Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dashboard / My courses / MAC2602-22-S1 / Welcome Message / Assessment 1 Question 6 Not yet answe Marked out of Sparta Pty (Ltd) purchases an

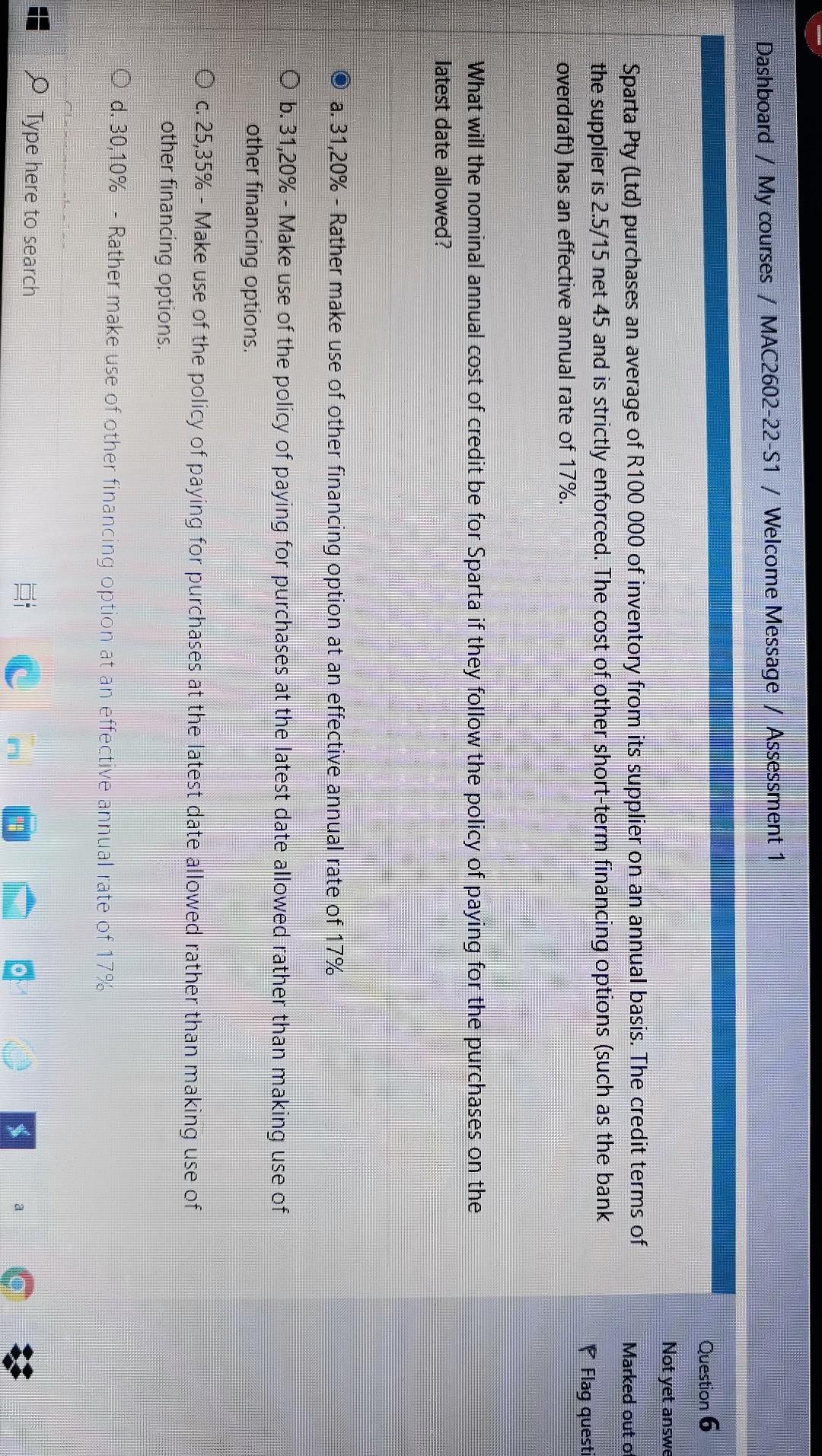

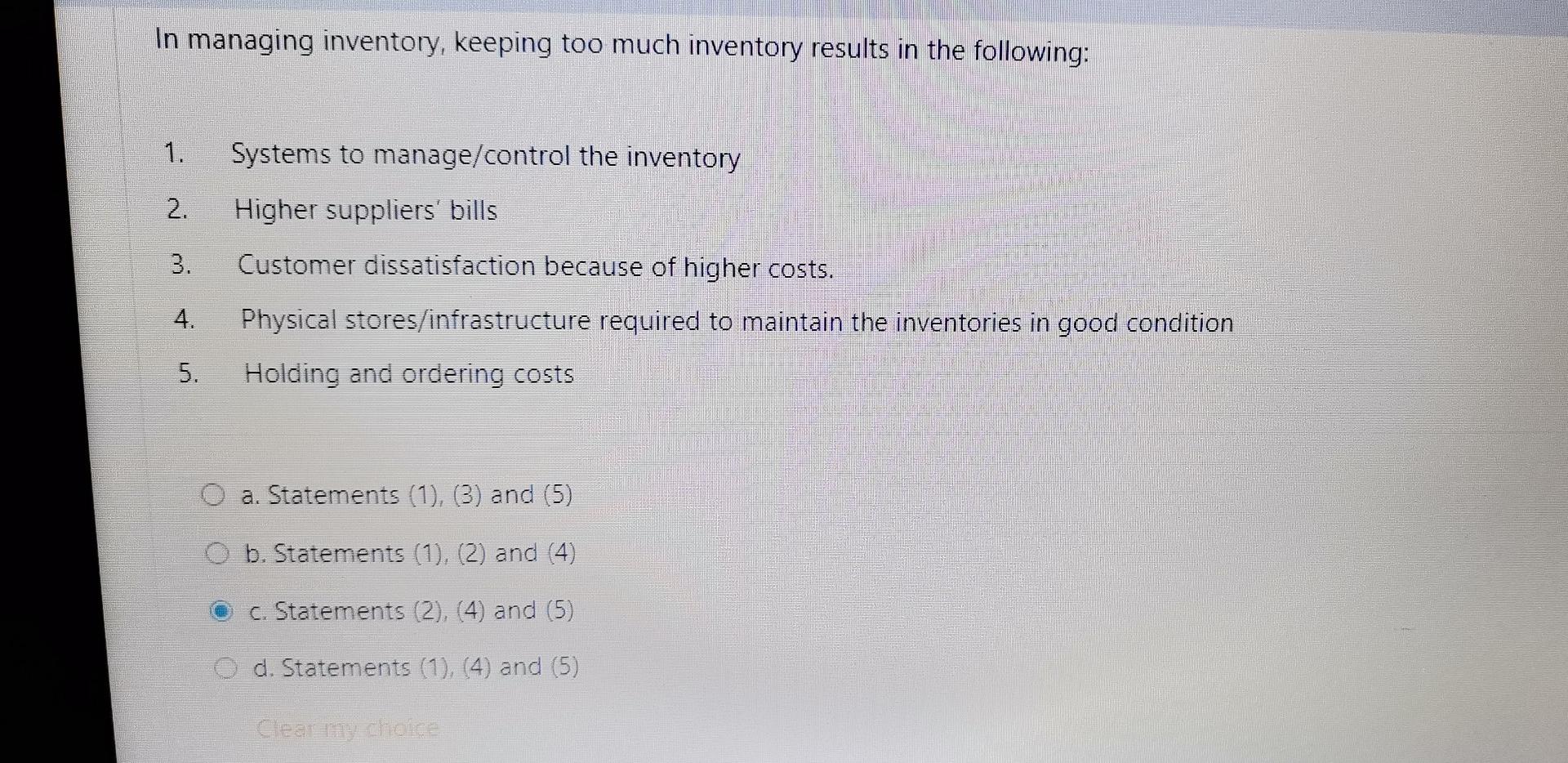

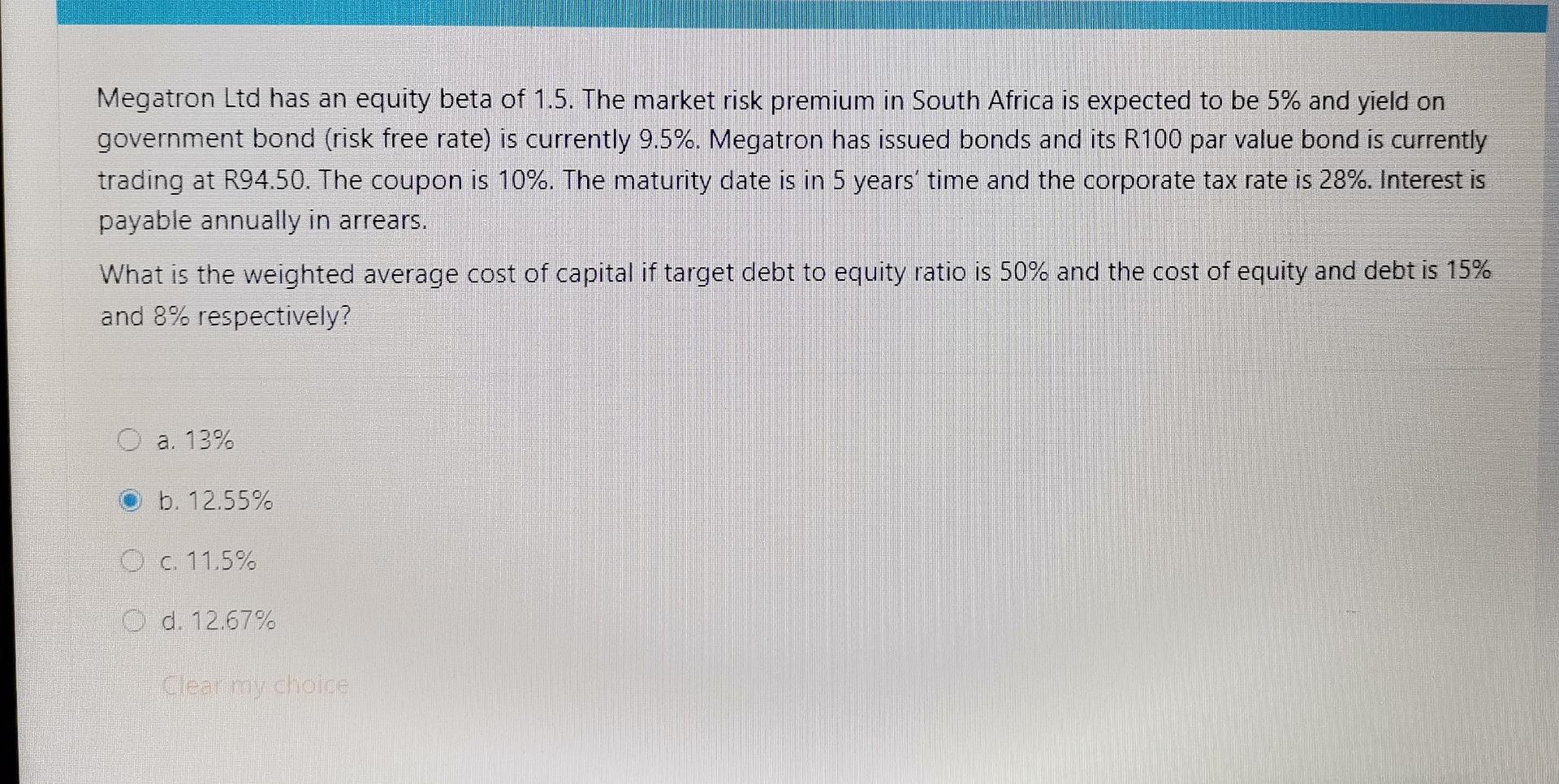

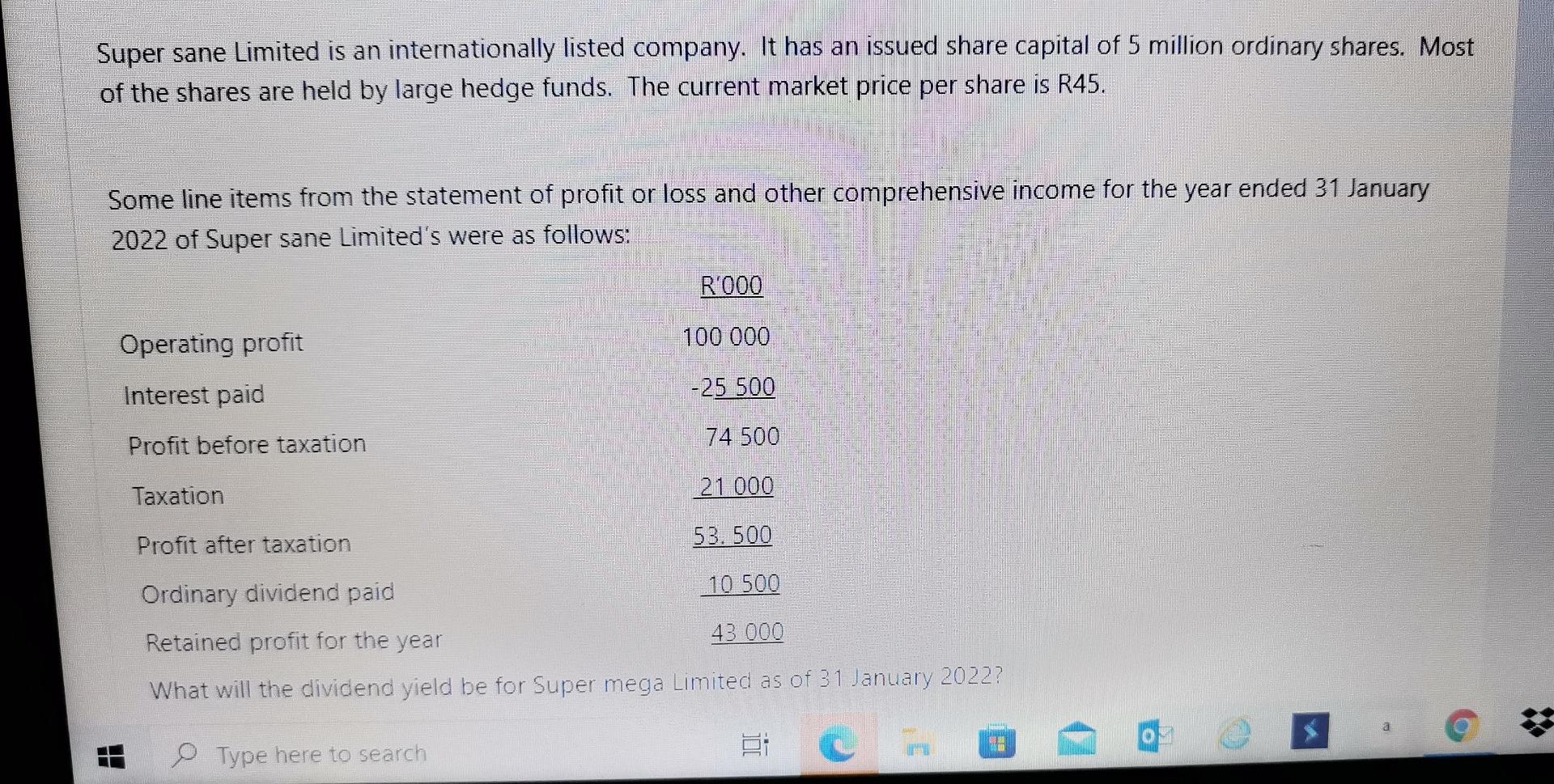

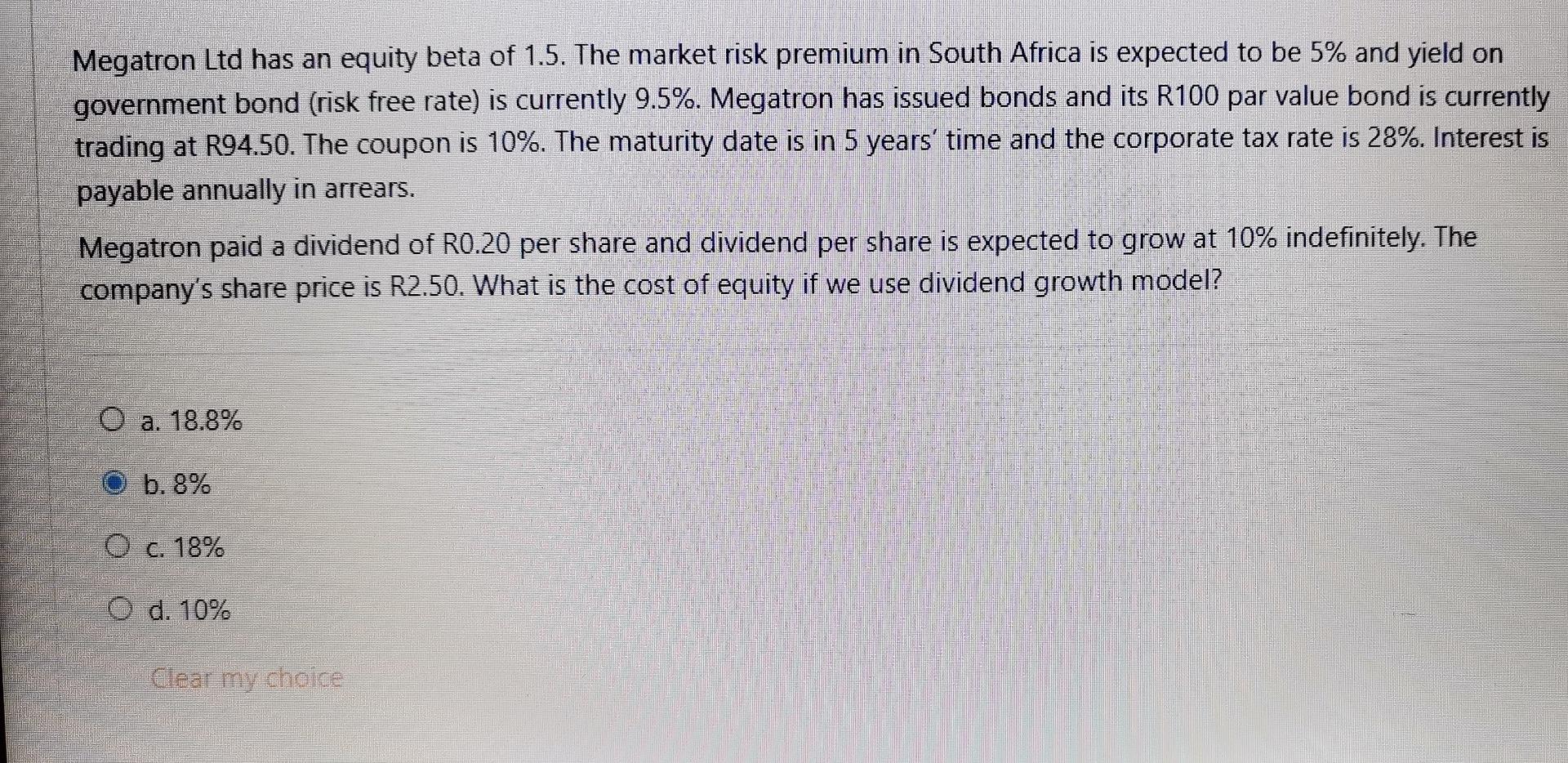

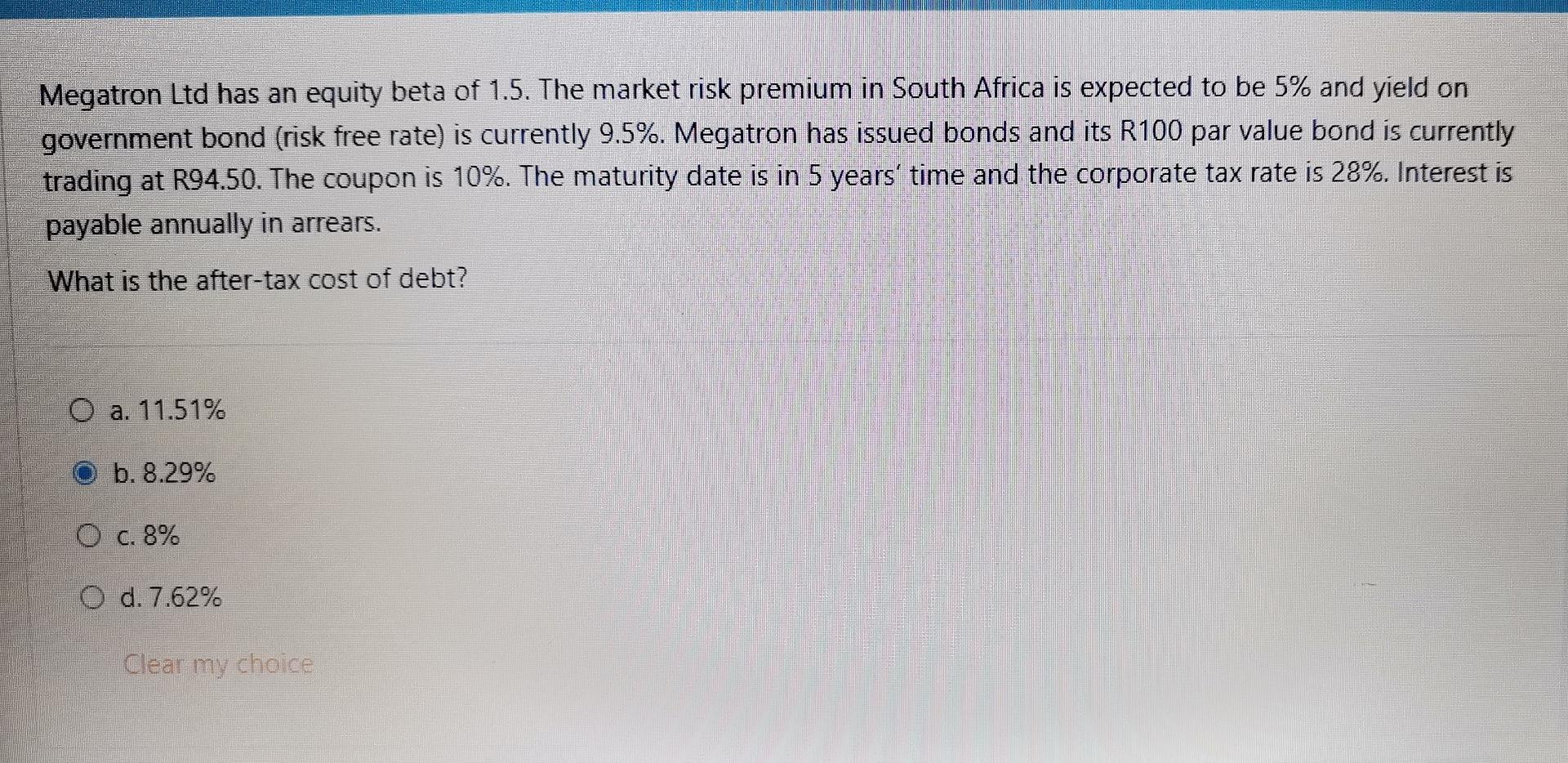

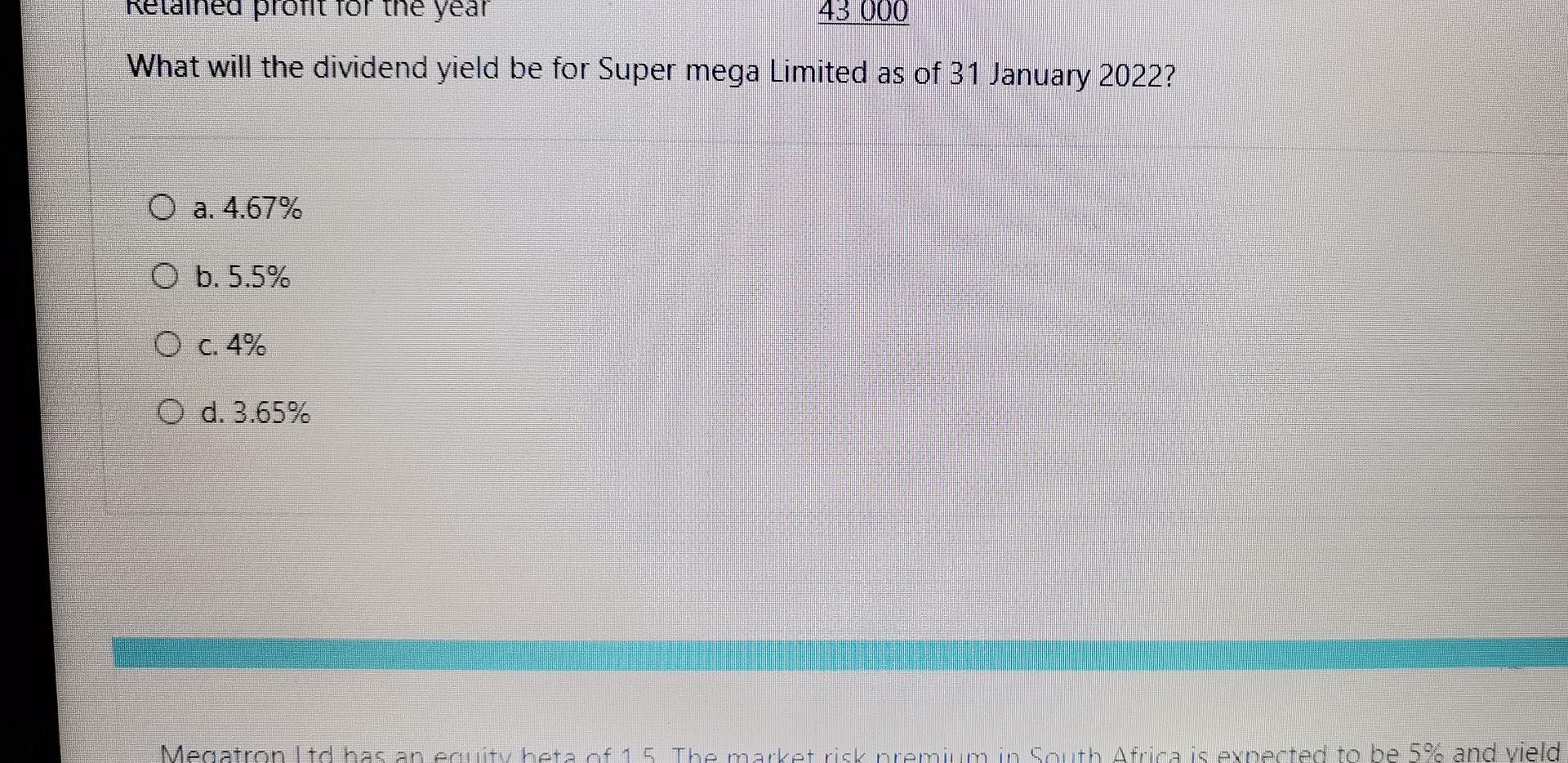

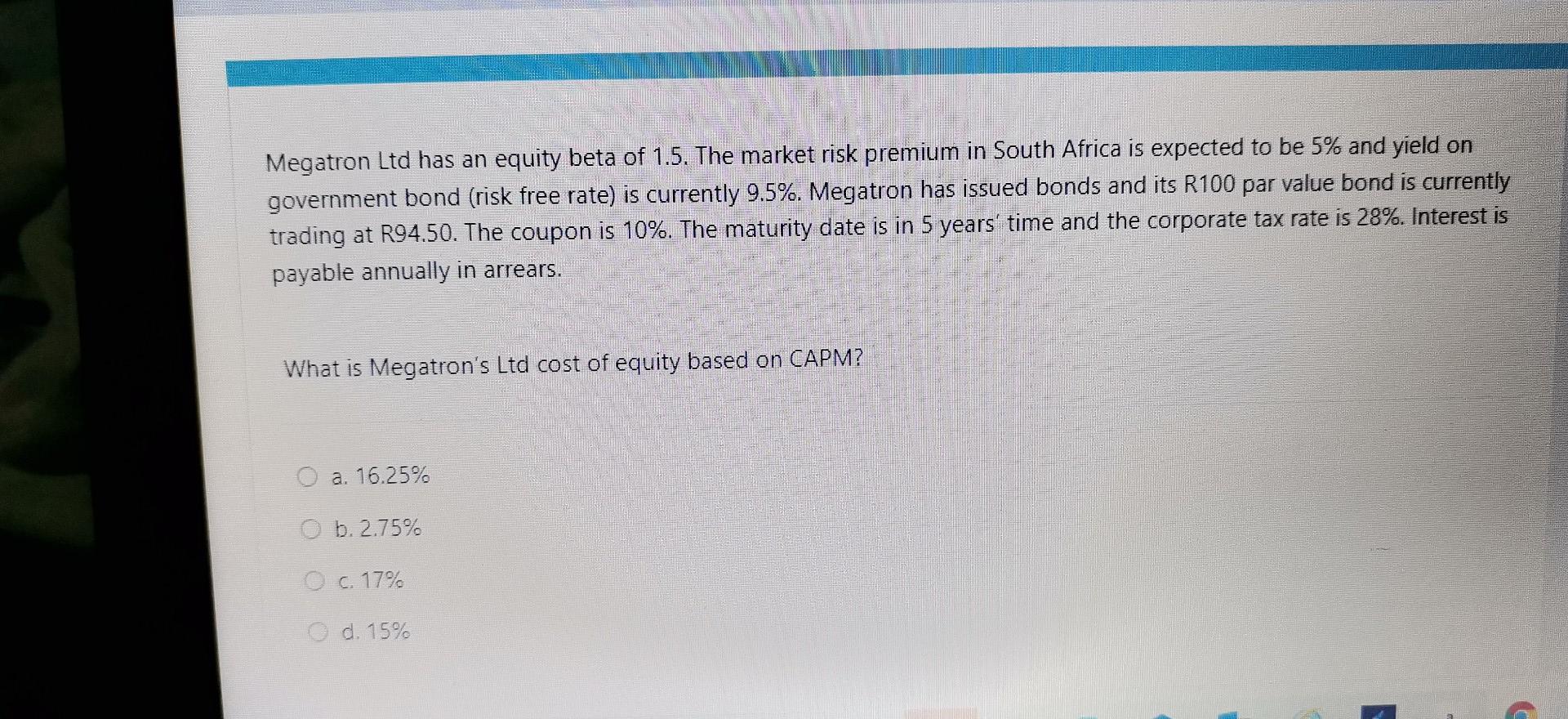

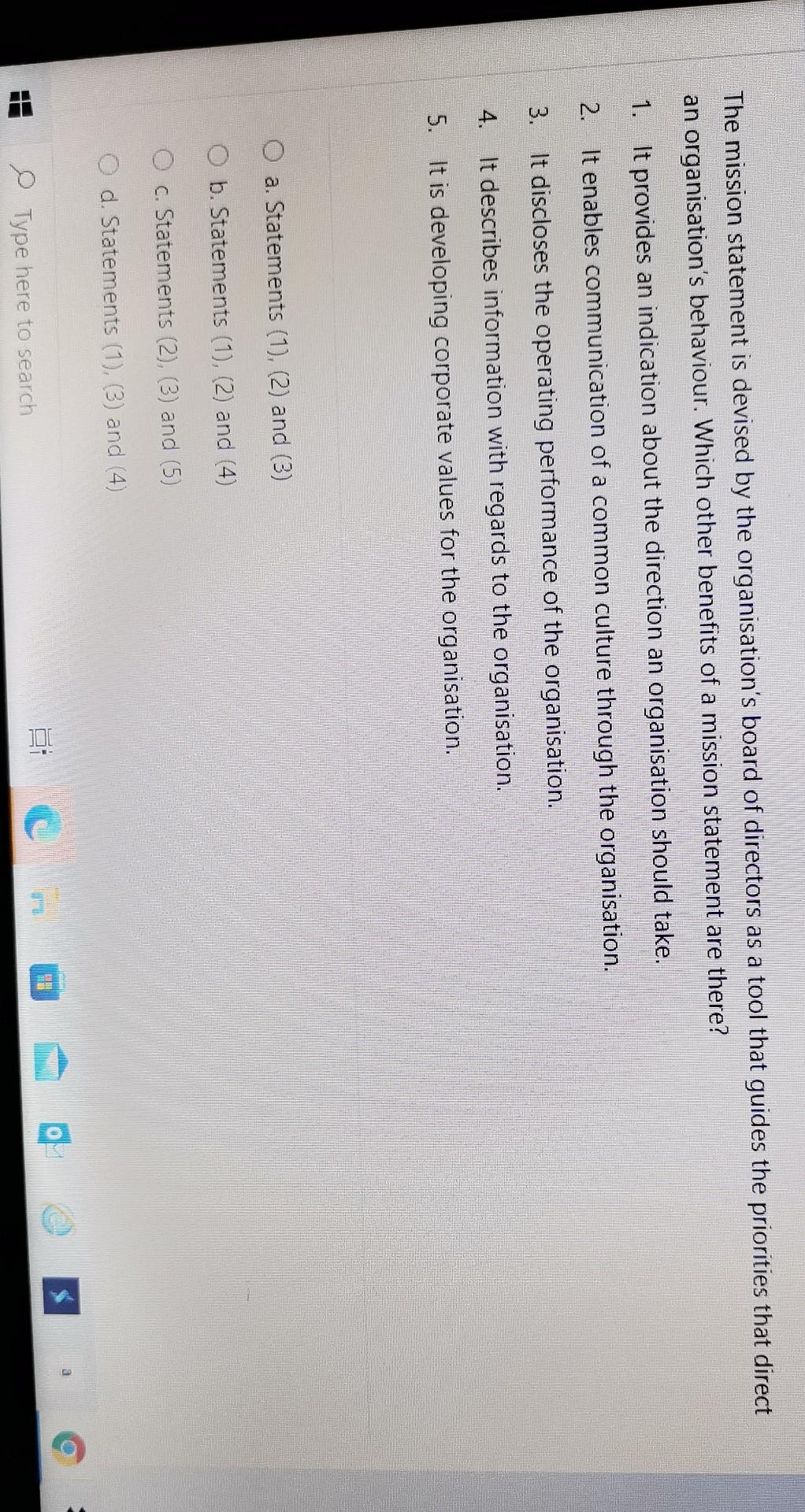

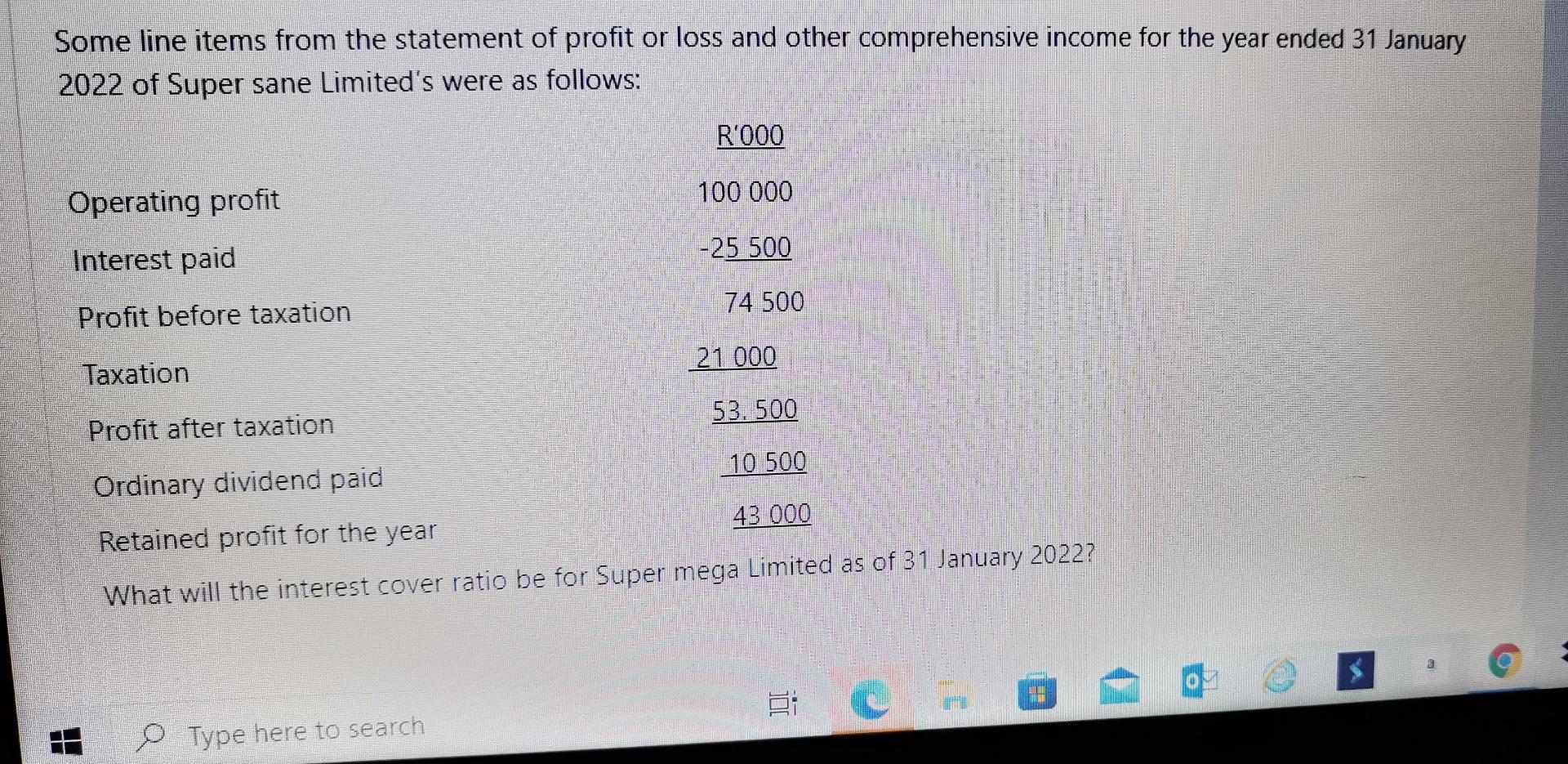

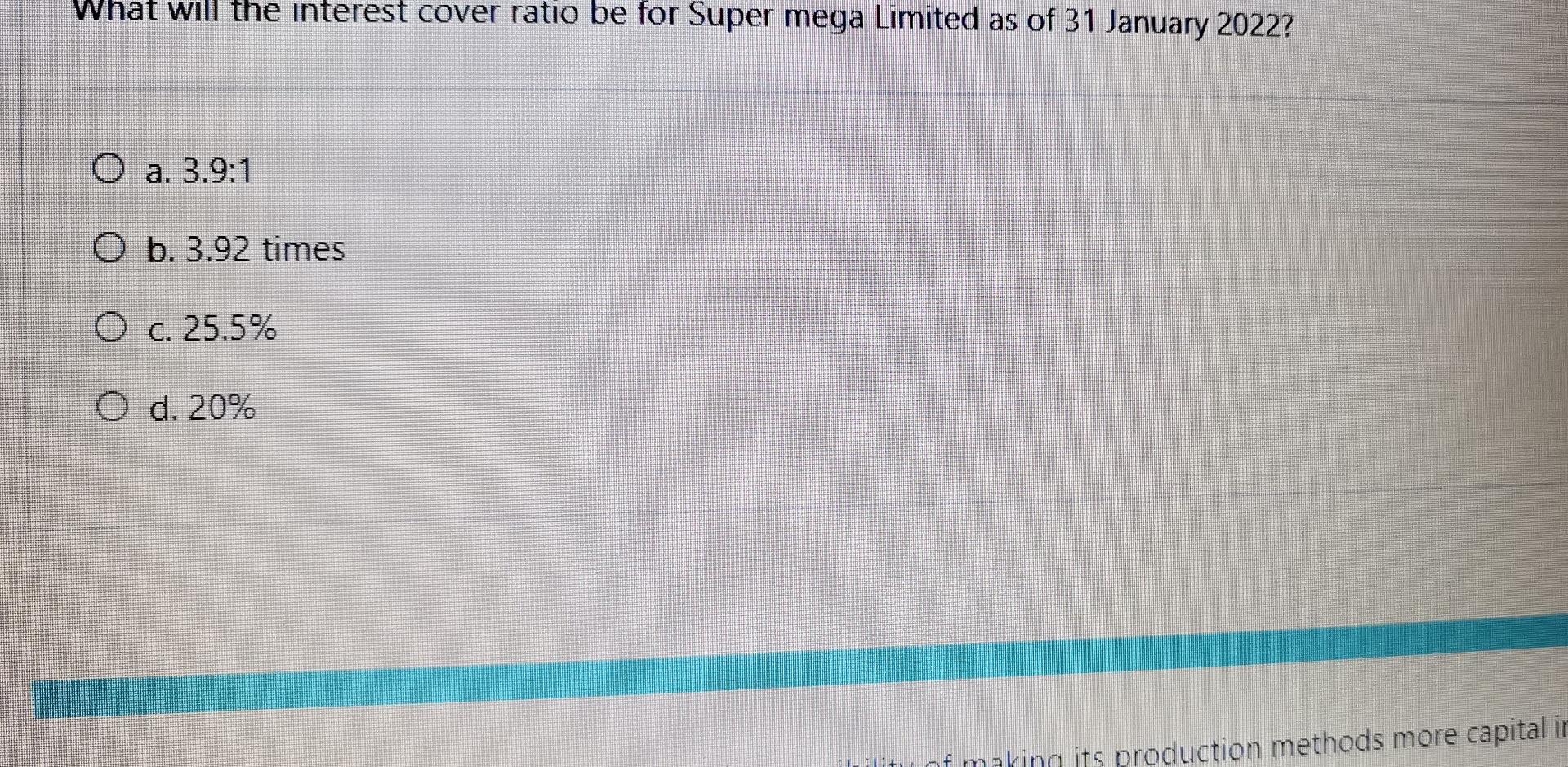

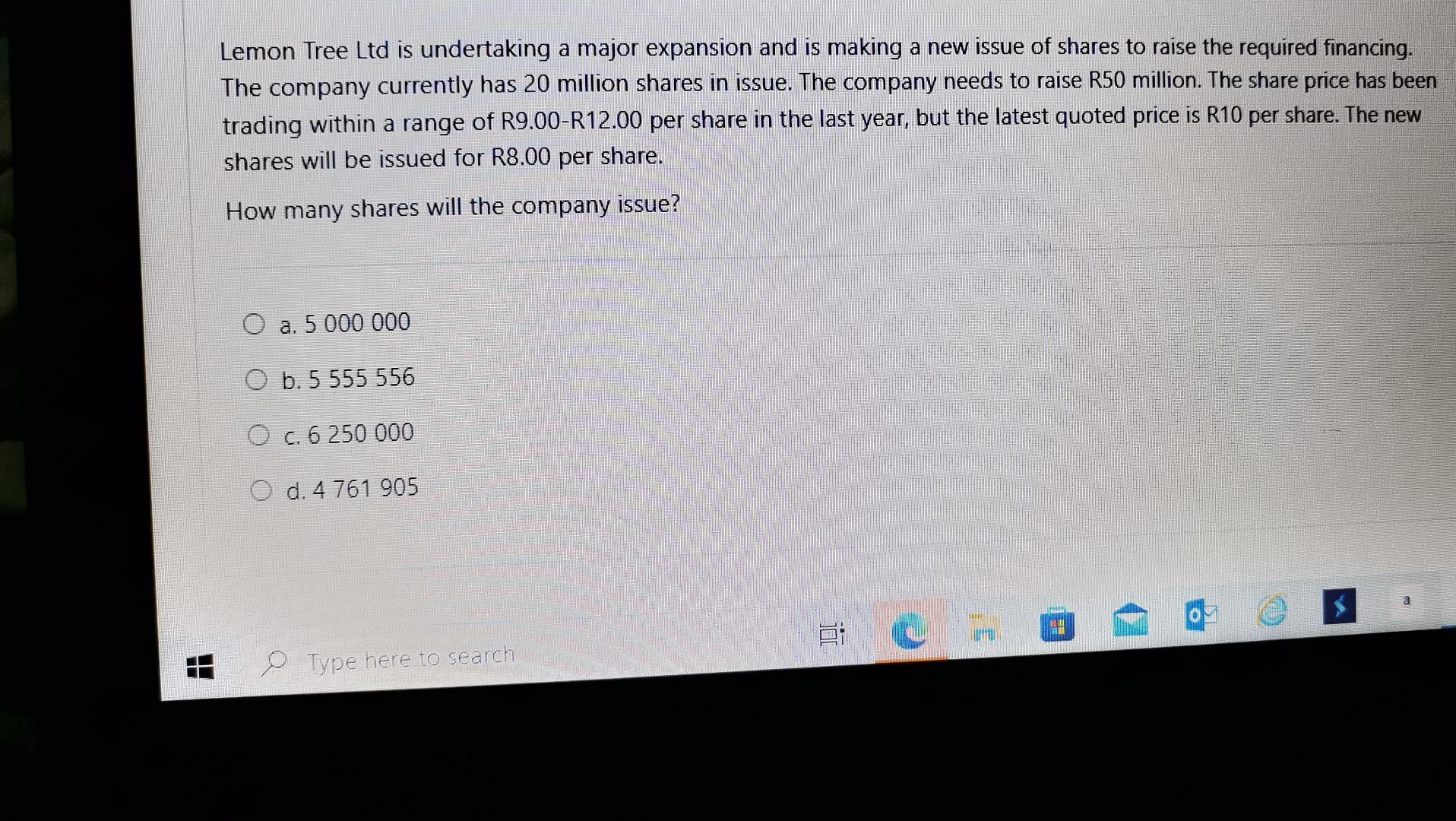

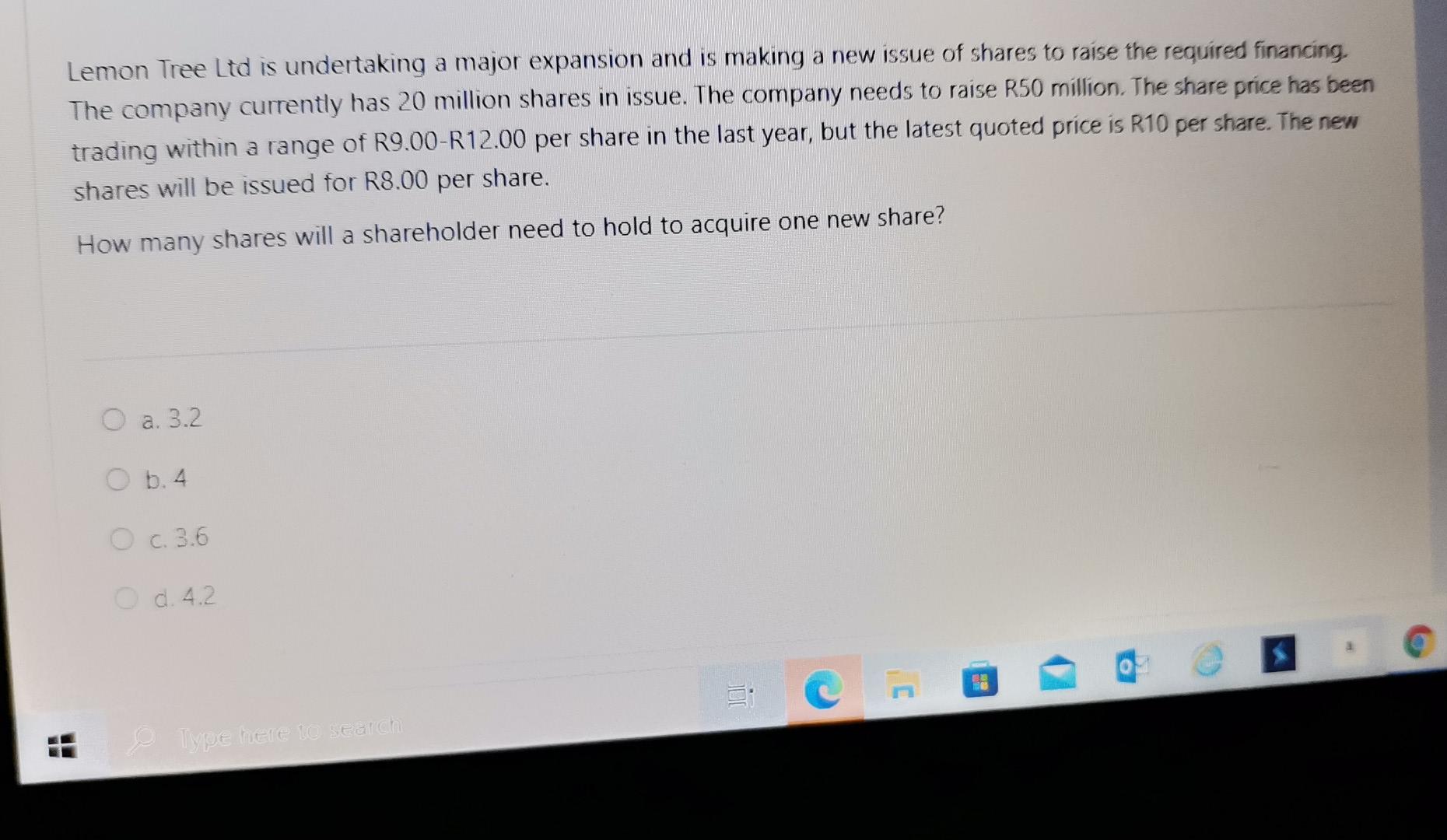

Dashboard / My courses / MAC2602-22-S1 / Welcome Message / Assessment 1 Question 6 Not yet answe Marked out of Sparta Pty (Ltd) purchases an average of R100 000 of inventory from its supplier on an annual basis. The credit terms of the supplier is 2.5/15 net 45 and is strictly enforced. The cost of other short-term financing options (such as the bank overdraft) has an effective annual rate of 17%. P Flag questi What will the nominal annual cost of credit be for Sparta if they follow