Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Daniel has had a 30% share in a manufacturing partnership since 2016 . He intends to dispose of his entire interest in the partnership in

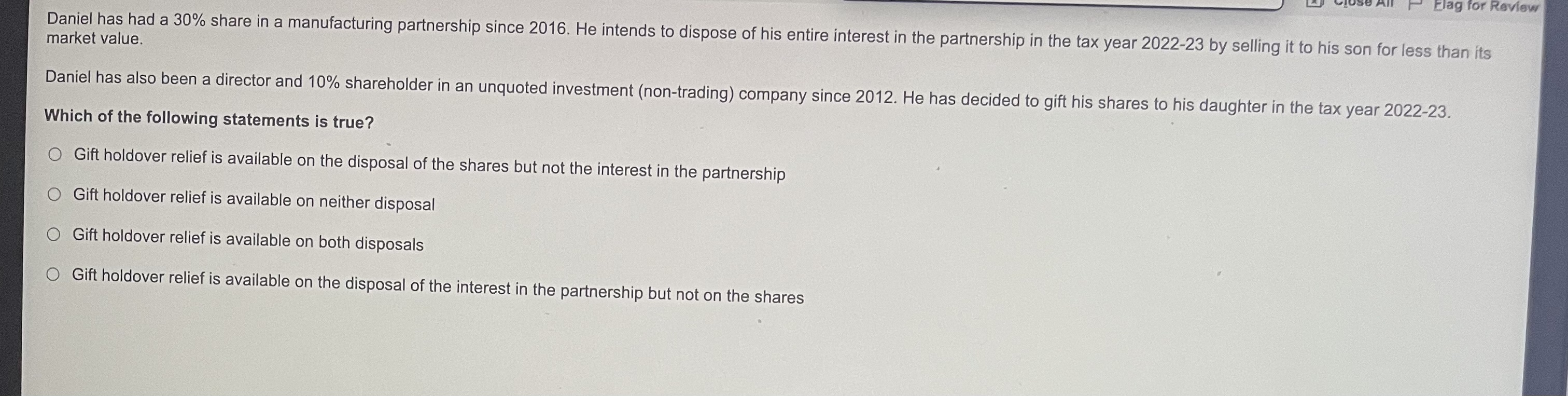

Daniel has had a 30% share in a manufacturing partnership since 2016 . He intends to dispose of his entire interest in the partnership in the tax year 202223 by selling it to his son for less than its market value. Daniel has also been a director and 10\% shareholder in an unquoted investment (non-trading) company since 2012. He has decided to gift his shares to his daughter in the tax year 202223. Which of the following statements is true? Gift holdover relief is available on the disposal of the shares but not the interest in the partnership Gift holdover relief is available on neither disposal Gift holdover relief is available on both disposals Gift holdover relief is available on the disposal of the interest in the partnership but not on the shares

Daniel has had a 30% share in a manufacturing partnership since 2016 . He intends to dispose of his entire interest in the partnership in the tax year 202223 by selling it to his son for less than its market value. Daniel has also been a director and 10\% shareholder in an unquoted investment (non-trading) company since 2012. He has decided to gift his shares to his daughter in the tax year 202223. Which of the following statements is true? Gift holdover relief is available on the disposal of the shares but not the interest in the partnership Gift holdover relief is available on neither disposal Gift holdover relief is available on both disposals Gift holdover relief is available on the disposal of the interest in the partnership but not on the shares Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started