Question

Daniela has simply transferred the amounts to both her Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) based on what her tax advisor

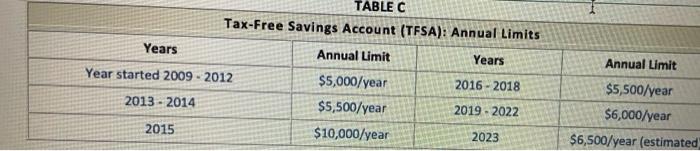

Daniela has simply transferred the amounts to both her Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) based on what her tax advisor recommends. Daniela has always contributed the maximum to both her RRSP and TFSA on January 1st each year. She however does not understand how either the RRSP or TFSA work. She has therefore asked you to work out a few scenarios to help her better understand. (5.5 marks)

Daniela: (currently 35 years old, birthday is June 27th):

- started her own dental practice upon graduation and has always drawn a salary of $200,000 each year from her company for the last 18 years, this year (2022) she has exceptionally paid herself a salary of $250,000.

Scenario 4:

Daniela is looking to purchase her first home and would like to pay cash. She is looking to make an offer of $350,000. The current market value of Danielas TFSA as of today is $352,000. If Daniela withdraws $350,000 from her TFSA, how much could she then re-contribute to her TFSA in 2022? 2023?

(1.5 marks)

2022: $____________

2023: $____________

Scenario 5:

Consider Danielas example in Scenario 4, but this time, instead of her TFSA being $352,000 when she goes to withdraw, the market takes a downturn, and the value at the time of her withdrawal is only $200,000. How much would her contribution room then be for 2022? 2023? (1.5 marks)

2022: $____________

2023: $____________

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started