Question

Darryl is the sole proprietor of a motorcycle shop. During the present year, Darryl had $32,000 of adjusted gross income before considering the tax effect

Darryl is the sole proprietor of a motorcycle shop. During the present year, Darryl had $32,000 of adjusted gross income before considering the tax effect of the following transactions. Darryl has no remaining nonrecaptured 1231 losses from the prior five tax years.

a. Land adjacent to the store was purchased 3-years ago for an anticipated store expansion. It cost $14,000 and was sold this year for $35,000.

b. Obsolete 5-year-old motorcycle repair equipment was sold for $12,000 during the year. It was fully depreciated. The equipment cost $65,000.

c. Darryl developed and patented a new synthetic oil called Super Z. Darryl had not reduced the patent to practice. He sold all his rights in the patent for $75,000 to Harley Davidson. Darryl had not amortized the $12,000 cost of obtaining the patent. He held the patent for more than a year, but less than five years.

d. A 3-year-old delivery truck with an adjusted basis of $6,000 was sold for $17,000. It had cost $10,000.

e. One of the motorcycle repair machines caught on fire and was completely destroyed. It had an adjusted basis of $17,000. The insurance recovery was $24,000. The machine was obsolete, had been purchased several years ago, and was not replaced.

f. Darryl bought an electronic cash register for $3,000 early in the year. It was not suitable for his business. Darryl sold it for $2,500 four months after it was purchased.

g. Darryls 2-year-old personal car was rear-ended by a truck. The auto was completely demolished. The adjusted basis of the car was $15,000. Darryl did not have any insurance for collision damage. The car was worth $12,000 before the crash.

h. Darryl sold for $300,000 an apartment building he had owned for 15 years. Total depreciation on the building was $363,189. The adjusted basis was $125,000.

i. Darryl sold Memorial Grady stock (purchased in January of last year for $16,000) for $39,000 in December of this year.

j. Darryl sold Del Amo Foods stock (purchased in September of this year for $27,000) for $21,000 in December of this year.

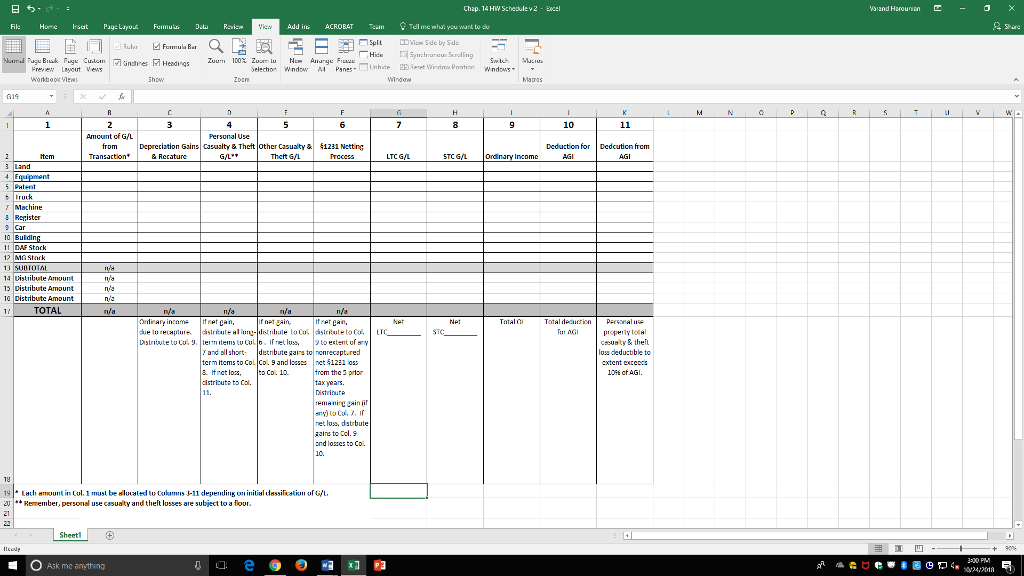

Using the Worksheet provided:

1. Analyze each transaction above to determine the amount of gain or loss from that transaction. Identify such amount in Column 1.

