buick GSX $40,000 7. 1970 Chevelle 454 SS $37,000 8. 1970 Plymouth Hemi 'Cuda $39,000 DHR is so confident in their workmanship that they offer a 10-year bumper-to-bumper warranty with all car sales. The warranty covers all defects and breakdowns that are not directly related to regular wear and tear. Dale is unsure of how much the warranty will cost to service, but, is confident that his vehicles will stand the test of time. Based on his experience, Dale estimates the probability of a vehicle making a warranty claim during the ten years of coverage is as follows: Year 1 1% 2 3 45 2% 2% 5% 5% 6 9 10 10% 12% 15% 18% 20% The average retail value per claim is $1,250. The average cost of parts and service at DHR is about 60% of that of a dealership DHR sold the 1972 Chevy Camaro to wealthy Telecom CEO during the year. Shortly after delivery of the vehicle, Dale found out that the CEO resigned from the company due to various accounting irregularities and restatements. Dale has been in contact with the customer and knows that he is happy with the car, and fully intends to pay once things settle down. DHR entered into a lease agreement on January 1 for the land and building that is used as the repair and body shop. DHR is required to make monthly payments of $2,500, commencing January 31, for a 10 year period (at which point, Dale expects to be fully retired and live off of his pension). The following additional information is available regarding the lease: The rate implicit in the lease is 7% The building and land have fair values of $170,000 and $250,000 respectively; The building has a useful life of approximately 13 years; The lease payments were set to provide the lessor with a return of 75% related to the building and 25% related to the land; There is no bargain purchase option, or renewal option, at the end of the lease; Exhibit II Continued - Notes from the File of Significant Transactions The capital asset breakdown is as follows: Capital Assets Machinery and equipment Leasehold improvements Office equipment Vehicles Cost 250,000 10,000 25,000 25,000 310,000 Accumulated Amortization 15,500 1,000 3,125 3,125 22,750 NBV 234,500 9,000 21.875 21,875 287,250 The leasehold improvements include various changes to the building and land (e.g., paving). The machinery and equipment are expected to have a residual value of $95,000 after their 10-year useful life. Both the office equipment and vehicle are expected to have useful lives of 8 years, with no residual values. The income taxes presented in the financial statements are based on the pre-tax income times the tax rate of 16.5%. No adjustments have been made to calculate taxes in accordance with the Income Tax Act. The following are the CCA rate relevant to the capital assets of DHR: 1. Machinery and equipment: 30% 2. Leasehold improvements: 10 years, straight-line 3. Office equipment: 20% 4. Vehicles: 30% The inventory balance includes a 1971 Corvette Coupe. The car was a custom made order for a wealthy doctor working in the GTA. Due to financial problems, the doctor was unable to purchase the vehicle, at which point DHR reposed the vehicle. The vehicle is included in inventory at its cost of $35,000. The vehicle will require minor moderations, costing upwards of $5,000, to make it ready for resale for $35,000