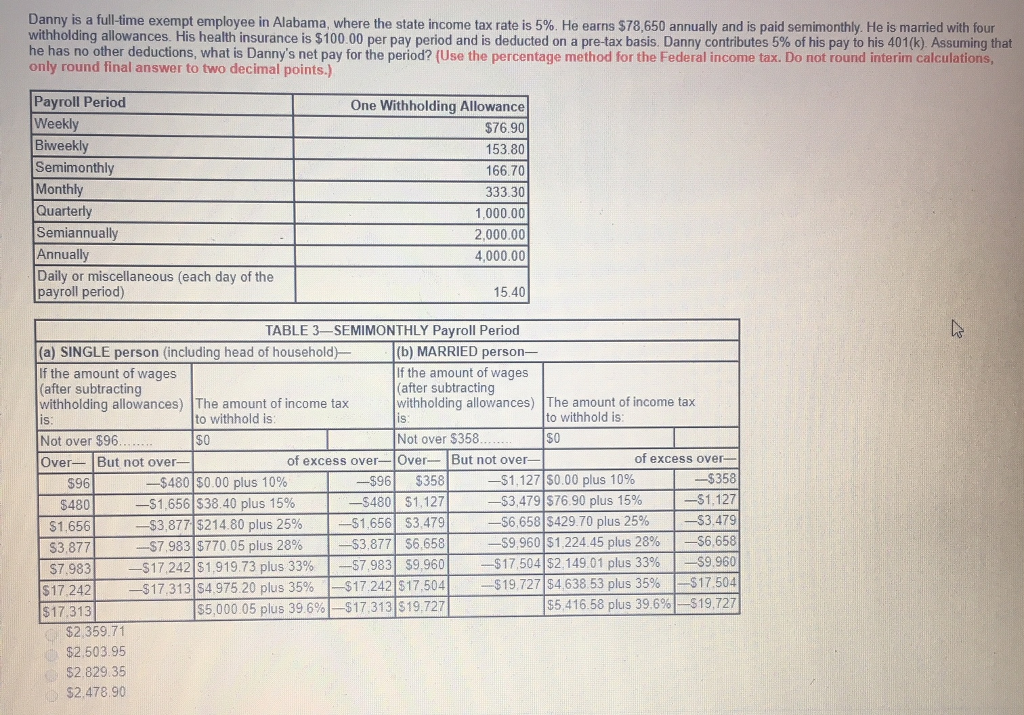

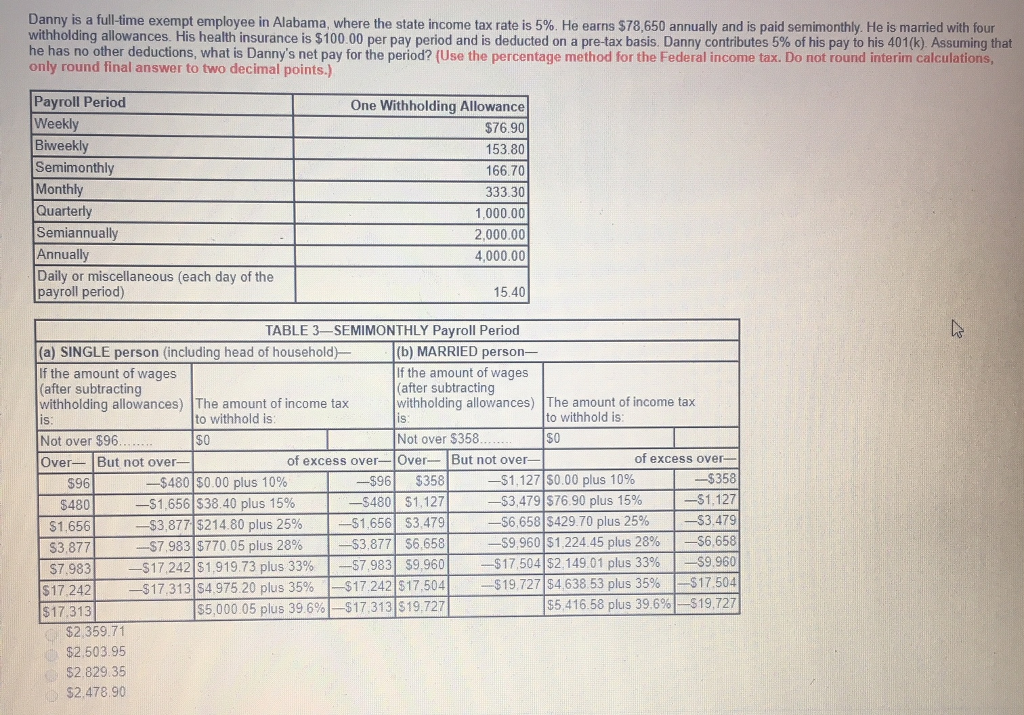

Danny a full-time exempt employee n Alabama, where the state come tax rate s 5% S7865 annually and is paid sem month He is with four e ear ma withholding allowances. His health insurance is $100 00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k) Assuming that he has no other deductions, what is Danny's net pay for the period? Use the percentage method for the Federal ico ne only round final answer to two decimal points.) Do no ou d n imi alan mons, Payroll Period Weekly Biweekl Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $76.90 153.80 66.70 333.30 1,000.00 2,000.00 4,000.00 15.40 TABLE 3 SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) The amount of income tax IS If the amount of wages (after subtracting withholding allowances) The amount of income tax is to withhold is to withhold is $0 Not over $96 Not over $358 $0 of excess over- $358 -$1,127 56,658 $429,70 plus 25% $3,479 -59.960|$1 224.45 plus 28% |-56658 -$17,504|$2.149.01 plus 3396 |-$9.960 -$19.727|$4,638 53 plus 35% -S17504 $5416.58 plus 39.6%)--519,727 of excess over-Over But not over- But not over- $96 Ove -$1,127 $0.00 plus 10% -$3,479 S76.90 plus 15% $96$358 -$480 $1,127 -53877)$214.80 plus 25% |-51,656|S3479 $3,877 $6,658 $17.242|$1.919.73 plus 33% |-57 983| S9.960 -517313|$4.975.20 plus 35% |-$17.242|$17504 $5,000 05 plus 39.6%)-$17.313|S19727 -$480|$0 00 plus 10% -$1,656 S38.40 plus 15% S480 $1,656 $3,877 $7.983 S17.242 $17,313 $7,983 $770.05 plus 