Danfoss is a global corporation with 28 sales companies in 17 countries and approximately 300 resellers and distributors worldwide. Danfoss corporate headquarters is located

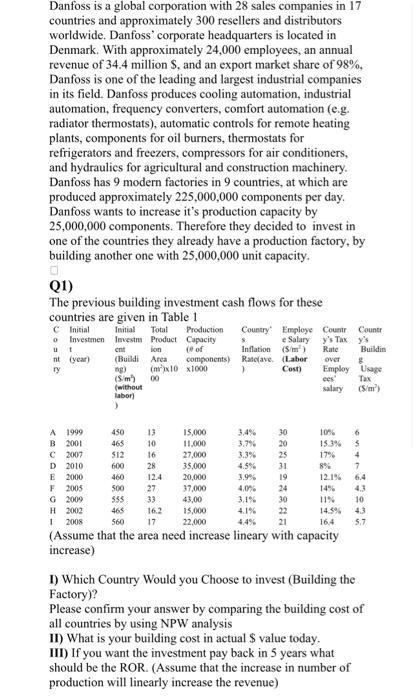

Danfoss is a global corporation with 28 sales companies in 17 countries and approximately 300 resellers and distributors worldwide. Danfoss corporate headquarters is located in Denmark. With approximately 24,000 employees, an annual revenue of 34.4 million S, and an export market share of 98%, Danfoss is one of the leading and largest industrial companies in its field. Danfoss produces cooling automation, industrial automation, frequency converters, comfort automation (e.g. radiator thermostats), automatic controls for remote heating plants, components for oil burners, thermostats for refrigerators and freezers, compressors for air conditioners, and hydraulics for agricultural and construction machinery. Danfoss has 9 modern factories in 9 countries, at which are produced approximately 225,000,000 components per day. Danfoss wants to increase it's production capacity by 25,000,000 components. Therefore they decided to invest in one of the countries they already have a production factory, by building another one with 25,000,000 unit capacity. 0 Q1) The previous building investment cash flows for these countries are given in Table 1 C Initial Initial Total Production o Investmen Investm Product Capacity (of u t nt (year) ry A 1999 B 2001 C 2007 D 2010 E 2000 F 2005 G 2009 H 2002 1 2008 ent ion (Buildi Area ng) (S/m) (without labor) ) 450 4635 512 600 components) (mx10 x1000 00 13 10 16 28 12.4 460 500 27 555 33 465 560 16.2 15,000 11,000 27,000 35,000 20,000 37,000 43,00 15,000 22,000 Country Employe Count S Inflation (S/m) Rate(ave. (Labor ) Cost) 3,4% 3.7% 3.3% 4.5% 3.9% 4,0% 3.4% 4.1% 4.4% e Salary y's Tax y's Rate 30 20 25 31 19 24 30 22 ees salary over 8 Employ Usage Tax (S/m) 10% 15.3% 17% 8% Countr 12.1% 14% 11% 14.5% 16.4 17 21 (Assume that the area need increase lineary with capacity increase) Buildin 6 5 4 7 6.4 10 43 5.7 1) Which Country Would you Choose to invest (Building the Factory)? Please confirm your answer by comparing the building cost of all countries by using NPW analysis II) What is your building cost in actual $ value today. III) If you want the investment pay back in 5 years what should be the ROR. (Assume that the increase in number of production will linearly increase the revenue)

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started