Answered step by step

Verified Expert Solution

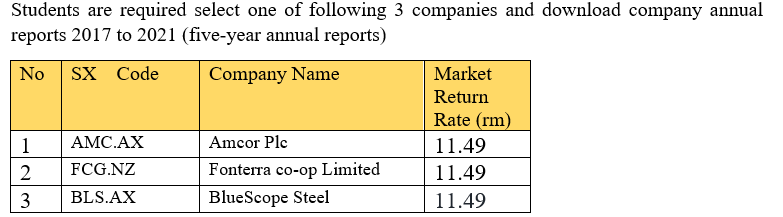

Question

1 Approved Answer

Data Analysis Analysis of companys capital structure policies (maximum 550 words) ( 6+6+15+3= 30 marks ) Describe the capital structure considering the following criteria: Why

- Data Analysis

- Analysis of companys capital structure policies (maximum 550 words) (6+6+15+3= 30 marks)

Describe the capital structure considering the following criteria:

-

- Why is capital structure analysis useful for a company? (discuss optimal capital structure, firm value, why higher EPS does not always support for the optimal capital structure).

- What does the capital structure theory say about a company's capital structure?

- Assess firms capital (i.e. capital structure of the selected company) over five-year period (i. e. 2017 2021) using the data collected from DatAnalysis Premium database. In your analysis

- Use debt ratios, debt equity ratios and Times interest earned ratios to assess the companys current performance against its past performance ( i. e trend analysis) and its current performance against its competitors (i.e. industry analysis). Please use 5year financial data from 2017 to 2021 (please conduct performance analysis over the 20172021 period).

- Based on the findings found in a, what is your opinion about the company's capital structure, specifically degree of financial leverage. (HINT: Make an assessment about its firm capital structure based on these solvency ratios).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started