the policy of paying for the purchases on the latest date allowed? a. 31,20% - Rather make use of other financing option at an effective annual rate of 17% O b. 31,20% - Make use of the policy of paying for purchases at the latest date allowed rather than making use of other financing options. O c. 25,35% - Make use of the policy of paying for purchases at the latest date allowed rather than making use of other financing options. O d. 30,10% Rather make use of other financing option at an effective annual rate of 17% Type here to search II 0 O a In managing inventory, keeping too much inventory results in the following: 1. Systems to manage/control the inventory 2. Higher suppliers' bills 3. Customer dissatisfaction because of higher costs. 4. Physical stores/infrastructure required to maintain the inventories in good condition Holding and ordering costs 5. . a. Statements (1), (B) and (5) b. Statements (1), (2) and (4) C. Statements (2), (4) and (5) O d. Statements (1), (4) and (5) Clear my choice Megatron Ltd has an equity beta of 1.5. The market risk premium in South Africa is expected to be 5% and yield on government bond (risk free rate) is currently 9.5%. Megatron has issued bonds and its R100 par value bond is currently trading at R94.50. The coupon is 10%. The maturity date is in 5 years' time and the corporate tax rate is 28%. Interest is payable annually in arrears. What is the weighted average cost of capital if target debt to equity ratio is 50% and the cost of equity and debt is 15% and 8% respectively? a. 13% b. 12.55% O c. 11.5% o d. 12.67% Clear my choice Super sane Limited is an internationally listed company. It has an issued share capital of 5 million ordinary shares. Most of the shares are held by large hedge funds. The current market price per share is R45. Some line items from the statement of profit or loss and other comprehensive income for the year ended 31 January 2022 of Super sane Limited's were as follows: R'000 Operating profit 100 000 Interest paid -25 500 Profit before taxation 74 500 Taxation 21 000 Profit after taxation 53. 500 10 500 Ordinary dividend paid Retained profit for the year 43 000 What will the dividend yield be for Super mega Limited as of 31 January 2022? c o HH Type here to search Megatron Ltd has an equity beta of 1.5. The market risk premium in South Africa is expected to be 5% and yield on government bond (risk free rate) is currently 9.5%. Megatron has issued bonds