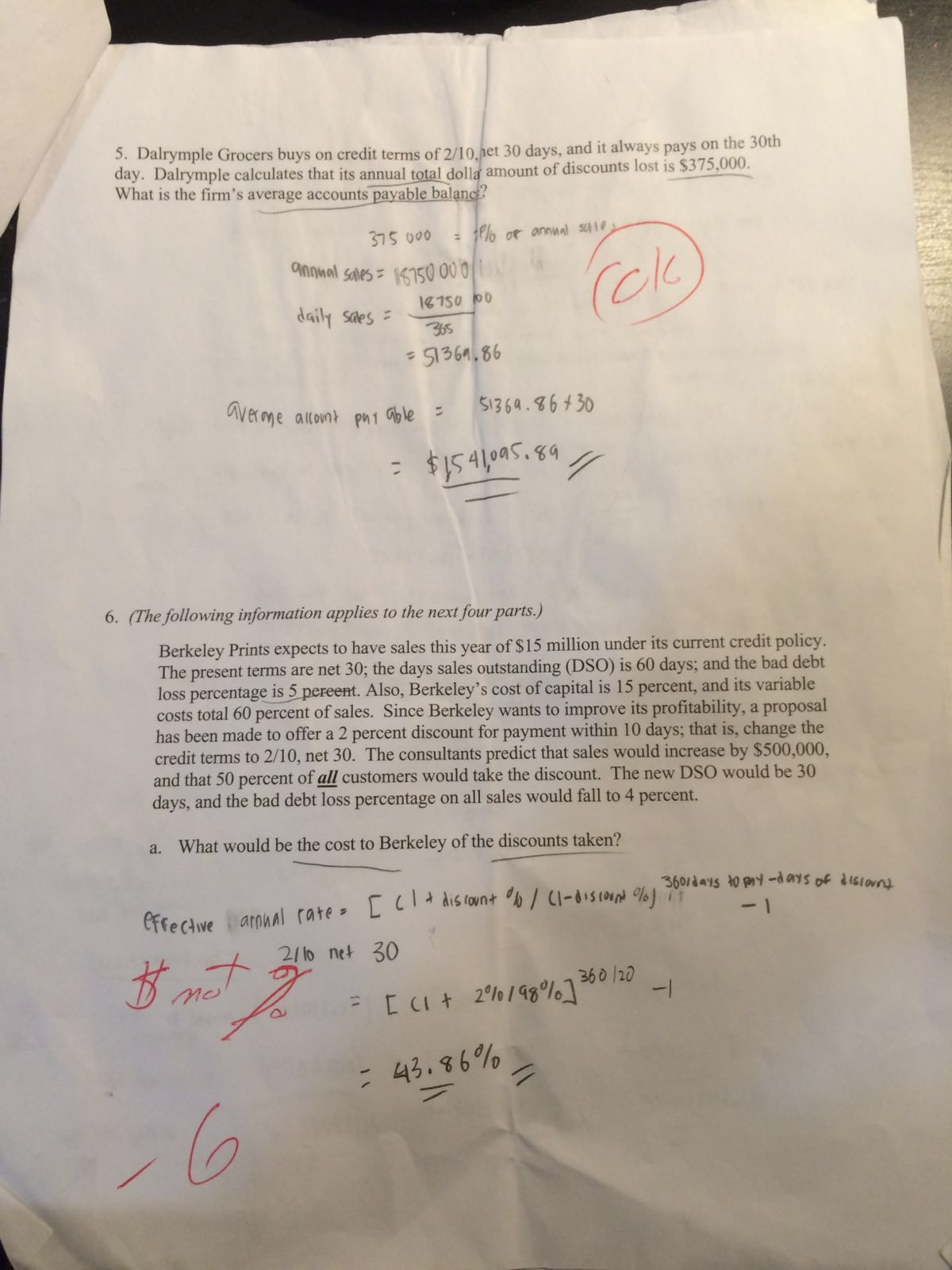

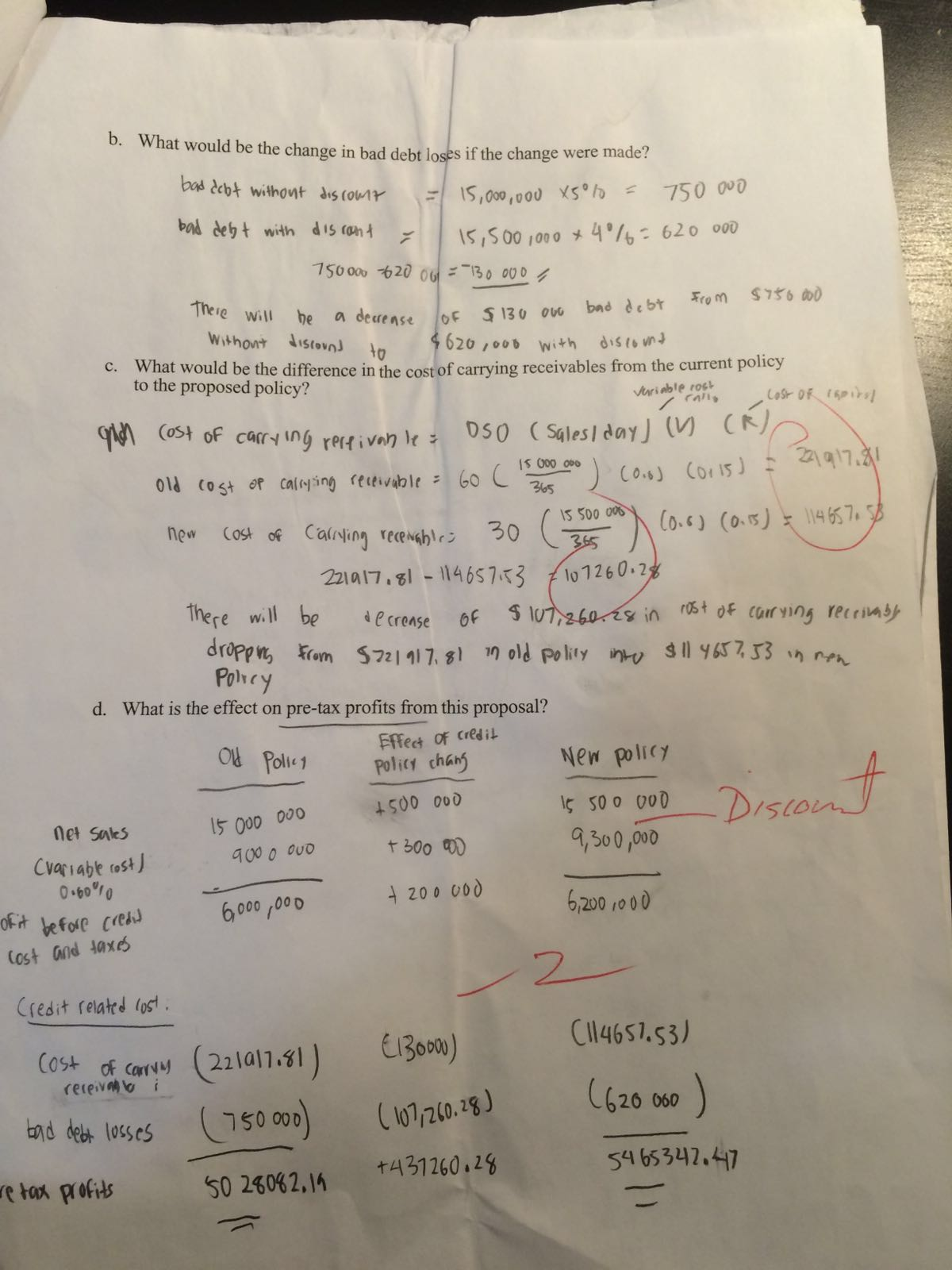

Dalrymple Grocers buys on credit terms of 2/10, let 30 days and it always pays on the 30th day. Dalrymple calculates that its annual total dollar amount of discounts lost is $375,000. What is the firm's average accounts payable balance? 375 000 = annual sales annual sales = 18750 000 daily sales = 18750 000/365 = 51369.86 average account payable = 51369.86 times 30 = $1,541,095.89 (The following information applies to the next four parts.) Berkeley Prints expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Berkeley's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Berkeley wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent. What would be the cost to Berkeley of the discounts taken? effective annaul rate = [(1 + discount% / (1 - discount%)^360/days to pay - days of discount_-1 2/10 net 30 = [(1 + 2%/98%]^360/20_-1 = 43. 86% What would be the change in bad debt loses if the change were made? bad debt without discount = 15,000,000 times 5% = 750 000 bad debt with discount = 15,500,000 times 4% = 620 000 750 000 - 620 000 = 130 000 There will be a decrease of $130 000 bad debt From $750 000 without discount to $620, 000 with discount What would be the difference in the cost of carrying receivables from the current policy to the proposed policy? Cost of carrying receivable = DSO (sales/day) (V) (R) old cost of carring receivable = 60(15 000 000/365) (0.6) (0.15) = 221917.81 new cost of carring receivable = 30(15 000 000/365) (0.6) (0.15) = 114657.58 221917.81 - 114657.58 = 107260.28 There will be decrease of $107,260.28 in cost of curring receiable dropping from in old policy into $11 465.53 in new policy What is the effect on pre-tax profits from this proposal