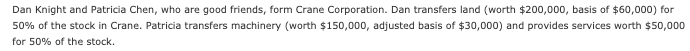

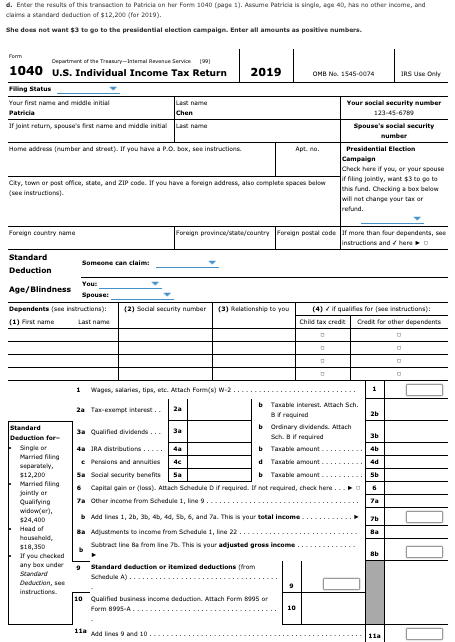

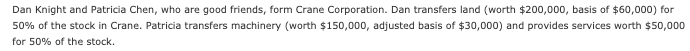

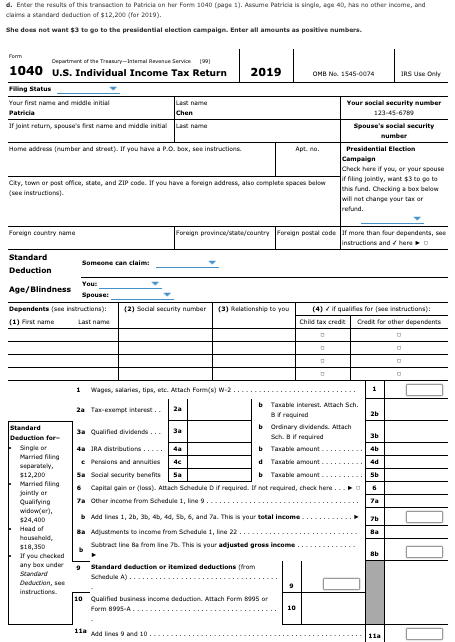

Dan Knight and Patricia Chen, who are good friends, form Crane Corporation. Dan transfers land (worth $200,000, basis of $60,000) for 50% of the stock in Crane. Patricia transfers machinery (worth $150,000, adjusted basis of $30,000) and provides services worth $50,000 for 50% of the stock. d. Enter the results of this transaction to Patricia on her Form 1040 (page 1). Assume Patricia is single, age 40, has no other income, and claims a standard deduction of $12,200 (for 2019). She does not want $3 to go to the presidential election campaign. Enter all amounts as positive numbers. 2019 OMB No. 1545-0074 IRS Use Only Department of the Treasury Internal Revenue Service 1991 1040 U.S. Individual Income Tax Return Filing Status Your first name and middle initial Last nam Patricia Chen I joint return, Spouse's first name and middle initial Last name Home address number and strat). If you have a P.O.box, see instructions Apt.no Your social security number 123-45-6789 Spouse's social security number Presidential Election Campaign Check here if you, or your spouse ir filing jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions Foreign country name Foreign province/State/country Foreign postal code for more than four dependents, see instructions and here Standard Someone can claim Deduction Your Age/Blindness Spouse: Dependents (see instructions): (2) Social security number (3) Relationship to you (4) il qualifies for see instructions): (1) First name Last name Child tax credit Credit for other dependents 1 2b 3b 4d 1 Wages, salaries, tips, etc. Altach Forms) W-2. 2a 2a Tax-exempt interest .. Taxable interest. Allach Sch. Brequired b Ordinary dividends. Attach 3a Qualified dividendi... 3a Sch. Bif required 4a IRA distribution Taxable amount e Persons and annuities 46 d Taxable amount Sa Social security benefits Sa b Taxable amount 6 Capital gain or (a). Altach Schedule Dif required. If not required, check here za Other income from Schedule 1, line 9 Add lines 1, 2, 3, 4, 4, 5, 6, and 7a. This is your total income sa Adjustments to income from Schedule 1, line 22.. Subtractine Bafromines. This is your adjusted gross income Sb standard Deduction for Single or Married ning separately $12,200 Married filing jointly or Qualifying widower) $24,400 Head of household $18,350 If you checked any box under Standard Deduction, see instructions 7a 7b Bb 9 Standard deduction or itemized deductions from Schedule A) 9 10 Qualified business income deduction. Attach Form 8995 or Form 8995 A 10 11a Add lines 9 and 10. 11a