and its R100 par value bond is currently trading at R94.50. The coupon is 10%. The maturity date is in 5 years' time and the corporate tax rate is 28%. Interest is payable annually in arrears. Megatron paid a dividend of RO.20 per share and dividend per share is expected to grow at 10% indefinitely. The company's share price is R2.50. What is the cost of equity if we use dividend growth model? O a. 18.8% b. 8% O c. 18% O d. 10% Clear my choice Megatron Ltd has an equity beta of 1.5. The market risk premium in South Africa is expected to be 5% and yield on government bond (risk free rate) is currently 9.5%. Megatron has issued bonds and its R100 par value bond is currently trading at R94.50. The coupon is 10%. The maturity date is in 5 years' time and the corporate tax rate is 28%. Interest is payable annually in arrears. What is the after-tax cost of debt? O a. 11.51% b. 8.29% O c. 8% O d. 7.62% Clear my choice protit tor the year 43 000 What will the dividend yield be for Super mega Limited as of 31 January 2022? O a. 4.67% O b. 5.5% O c.4% O d. 3.65% Megatron ltd has an eruity heta of 15 The market rick premium in South Africa is expected to be 5% and vield Megatron Ltd has an equity beta of 1.5. The market risk premium in South Africa is expected to be 5% and yield on government bond (risk free rate) is currently 9.5%. Megatron has issued bonds and its R100 par value bond is currently trading at R94.50. The coupon is 10%. The maturity date is in 5 years' time and the corporate tax rate is 28%. Interest is payable annually in arrears. What is Megatron's Ltd cost of equity based on CAPM? a. 16.25% Ob.2.75% O c. 17% O d. 15% C The mission statement is devised by the organisation's board of directors as a tool that guides the priorities that direct an organisation's behaviour. Which other benefits of a mission statement are there? 1. It provides an indication about the direction an organisation should take. 2. It enables communication of a common culture through the organisation. 3. It discloses the operating performance of the organisation. 4. It describes information with regards to the organisation. 5. It is developing corporate values for the organisation. O a. Statements (1), (2) and (3) O b. Statements (1), (2) and (4) C. Statements (2), (3) and (5) O d. Statements (1), (3) and (4) Etc. HI Type here to search Some line items from the statement of profit or loss and other comprehensive income for the year