Question: Dany Ekwood has two mutually exclusive start-up ideas that require the same investment of $75 thousand at time t=0. The first idea is an

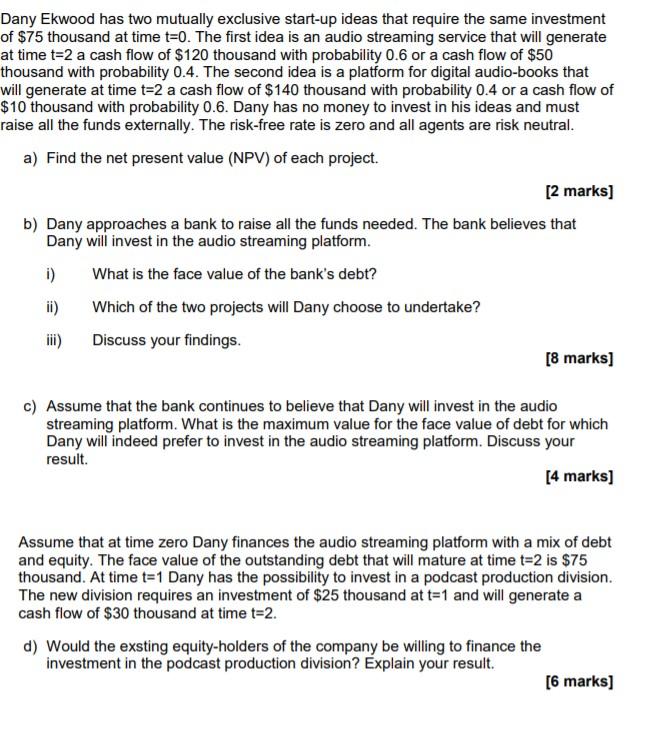

Dany Ekwood has two mutually exclusive start-up ideas that require the same investment of $75 thousand at time t=0. The first idea is an audio streaming service that will generate at time t=2 a cash flow of $120 thousand with probability 0.6 or a cash flow of $50 thousand with probability 0.4. The second idea is a platform for digital audio-books that will generate at time t=2 a cash flow of $140 thousand with probability 0.4 or a cash flow of $10 thousand with probability 0.6. Dany has no money to invest in his ideas and must raise all the funds externally. The risk-free rate is zero and all agents are risk neutral. a) Find the net present value (NPV) of each project. [2 marks] b) Dany approaches a bank to raise all the funds needed. The bank believes that Dany will invest in the audio streaming platform. i) What is the face value of the bank's debt? ii) Which of the two projects will Dany choose to undertake? iii) Discuss your findings. [8 marks] c) Assume that the bank continues to believe that Dany will invest in the audio streaming platform. What is the maximum value for the face value of debt for which Dany will indeed prefer to invest in the audio streaming platform. Discuss your result. [4 marks] Assume that at time zero Dany finances the audio streaming platform with a mix of debt and equity. The face value of the outstanding debt that will mature at time t=2 is $75 thousand. At time t=1 Dany has the possibility to invest in a podcast production division. The new division requires an investment of $25 thousand at t=1 and will generate a cash flow of $30 thousand at time t=2. d) Would the exsting equity-holders of the company be willing to finance the investment in the podcast production division? Explain your result. [6 marks]

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

a The net present value NPV of each project can be calculated as follows For the audio streaming service NPV 06 120000 04 50000102 75000 NPV 63000 For ... View full answer

Get step-by-step solutions from verified subject matter experts