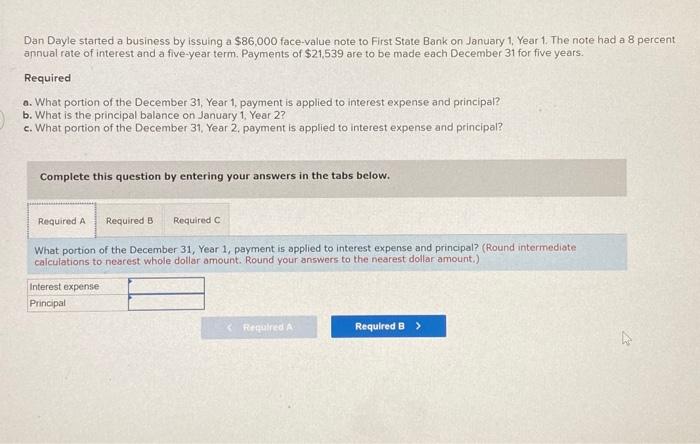

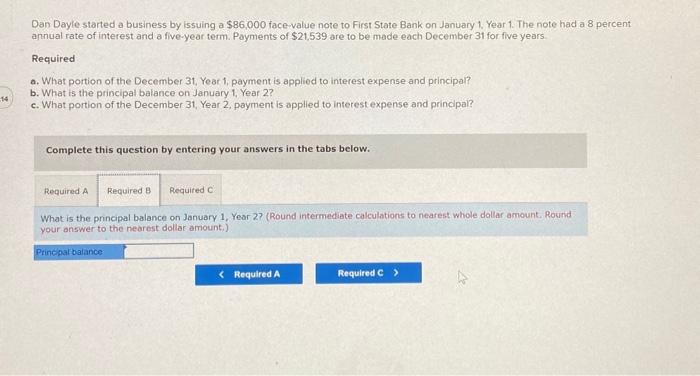

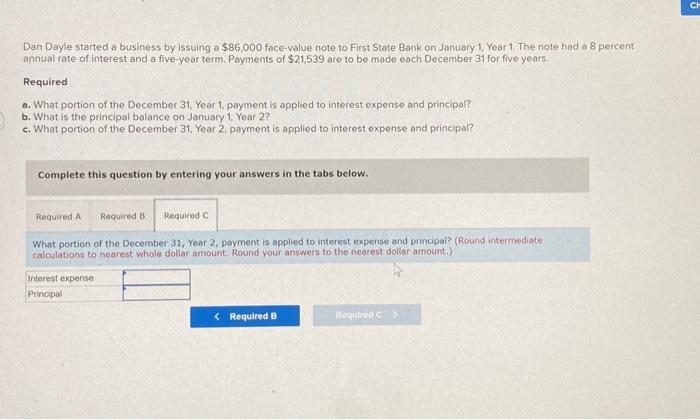

Dan Dayle started a business by issuing a $86,000 face-value note to First State Bank on January 1, Year 1. The note had a 8 percent annual rate of interest and a five-year term. Payments of $21,539 are to be made each December 31 for five years. Required a. What portion of the December 31, Year 1, payment is applied to interest expense and principal? b. What is the principal balance on January 1, Year 2 ? c. What portion of the December 31, Year 2, payment is applied to interest expense and principal? Complete this question by entering your answers in the tabs below. What portion of the December 31 , Year 1 , payment is applied to interest expense and principal? (Round intermediate calculations to nearest whole dollar amount. Round your answers to the nearest dollar amount.) Dan Dayle started a business by issuing a $86,000 face-value note to First State Bank on January 1. Year 1. The note had a 8 percent apnual rate of interest and a five-year term. Payments of $21,539 are to be made each December 31 for five years Required a. What portion of the December 31, Yeat 1, payment is applied to interest expense and principal? b. What is the principal balance on January 1 , Year 2? c. What portion of the December 31, Year 2, payment is applied to interest expense and princlpai? Complete this question by entering your answers in the tabs below. What is the principal balance on January 1, Year 27 (Round intermediate calculations to nearest whole dollar amount. Round your onswer to the nearest dollar amount.) Dan Dayle started a business by issuing a $86,000 face-value note to First State Bank on January 1 , Year 1 . The note had a 8 percent annual rate of interest and a five-year term. Payments of $21,539 are to be made each December 31 for five years. Required a. What portion of the December 31, Year 1, payment is applied to interest expense and principal? b. What is the principal balance on January 1 , Year 2 ? c. What portion of the December 31 , Year 2, payment is applied to interest expense and principal? Complete this question by entering your answers in the tabs below. Whot portion of the December 31, Year 2, payment is applied to interest expense and principar? (Round intermediate calculations to nearest whole dollar amount. Round your answers to the nearest dollor amount.)