ended 31 January 2022 of Super sane Limited's were as follows: R'000 100 000 Operating profit -25 500 Interest paid 74 500 Profit before taxation 21 000 Taxation 53.500 Profit after taxation 10.500 Ordinary dividend paid 43 000 Retained profit for the year What will the interest cover ratio be for Super mega Limited as of 31 January 2022? O Type here to search What will the interest cover ratio be for Super mega Limited as of 31 January 2022? O a. 3.9:1 O b. 3.92 times O c. 25.5% O d. 20% of making its production methods more capital in A mining company is doing research on the possibility of making its production methods more capital intensive, that will lead to increased production and therefore higher output, resulting in increased profits. This will however lead to the retrenchment of a large number of employees. Which of the following stakeholder groups will be most negatively affected if this plan is implemented? O a. Employees O b. Shareholders O c. Local authorities O d. Suppliers in Type here to search Which of the following is NOT one of the four stages of growth in the structure of an organisation's life cycle: a. Birth O b. Youth O c. Midlife O d. Acceleration e. Maturity a LE + Type here to search After the shift in the role of financial managers from being scorekeepers, the main focus of the financial manager became ? O a. the acquiring of funds as well as the use of these funds by applying general management principles. O b. the planning, organising and control of the financial activities of a business. O c. the management and control of money and money-related operations within a business. O d. to contribute with his/her financial knowledge and skills towards the long-term creation of sustainable wealth for the owners/investors of the business. a What in the present value of a zero-coupon bond with a par value of R1 000 000, which is due to be redeemed in 10 What is the present value of a zero-coupon bond with a par value of R 1 000 000, which is due to be redeemed in 10 years' time, when the market interest rate for such a bond is 6% p.a. Interest is compounded semi-annually? a. R553 676 O b.R744 094 O C. R742 470 O d. R861 667 a FSO 000 is investen for a nerind of five vears at 5% na interest is calculated semi-annually What is the total interest for Type here to search : C 11 R50 000 is invested for a period of five years at 5% p.a. Interest is calculated semi-annually. What is the total interest for the period if simple interest is added? O a. R25 000 O b. R12 500 O c. R2 500 O d. R9 200 2 cm Type here to search Lemon Tree Ltd is undertaking a major expansion and is making a new issue of shares to raise the required financing. The company currently has 20 million shares in issue. The company needs to raise R50 million. The share price has been trading within a range of R9.00-R12.00 per share in the last year, but the latest quoted price is R10 per share. The new shares will be issued for R8.00 per share. How many shares will the company issue? O a. 5 000 000 O b. 5 555 556 O c. 6 250 000 O d. 4 761 905 00 #c E Type here to search Lemon Tree Ltd is undertaking a major expansion and is making a new issue of shares to raise the required financing. The company currently has 20 million shares in issue. The company needs to raise R50 million. The share price has been trading within a range of R9.00-R12.00 per share in the last year, but the latest quoted price is R10 per share. The new shares will be issued for R8.00 per share. a How many shares will a shareholder need to hold to acquire one new share? a. 3.2 O b. 4 O c.3.6 O d. 4.2 ED : CD 3 pe here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started