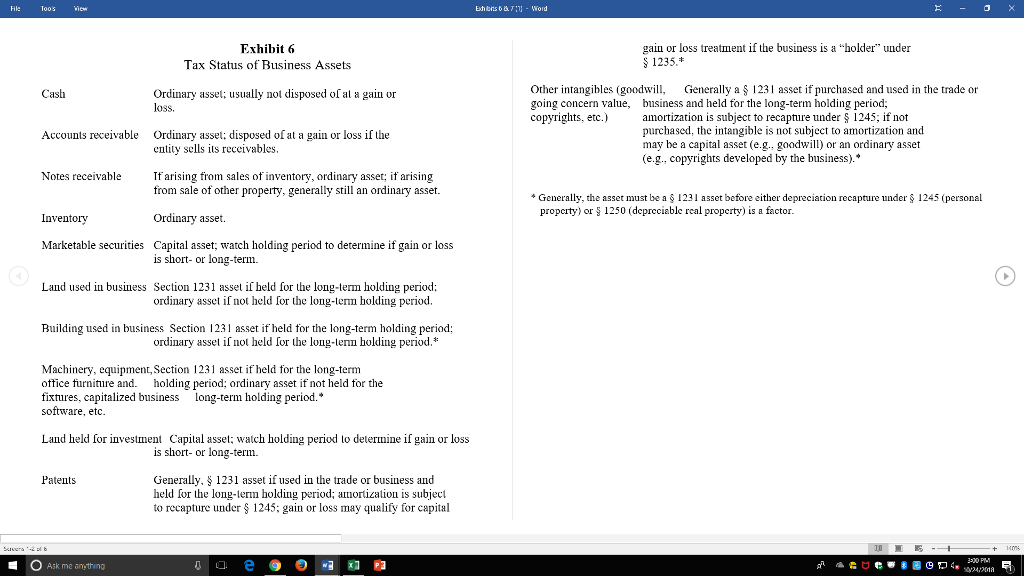

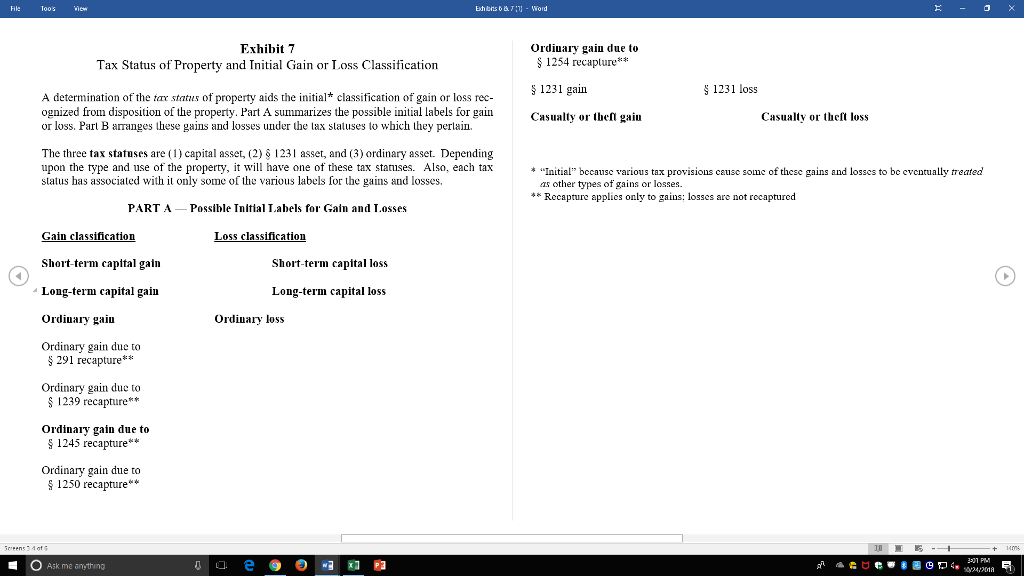

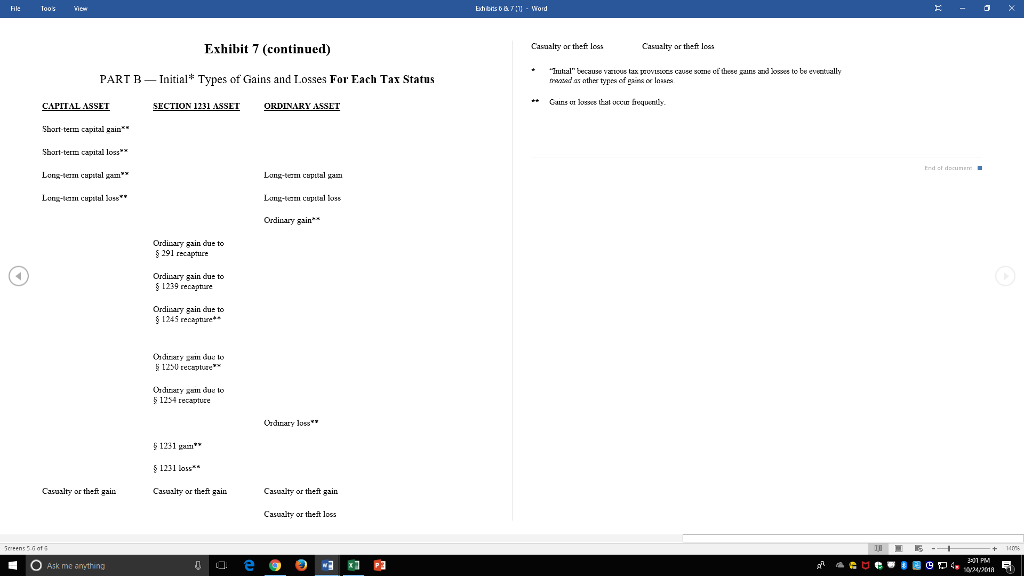

2. Determine the initial classification(s) of each gain and loss (Exhibits 6 and 7 can assist) and place the gains/losses in the correct columns (Columns 3-11) on the Worksheet.

4. After completing the Worksheet, determine Darryls AGI and deductions from AGI.

Chap. 14 HW Schedule v 2 - Dicel File Home Irsat Page Layout Formulas Dan Review View Add in ACROBAT Team Tell me what you want to de Ruler Spit View Side by Side Formula Bar Hic Normal Pagu Brak Page Custom Undines Headings Preview Layout Views Workbook View! Zuum 100% Zumlu New Amange Fra Selection Window AL Unhide Syneous Scrolling BB Reset Window Position Panes Switch Windows Maci Zoom Window Magos Show G19 x fox A 1 1 B 2 C 3 D 4 E 5 F G H 1 6 7 8 9 10 Amount of G/L Personal Use from 2 Mem Transaction* & Recature Depreciation Gains Casualty & Theft Other Casualty & $1231 Netting G/L** Theft G/L Process 11 LTCG/L STCG/L Ordinary Income Deduction for AGI Dedcution from AGI 3 Land 4 Equipment 5 Patent 6 Truck 7 Machine 3 Register 9 Car 10 Building 11 DAF Stock 12 MG Stack 13 SUBTOTAL 14 Distribute Amount 15 Distribute Amount n/a n/a 16 Distribute Amount / 17 TOTAL n/a n/a n/a Ordinary income fret gain, due to recapture Distribute to Col. 9. n/a If net gain, n/a fret gain, Net Net Total distribute to Col. LTC STC Total deduction for AGI Personal 9to extent of any property total County & theft loss deductible to extent exces 10% of AGI. distribute all long-distribute to Col. term items to Colo. If net loss, 7 and all short- distribute gains to nonrecaptured term items to Col Col. 9 and losses net 1231 loss 8. If net loss, to Col. 10. distribute to Col. 11. from the 3 prior tax years. Distribute remaining gain of any) to Col. 7. if net loss, distribute gains to Col. 9 and losses to Col 10. 18 19 Each amount in Col. 1 must be allocated to Columns 3-11 depending on initial dassification of G/L. 20 **Remember, personal use casualty and theft losses are subject to a floor. 21 Sheet1 Rudy Ask me anything J Varand Harunian Share M N 0 Q R S V W 4 3:00 PM 10/24/2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze each transaction and determine Darryls adjusted gross income AGI and the classification of the gainslosses well go through each item system...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started