Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment 2 01 (50 marks) Dan & Eric have been friends since high school, they then left the country for the neighboring South Africa,

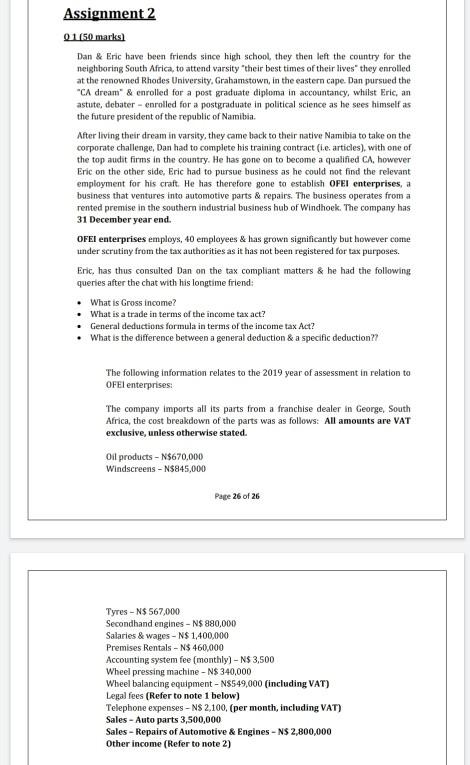

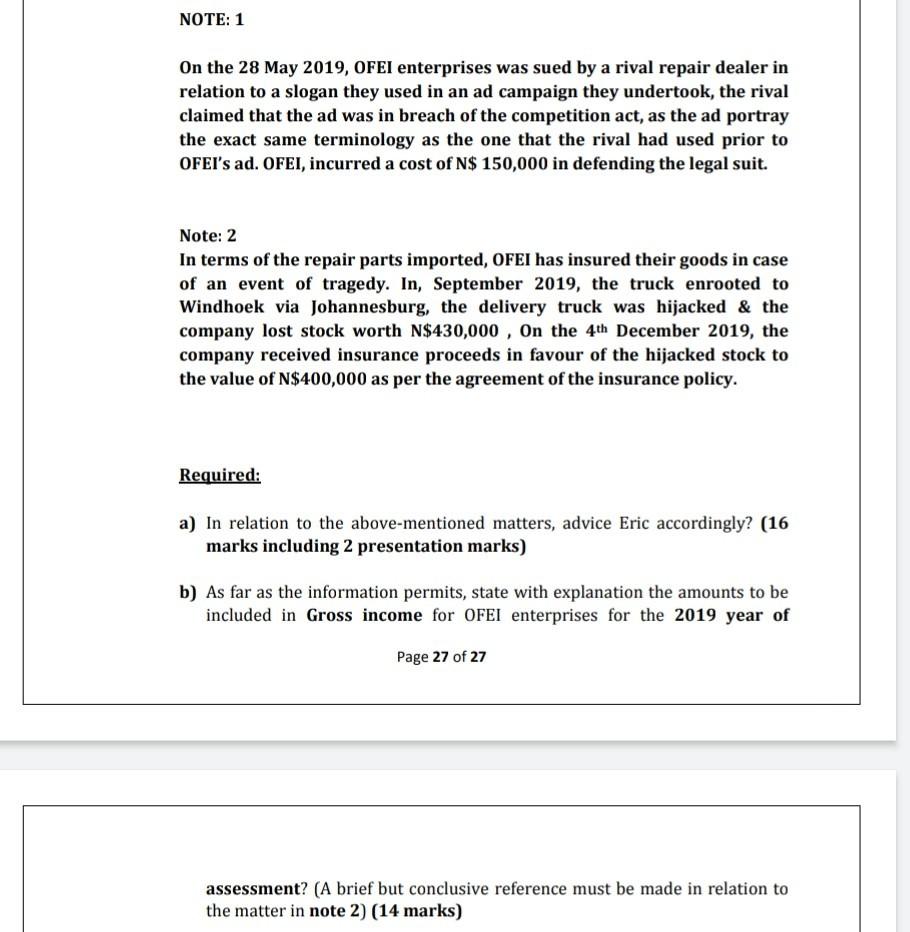

Assignment 2 01 (50 marks) Dan & Eric have been friends since high school, they then left the country for the neighboring South Africa, to attend varsity "their best times of their lives" they enrolled at the renowned Rhodes University, Grahamstown, in the eastern cape. Dan pursued the "CA dream" & enrolled for a post graduate diploma in accountancy, whilst Eric, an astute, debater - enrolled for a postgraduate in political science as he sees himself as the future president of the republic of Namibia. After living their dream in varsity, they came back to their native Namibia to take on the corporate challenge, Dan had to complete his training contract (i.e. articles), with one of the top audit firms in the country. He has gone on to become a qualified CA, however Eric on the other side, Eric had to pursue business as he could not find the relevant employment for his craft. He has therefore gone to establish OFEI enterprises, a business that ventures into automotive parts & repairs. The business operates from a rented premise in the southern industrial business hub of Windhoek. The company has 31 December year end. OFEI enterprises employs, 40 employees & has grown significantly but however come under scrutiny from the tax authorities as it has not been registered for tax purposes. Eric, has thus consulted Dan on the tax compliant matters & he had the following queries after the chat with his longtime friend: . What is Gross income? What is a trade in terms of the income tax act? General deductions formula in terms of the income tax Act? What is the difference between a general deduction & a specific deduction?? The following information relates to the 2019 year of assessment in relation to OFEI enterprises: The company imports all its parts from a franchise dealer in George, South Africa, the cost breakdown of the parts was as follows: All amounts are VAT exclusive, unless otherwise stated. Oil products - N$670,000 Windscreens - N$845,000 Page 26 of 26 Tyres N$ 567,000 Secondhand engines - N$ 880,000 Salaries & wages - N$ 1,400,000 Premises Rentals - N$ 460,000 Accounting system fee (monthly) - N$ 3,500 Wheel pressing machine - N$ 340,000 Wheel balancing equipment - NS549,000 (including VAT) Legal fees (Refer to note 1 below) Telephone expenses - NS 2,100, (per month, including VAT) Sales - Auto parts 3,500,000 Sales - Repairs of Automotive & Engines - N$ 2,800,000 Other income (Refer to note 2) NOTE: 1 On the 28 May 2019, OFEI enterprises was sued by a rival repair dealer in relation to a slogan they used in an ad campaign they undertook, the rival claimed that the ad was in breach of the competition act, as the ad portray the exact same terminology as the one that the rival had used prior to OFEI's ad. OFEI, incurred a cost of N$ 150,000 in defending the legal suit. Note: 2 In terms of the repair parts imported, OFEI has insured their goods in case of an event of tragedy. In, September 2019, the truck enrooted to Windhoek via Johannesburg, the delivery truck was hijacked & the company lost stock worth N$430,000, On the 4th December 2019, the company received insurance proceeds in favour of the hijacked stock to the value of N$400,000 as per the agreement of the insurance policy. Required: a) In relation to the above-mentioned matters, advice Eric accordingly? (16 marks including 2 presentation marks) b) As far as the information permits, state with explanation the amounts to be included in Gross income for OFEI enterprises for the 2019 year of Page 27 of 27 assessment? (A brief but conclusive reference must be made in relation to the matter in note 2) (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Gross income is the revenue generated from a businesss sales and services Gross income also known as gross profit pretax income or beforetax income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started