Answered step by step

Verified Expert Solution

Question

1 Approved Answer

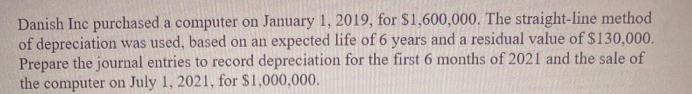

Danish Inc purchased a computer on January 1, 2019, for $1,600,000. The straight-line method of depreciation was used, based on an expected life of

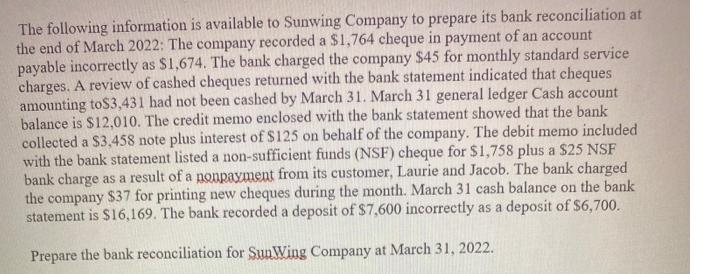

Danish Inc purchased a computer on January 1, 2019, for $1,600,000. The straight-line method of depreciation was used, based on an expected life of 6 years and a residual value of $130,000. Prepare the journal entries to record depreciation for the first 6 months of 2021 and the sale of the computer on July 1, 2021, for $1,000,000. The following information is available to Sunwing Company to prepare its bank reconciliation at the end of March 2022: The company recorded a $1,764 cheque in payment of an account payable incorrectly as $1,674. The bank charged the company $45 for monthly standard service charges. A review of cashed cheques returned with the bank statement indicated that cheques amounting to$3,431 had not been cashed by March 31. March 31 general ledger Cash account balance is $12,010. The credit memo enclosed with the bank statement showed that the bank collected a $3.458 note plus interest of $125 on behalf of the company. The debit memo included with the bank statement listed a non-sufficient funds (NSF) cheque for $1,758 plus a $25 NSF bank charge as a result of a nonpayment from its customer, Laurie and Jacob. The bank charged the company $37 for printing new cheques during the month. March 31 cash balance on the bank statement is $16,169. The bank recorded a deposit of $7,600 incorrectly as a deposit of $6,700. Prepare the bank reconciliation for SunWing Company at March 31, 2022.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Bank Reconciliation Balance as per bank statement 1616900 Add Error in re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started