Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 Dana Taxpayer is a surviving spouse. Her husband Jim passed away on June 14th, 2021. Dana works as a teacher at a local high

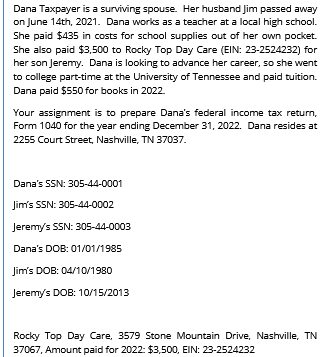

Dana Taxpayer is a surviving spouse. Her husband Jim passed away on June 14th, 2021. Dana works as a teacher at a local high school. She paid $435 in costs for school supplies out of her own pocket. She also paid $3,500 to Rocky Top Day Care (EIN: 23-2524232) for her son Jeremy. Dana is looking to advance her career, so she went to college part-time at the University of Tennessee and paid tuition. Dana paid $550 for books in 2022. Your assignment is to prepare Dana's federal income tax return, Form 1040 for the year ending December 31, 2022. Dana resides at 2255 Court Street, Nashville, TN 37037. Dana's SSN: 305-44-0001 Jim's SSN: 305-44-0002 Jeremy's SSN: 305-44-0003 Dana's DOB: 01/01/1985 Jim's DOB: 04/10/1980 Jeremy's DOB: 10/15/2013 Rocky Top Day Care, 3579 Stone Mountain Drive, Nashville, TN 37067, Amount paid for 2022: $3,500, EIN: 23-2524232

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare Danas federal income tax return well consider various factors such as filing status deduc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started