Answered step by step

Verified Expert Solution

Question

1 Approved Answer

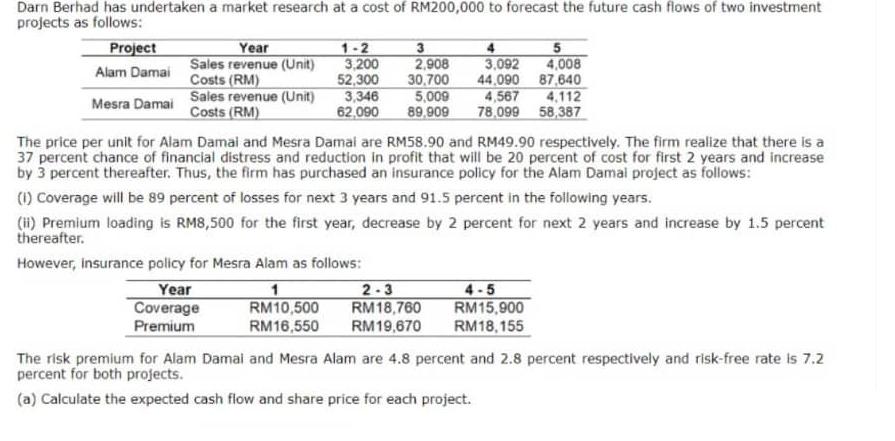

Darn Berhad has undertaken a market research at a cost of RM200,000 to forecast the future cash flows of two investment projects as follows:

Darn Berhad has undertaken a market research at a cost of RM200,000 to forecast the future cash flows of two investment projects as follows: Project Year 1-2 3 5 3,200 2,908 4,008 Alam Damai Sales revenue (Unit) Costs (RM) 52,300 30,700 3,092 44,090 87,640 4,567 4,112 78,099 58,387 3,346 5,009 Mesra Damai Sales revenue (Unit) Costs (RM) 62,090 89,909 The price per unit for Alam Damal and Mesra Damal are RM58.90 and RM49.90 respectively. The firm realize that there is a 37 percent chance of financial distress and reduction in profit that will be 20 percent of cost for first 2 years and increase by 3 percent thereafter. Thus, the firm has purchased an insurance policy for the Alam Damal project as follows: (1) Coverage will be 89 percent of losses for next 3 years and 91.5 percent in the following years. (ii) Premium loading is RM8,500 for the first year, decrease by 2 percent for next 2 years and increase by 1.5 percent thereafter. However, Insurance policy for Mesra Alam as follows: Year 2-3 1 RM10,500 RM18,760 RM16,550 RM19,670 RM18,155 4-5 RM15,900 Coverage Premium The risk premium for Alam Damai and Mesra Alam are 4.8 percent and 2.8 percent respectively and risk-free rate is 7.2 percent for both projects. (a) Calculate the expected cash flow and share price for each project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Project Year 1 2 3 4 5 Alam Damai Units 3200 3200 2908 3092 4008 Revenue 188480 188480 171281 182119 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started