28% $2359.71 $2,503.95 $2,829.35 $2.478 9 Danny a full-time exempt employee n Alabama, where the state come tax rate s 5% S7865 annually and is paid sem month He is with four e ear ma withholding allowances. His health insurance is $100 00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k) Assuming that he has no other deductions, what is Danny's net pay for the period? Use the percentage method for the Federal ico ne only round final answer to two decimal points.) Do no ou d n imi alan mons, Payroll Period Weekly Biweekl Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $76.90 153.80 66.70 333.30 1,000.00 2,000.00 4,000.00 15.40 TABLE 3 SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) The amount of income tax IS If the amount of wages (after subtracting withholding allowances) The amount of income tax is to withhold is to withhold is $0 Not over $96 Not over $358 $0 of excess over- $358 -$1,127 56,658 $429,70 plus 25% $3,479 -59.960|$1 224.45 plus 28% |-56658 -$17,504|$2.149.01 plus 3396 |-$9.960 -$19.727|$4,638 53 plus 35% -S17504 $5416.58 plus 39.6%)--519,727 of excess over-Over But not over- But not over- $96 Ove -$1,127 $0.00 plus 10% -$3,479 S76.90 plus 15% $96$358 -$480 $1,127 -53877)$214.80 plus 25% |-51,656|S3479 $3,877 $6,658 $17.242|$1.919.73 plus 33% |-57 983| S9.960 -517313|$4.975.20 plus 35% |-$17.242|$17504 $5,000 05 plus 39.6%)-$17.313|S19727 -$480|$0 00 plus 10% -$1,656 S38.40 plus 15% S480 $1,656 $3,877 $7.983 S17.242 $17,313 $7,983 $770.05 plus 28% $2359.71 $2,503.95 $2,829.35 $2.478 9