Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DE Data A Jonathan Tyler is a single resident taxpayer with no dependants. His tax file number is 947 581 245 and his date

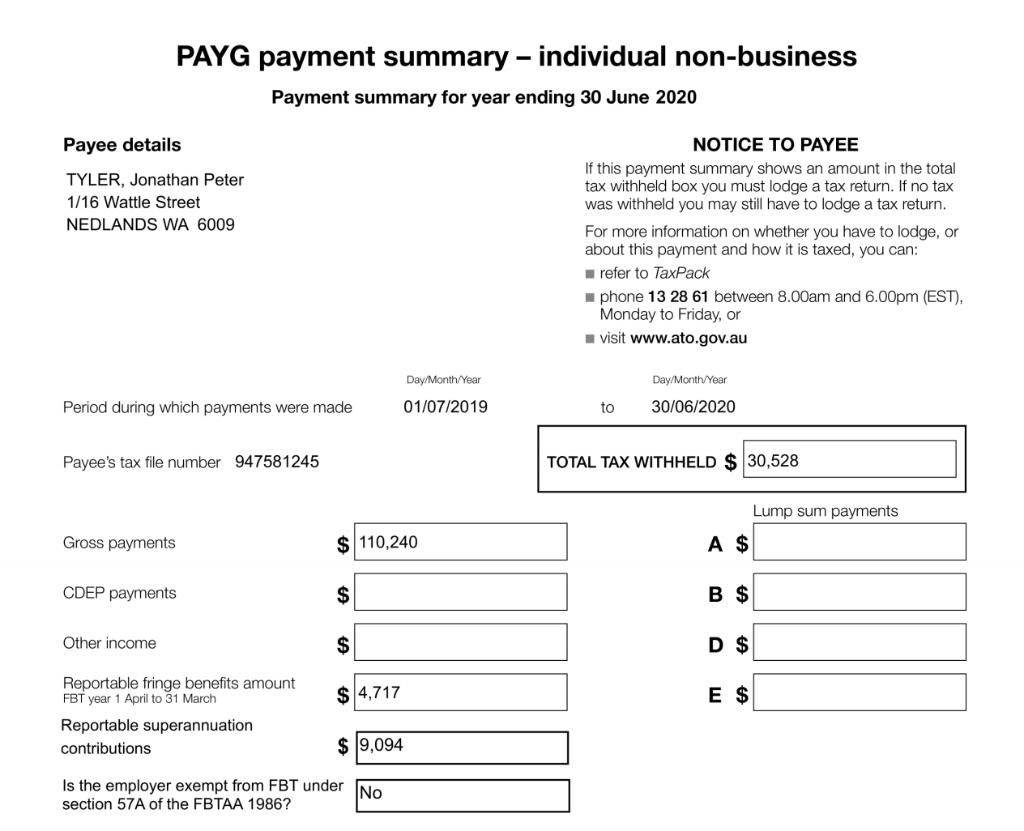

DE Data A Jonathan Tyler is a single resident taxpayer with no dependants. His tax file number is 947 581 245 and his date of birth is 22 February 1990. Jonathan's address is 1/16 Wattle Street, Nedlands, 6009. Jonathan works as an engineer at MinCo Limited, Australian mining company with its head office in West Perth. His salary is paid into his Bankwest bank account: BSB No: 084-976 Account No: 06978425 Account Name: J.P. Tyler If Jonathan is to receive a tax refund this year, he would like it to be paid into this bank account. The bank account interest totalled $460 for the year. As Jonathan had not initially notified the bank of his tax file number, tax of $54.05 was withheld by the bank from the first interest payment. Jonathan has since supplied his TFN to the bank. A copy of Jonathan's 2019/20 payment summary from MinCo Limited is available here. Jonathan has receipts for the following items, which he is seeking to claim as deductions: Steel-capped boots. Hard hat Sunscreen expenses Briefcase* Business suit $370 $125 $34 $280 $1,100 Dry cleaning of business suit $276 $2,185 Jonathan uses his briefcase to carry work papers. Jonathan drives to work and parks in the public car park nearby. His parking costs amounted to $2,250 for the year. Jonathan has private health insurance with HXF Insurance. A copy of Jonathan's private health insurance statement for 2019/20 is available here. During the year, Jonathan made donations of $200 to Princess Margaret Hospital and $100 to The University of Western Australia. He also gave $50 to a struggling pensioner living in his street. Jonathan estimated that he spent a further $100 on buskers throughout the year. Jonathan sold some shares during the year that he had held for 3 months, giving him a 'current year capital gains' figure of $2,400. Jonathan has no other capital gains events during the year (no other current year capital gains or losses), and no capital losses carried over from previous years. In October 2019, Jonathan paid a registered tax agent $280 to prepare and lodge his 2019 tax return. PAYG payment summary - individual non-business Payment summary for year ending 30 June 2020 Payee details TYLER, Jonathan Peter 1/16 Wattle Street NEDLANDS WA 6009 Period during which payments were made Payee's tax number 947581245 Gross payments CDEP payments Other income Reportable fringe benefits amount FBT year 1 April to 31 March Reportable superannuation contributions $110,240 $ $ $4,717 $9,094 Is the employer exempt from FBT under section 57A of the FBTAA 1986? Day/Month/Year 01/07/2019 No NOTICE TO PAYEE If this payment summary shows an amount in the total tax withheld box you must lodge a tax return. If no tax was withheld you may still have to lodge a tax return. For more information on whether you have to lodge, or about this payment and how it is taxed, you can: refer to TaxPack phone 13 28 61 between 8.00am and 6.00pm (EST), Monday to Friday, or visit www.ato.gov.au to Day/Month/Year 30/06/2020 TOTAL TAX WITHHELD $ 30,528 A $ B $ D $ E $ Lump sum payments

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Jonathan Received Bank Interest of 460 from tax Refund Bank withheld 54 05 Therefore the remaining a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started