Answered step by step

Verified Expert Solution

Question

1 Approved Answer

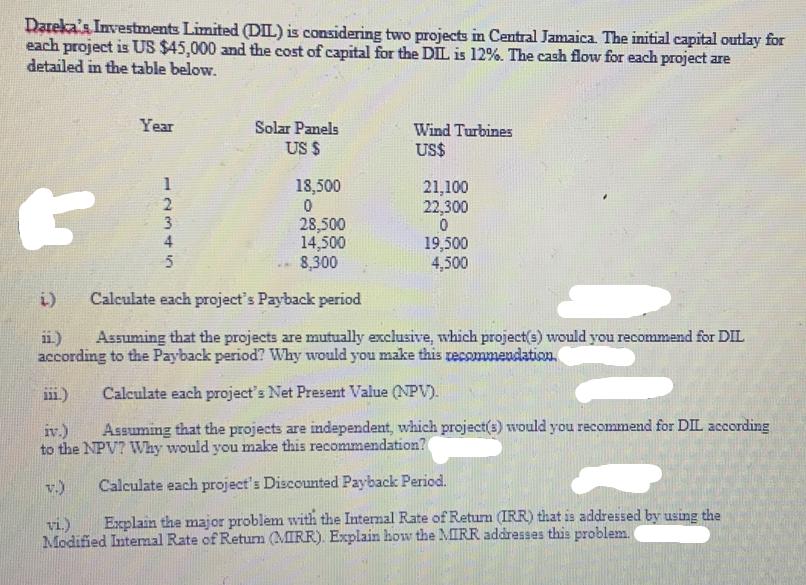

Dareka's Investments Limited (DIL) is considering two projects in Central Jamaica. The initial capital outlay for each project is US $45,000 and the cost

Dareka's Investments Limited (DIL) is considering two projects in Central Jamaica. The initial capital outlay for each project is US $45,000 and the cost of capital for the DIL is 12%. The cash flow for each project are detailed in the table below. Year Solar Panels Wind Turbines US $ US$ 123445 18,500 21,100 2 0 22,300 3 4 28,500 0 14,500 19,500 8,300 4,500 i) Calculate each project's Payback period ii.) Assuming that the projects are mutually exclusive, which project(s) would you recommend for DIL according to the Payback period? Why would you make this recommendation. iv.) Calculate each project's Net Present Value (NPV). Assuming that the projects are independent, which project(s) would you recommend for DIL according to the NPV? Why would you make this recommendation? v.) vi.) Calculate each project's Discounted Payback Period. Explain the major problem with the Internal Rate of Return (IRR) that is addressed by using the Modified Internal Rate of Return (MIRR). Explain how the MIRR addresses this problem.

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Calculating each projects Payback period For Solar Panels Payback period 1 30000 18500 25 years For ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started