Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Daniel receives 400 shares of A&M Corporation stock from his aunt on May 20, 2023, as a gift when the stock has a $60,000

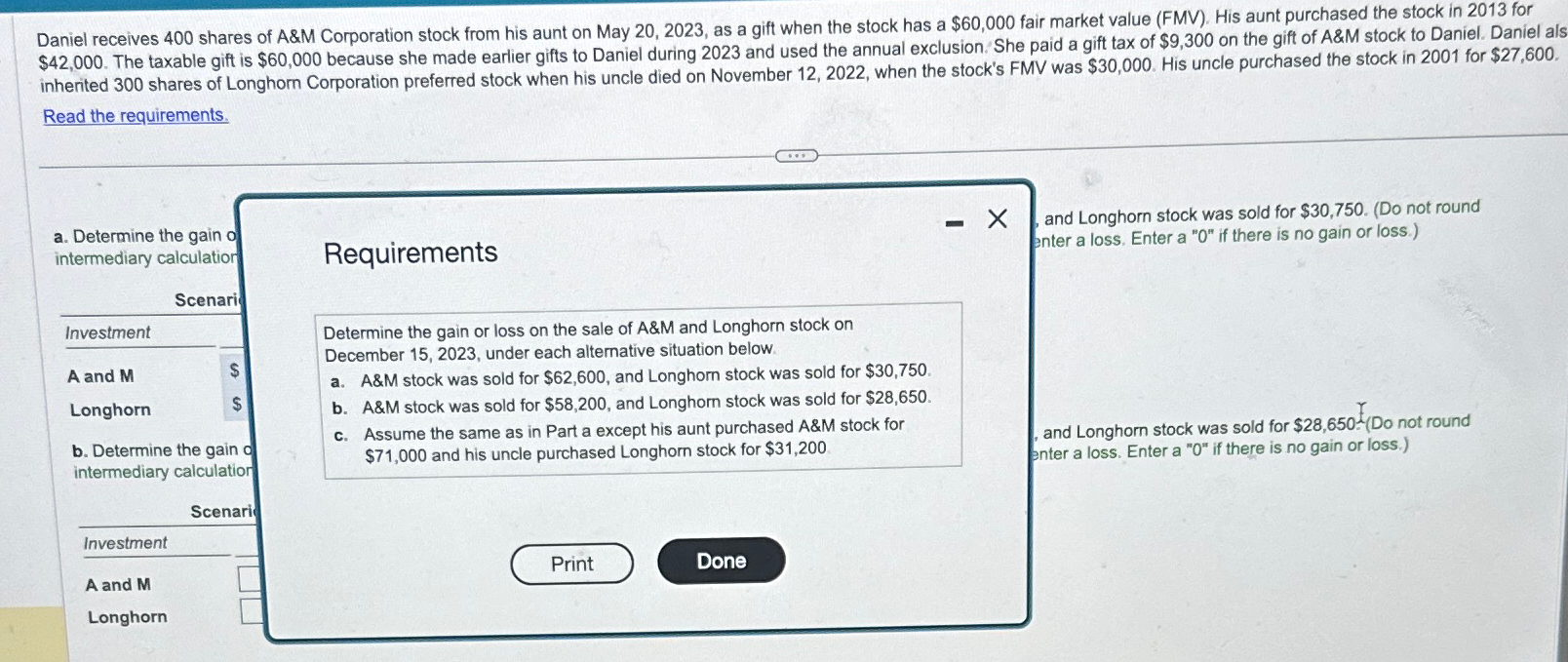

Daniel receives 400 shares of A&M Corporation stock from his aunt on May 20, 2023, as a gift when the stock has a $60,000 fair market value (FMV). His aunt purchased the stock in 2013 for $42,000. The taxable gift is $60,000 because she made earlier gifts to Daniel during 2023 and used the annual exclusion. She paid a gift tax of $9,300 on the gift of A&M stock to Daniel. Daniel als inherited 300 shares of Longhom Corporation preferred stock when his uncle died on November 12, 2022, when the stock's FMV was $30,000. His uncle purchased the stock in 2001 for $27,600. Read the requirements. a. Determine the gain o intermediary calculation Requirements Scenari Investment A and M $ Longhorn $ b. Determine the gain o intermediary calculation Scenari Investment A and M Longhorn - and Longhorn stock was sold for $30,750. (Do not round enter a loss. Enter a "0" if there is no gain or loss.) Determine the gain or loss on the sale of A&M and Longhorn stock on December 15, 2023, under each alternative situation below. a. A&M stock was sold for $62,600, and Longhorn stock was sold for $30,750. b. A&M stock was sold for $58,200, and Longhorn stock was sold for $28,650. c. Assume the same as in Part a except his aunt purchased A&M stock for $71,000 and his uncle purchased Longhorn stock for $31,200 , and Longhorn stock was sold for $28,650 (Do not round enter a loss. Enter a "0" if there is no gain or loss.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started