Question

Danys Amusement Company operates 3 dragon themed children's amusement parks in the south. The parks have various rides and the company must invest heavily to

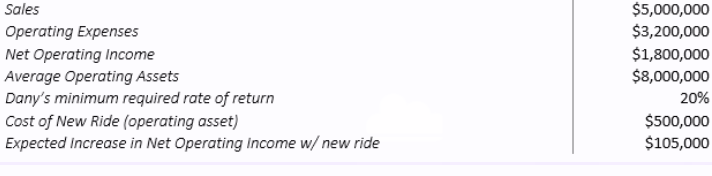

Danys Amusement Company operates 3 dragon themed children's amusement parks in the south. The parks have various rides and the company must invest heavily to bring new and exciting adventures to its patrons. The company is doing analysis on its Houston park, Drogon, to better understand the finances and whether they should invest additional capital to build a new ride. The above information relates to Drogon for the period.

What is Drogons gross margin? (Round 4 decimal places on all

What is Drogons total asset turnover

What is Drogons total asset turnover

What is Drogons return on investment

What is Drogons residual income? (Whole number, no commas, no dollar signs

Is Drogon performing better than the Dany's standard?

What is the anticipated ROI of the new ride? (Round 4 decimal places

What is the residual income of the new ride?

What is Drogons expected total ROI after the purchase of the ride?

Should Dany purchase the new ride

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started