Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dallas, a 44-year-old taxpayer, earned $80,000 in wages. What is the maximum contribution he can make to his 401(k) plan in 2022? $6,000 $7,000 $20,500

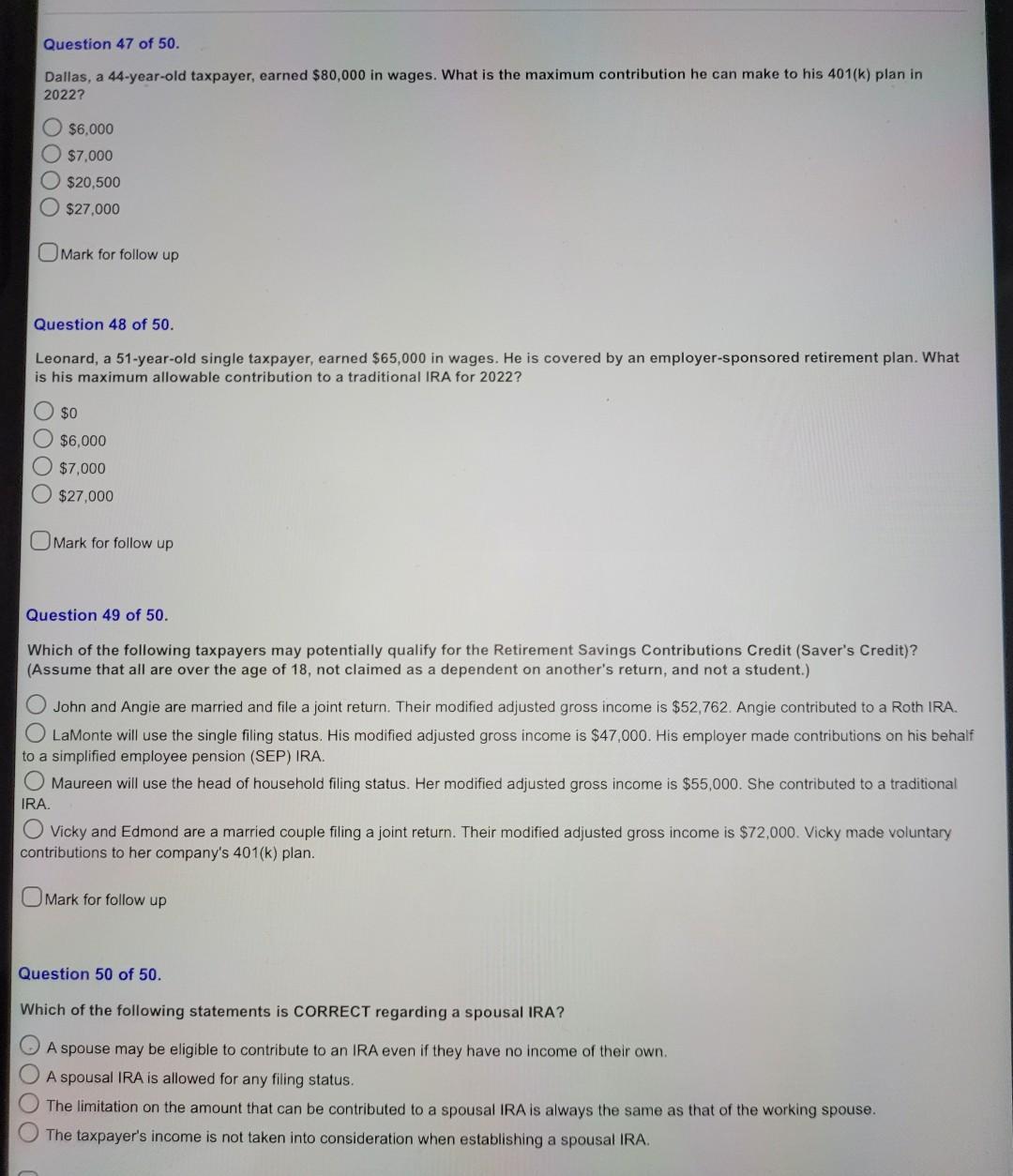

Dallas, a 44-year-old taxpayer, earned $80,000 in wages. What is the maximum contribution he can make to his 401(k) plan in 2022? $6,000 $7,000 $20,500 $27,000 Mark for follow up Question 48 of 50 . Leonard, a 51 -year-old single taxpayer, earned $65,000 in wages. He is covered by an employer-sponsored retirement plan. What is his maximum allowable contribution to a traditional IRA for 2022? $0 $6,000 $7,000 $27,000 Mark for follow up Question 49 of 50 . Which of the following taxpayers may potentially qualify for the Retirement Savings Contributions Credit (Saver's Credit)? (Assume that all are over the age of 18 , not claimed as a dependent on another's return, and not a student.) John and Angie are married and file a joint return. Their modified adjusted gross income is $52,762. Angie contributed to a Roth IRA. LaMonte will use the single filing status. His modified adjusted gross income is $47,000. His employer made contributions on his behalf to a simplified employee pension (SEP) IRA. Maureen will use the head of household filing status. Her modified adjusted gross income is $55,000. She contributed to a traditional IRA. Vicky and Edmond are a married couple filing a joint return. Their modified adjusted gross income is $72,000. Vicky made voluntary contributions to her company's 401(k) plan. Mark for follow up Question 50 of 50 . Which of the following statements is CORRECT regarding a spousal IRA? A spouse may be eligible to contribute to an IRA even if they have no income of their own. A spousal IRA is allowed for any filing status. The limitation on the amount that can be contributed to a spousal IRA is always the same as that of the working spouse. The taxpayer's income is not taken into consideration when establishing a spousal IRA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started