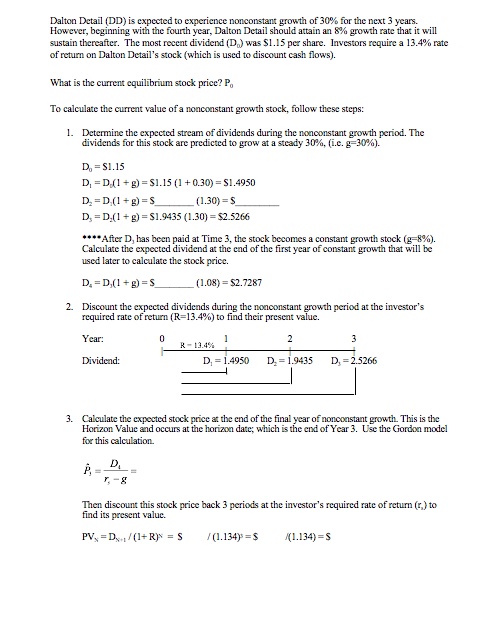

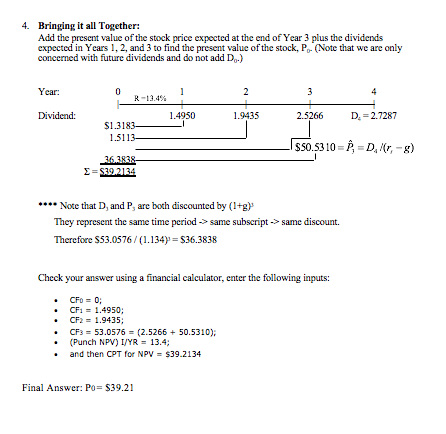

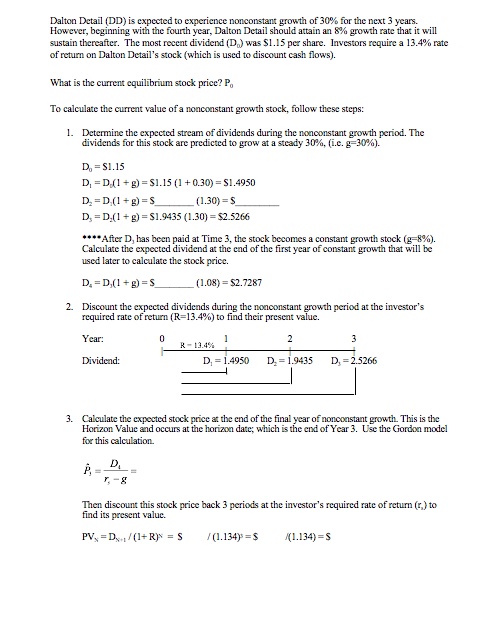

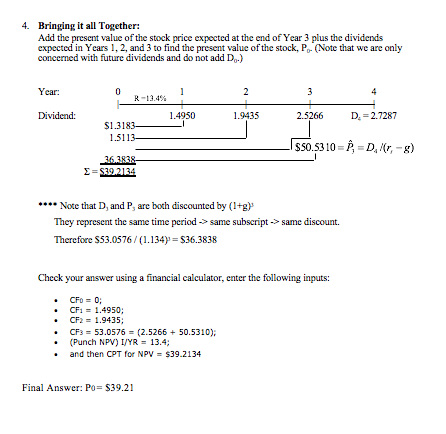

Dalton Detail (DD) is expected to experience nonconstant growth of 30% for the next 3 years. However, beginning with the fourth year, Dalton Detail should attain an 8% growth rate that it will sustain thereafter. The most recent dividend (D.) was $1.15 per share. Investors require a 13.4% rate of return on Dalton Detail's stock (which is used to discount cash flows). What is the current equilibrium stock price? P, To calculate the current value of a nonconstant growth stock, follow these steps: 1. Determine the expected stream of dividends during the nonconstant growth period. The dividends for this stock are predicted to grow at a steady 30%, (i.c. g=30%). D-S1.15 D. =D (1 +9)= 1.15 (1 +0.30) = $1.4950 DED(1 +9)=$ (1.30) D. = D. (1+) = $1.9435 (1.30) = $2.5266 ****After D, has been paid at Time 3, the stock becomes a constant growth stock (=8%). Calculate the expected dividend at the end of the first year of constant growth that will be used later to calculate the stock price. D. =D,(1 +9)= (1.08) 52.7287 2. Discount the expected dividends during the non constant growth period at the investor's required rate of return (R=13.4%) to find their present value. Year: 0 1 2 3 Dividend: D = 1.4950 D. = 1.9435 D = 2.5266 3. Calculate the expected stock price at the end of the final year of nonconstant growth. This is the Horizon Value and occurs at the horizon date, which is the end of Year 3. Use the Gordon model for this calculation D. i Then discount this stock price back 3 periods at the investor's required rate of return ((.) to find its present value. PV, D/(1+R) = S (1.134) $ (1.134) =$ 4. Bringing it all Together: Add the present value of the stock price expected at the end of Year 3 plus the dividends expected in Years 1, 2, and 3 to find the present value of the stock, P. (Note that we are only concerned with future dividends and do not add D.) Year: 0 1 2 3 Dividend: 1.4950 1.9435 2.5266 D. = 2.7287 $1.3183- 1.5113- $50.53 10 =,=D.Ar-8) 36.3838 =$39.2134 **** Note that D, and P, are both discounted by (1+g) They represent the same time period ->same subscript -> same discount. Therefore $53.0576/(1.134) = $36.3838 Check your answer using a financial calculator, enter the following inputs: CFO = 0; CF1 = 1.4950; CF2 = 1.9435 CF3 = 53.0576 = (2.5266 + 50.5310); (Punch NPV) I/YR = 13.4; and then CPT for NPV = $39.2134 Final Answer: Po= $39.21