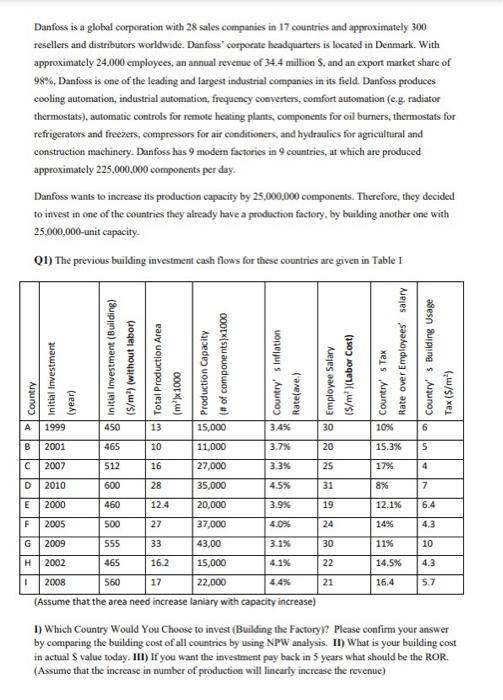

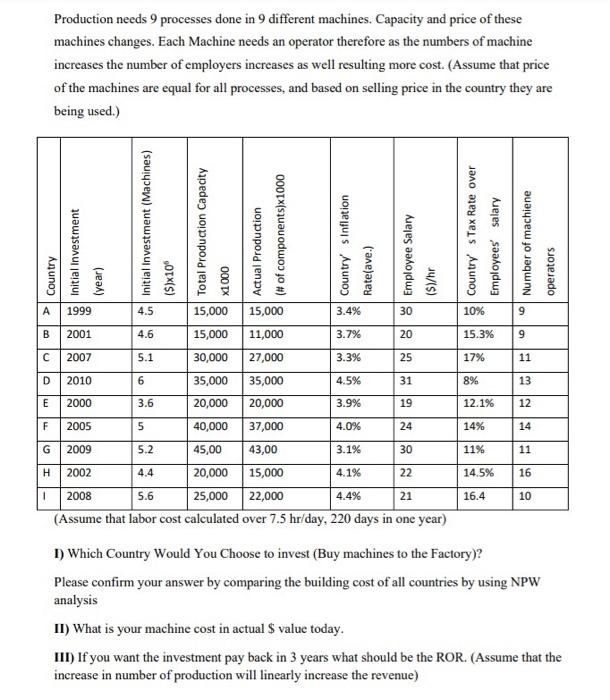

Danfoss is a globol corporation with 28 sales companies in 17 countries and approximately 300 resellers and distributors worldwide. Danfoss" corporate beadquarters is located in Denmark. With approximately 24,000 employees, an annual revenue of 34.4 million $, and an export market share of 98%, Danfoss is one of the leading and largest industrial companies in its field. Danfoss produces cooling automation, industrial automation, frequency converters, comfort automation (e.g. radiator thermostats), automatic controls for remote heating plants, components for oil burners, thermostats for refrigerators and freezers, compressors for air conditioners, and hydraulies for agricultural and construction machincry. Danfoss has 9 modern factories in 9 countries, at which are produced approximately 225,000,000 components per day. Danfoss wants to increase its production capacity by 25,000.000 components. Therefore, they decided to invest in one of the countries they already have a production factory, by building another one with 25,000,000-unit capacity- Q1) The previous building investment cash flows for these countries are given in Table 1 1) Which Country Would You Choose to invest (Building the Factory)? Please confirm your answer by comparing the building cost of all countries by using NPW analysis. II) What is your building cost in actual S value today. III) If you want the investment pay back in 5 years what should be the ROR. (Assume that the increase in number of production will linearly increase the revenue) Production needs 9 processes done in 9 different machines. Capacity and price of these machines changes. Each Machine needs an operator therefore as the numbers of machine increases the number of employers increases as well resulting more cost. (Assume that price of the machines are equal for all processes, and based on selling price in the country they are being used.) (Assume that labor cost caiculated over 1.2 nr/aay, LU aays in one year) I) Which Country Would You Choose to invest (Buy machines to the Factory)? Please confirm your answer by comparing the building cost of all countries by using NPW analysis II) What is your machine cost in actual $ value today. III) If you want the investment pay back in 3 years what should be the ROR. (Assume that the increase in number of production will linearly increase the revenue)