Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DAM 7. Both the managing director and regional manager of Trail Ltd have the benefit of the use of company cars which may also be

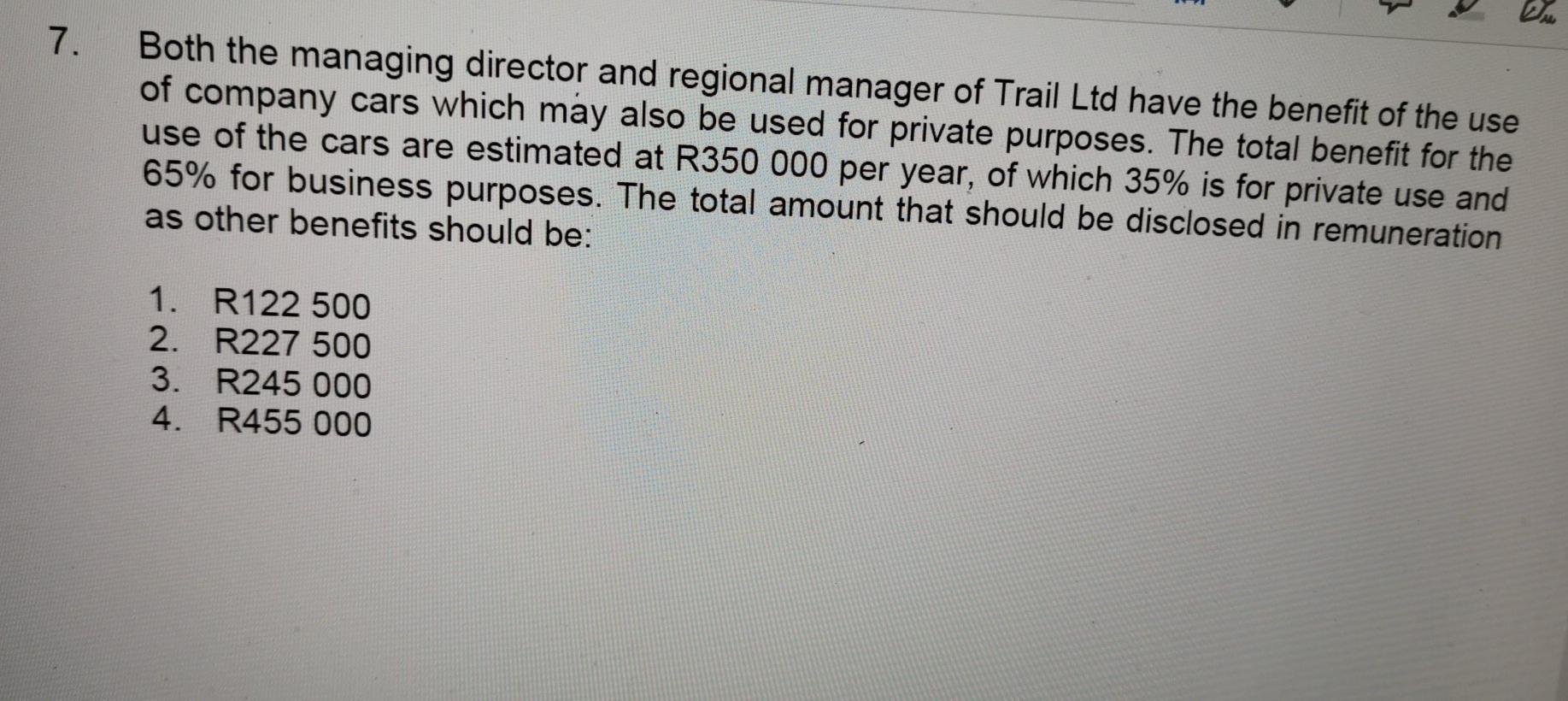

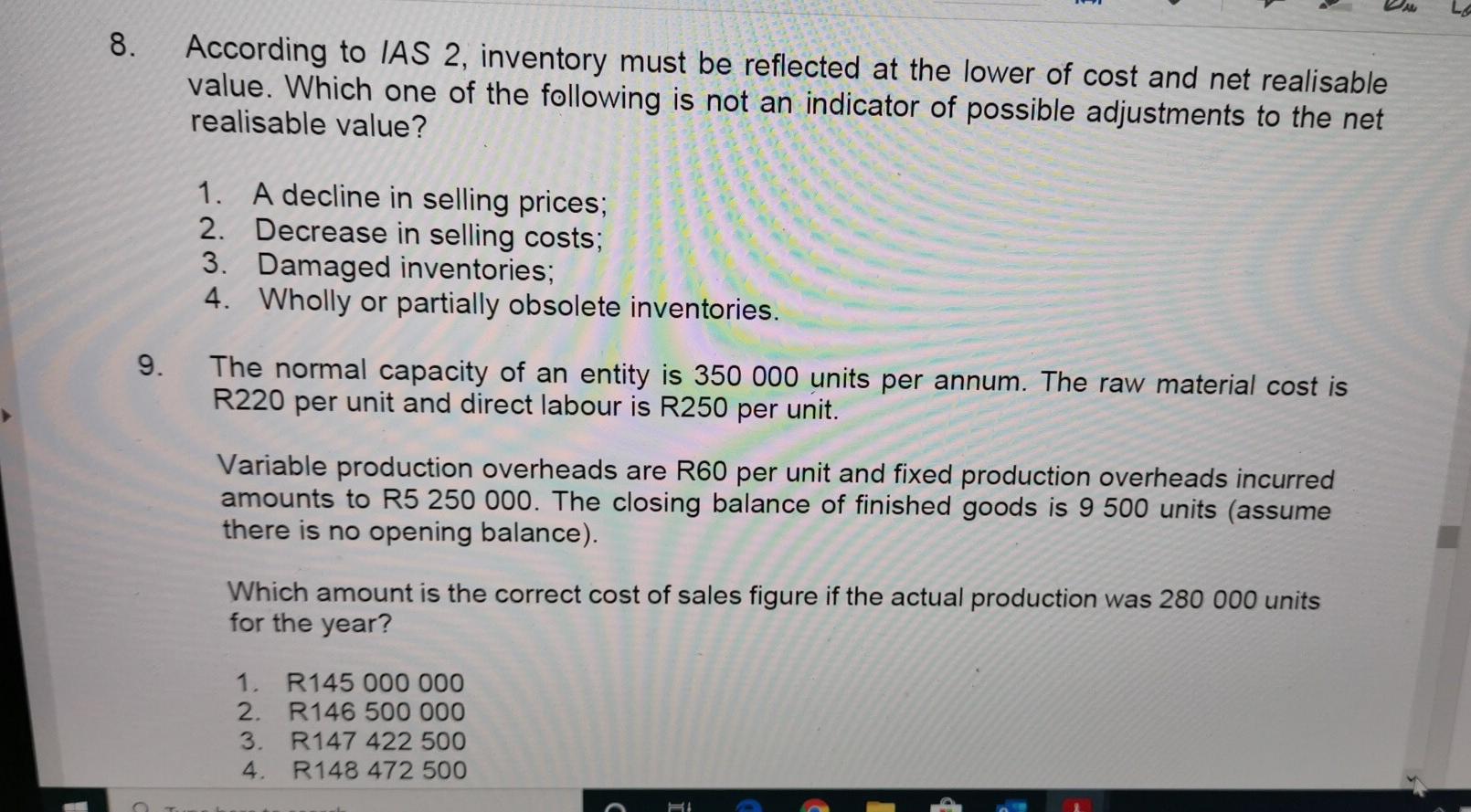

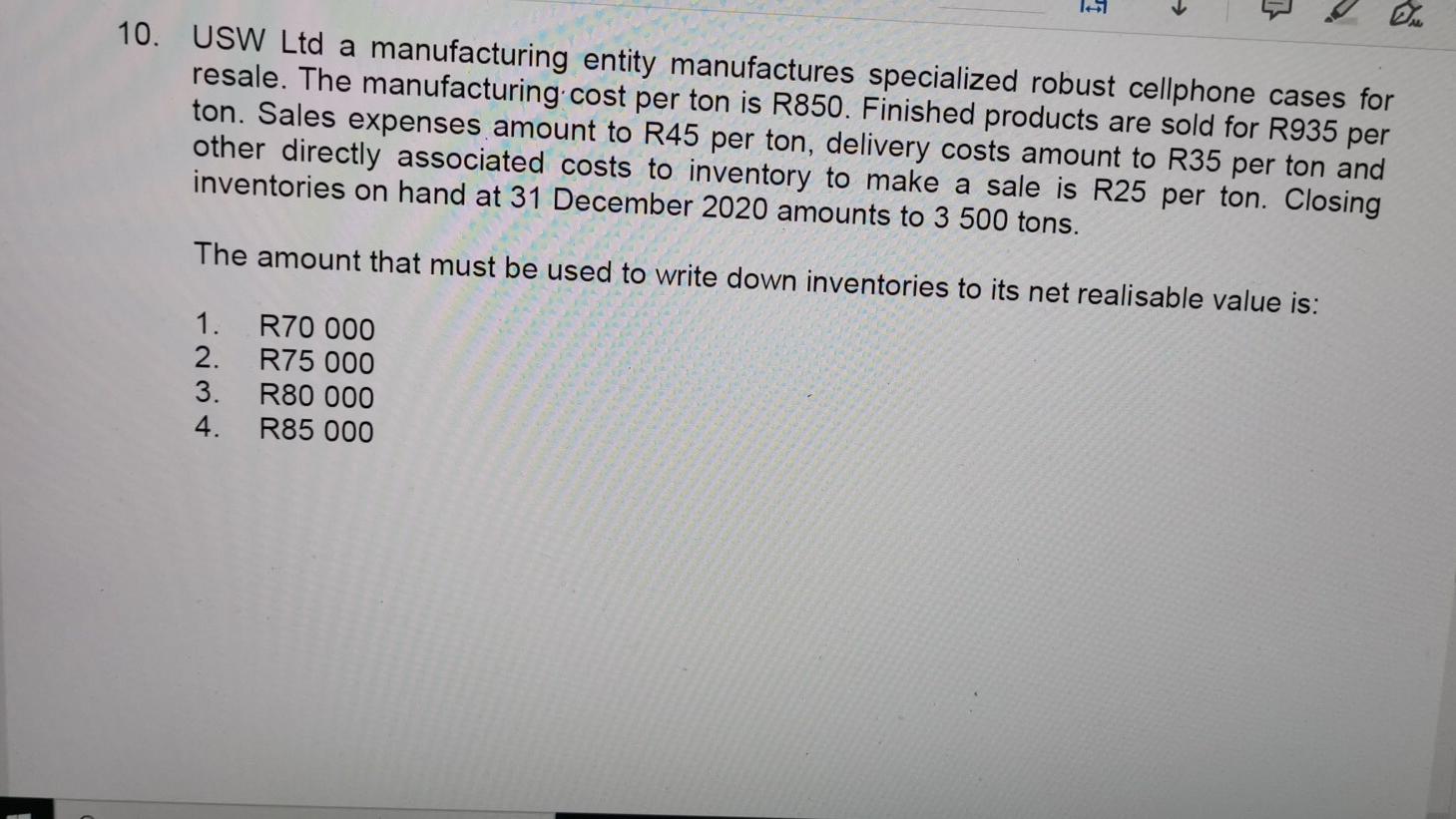

DAM 7. Both the managing director and regional manager of Trail Ltd have the benefit of the use of company cars which may also be used for private purposes. The total benefit for the use of the cars are estimated at R350 000 per year, of which 35% is for private use and 65% for business purposes. The total amount that should be disclosed in remuneration as other benefits should be: 1. R122 500 2. R227 500 3. R245 000 4. R455 000 8. According to IAS 2, inventory must be reflected at the lower of cost and net realisable value. Which one of the following is not an indicator of possible adjustments to the net realisable value? 1. A decline in selling prices; 2. Decrease in selling costs; 3. Damaged inventories; 4. Wholly or partially obsolete inventories. 9. The normal capacity of an entity is 350 000 units per annum. The raw material cost is R220 per unit and direct labour is R250 per unit. Variable production overheads are R60 per unit and fixed production overheads incurred amounts to R5 250 000. The closing balance of finished goods is 9 500 units (assume there is no opening balance). Which amount is the correct cost of sales figure if the actual production was 280 000 units for the year? 1. R145 000 000 2. R146 500 000 3. R147 422 500 4 R148 472 500 11 10. USW Ltd a manufacturing entity manufactures specialized robust cellphone cases for resale. The manufacturing cost per ton is R850. Finished products are sold for R935 per ton. Sales expenses amount to R45 per ton, delivery costs amount to R35 per ton and other directly associated costs to inventory to make a sale is R25 per ton. Closing inventories on hand at 31 December 2020 amounts to 3 500 tons. The amount that must be used to write down inventories to its net realisable value is: 1. R70 000 2. R75 000 3. R80 000 4. R85 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started