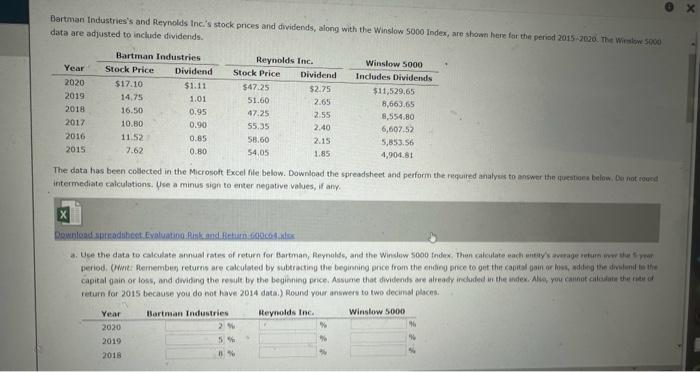

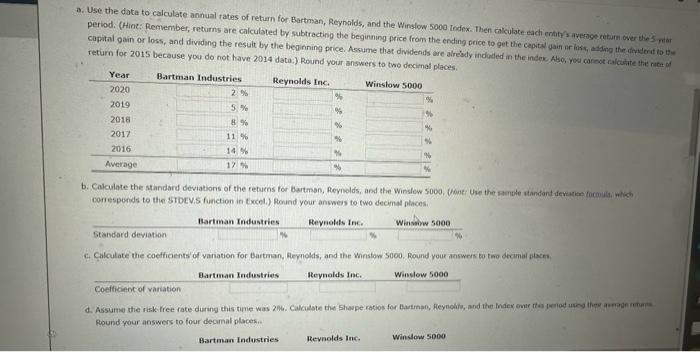

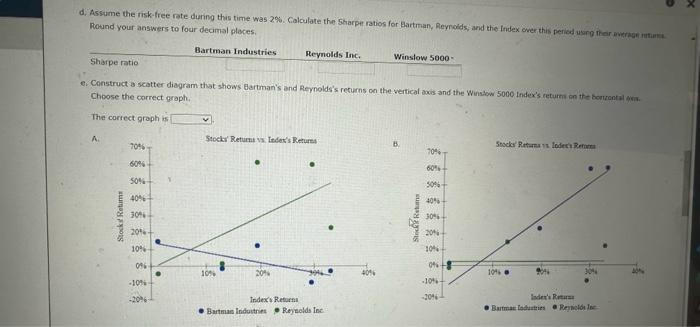

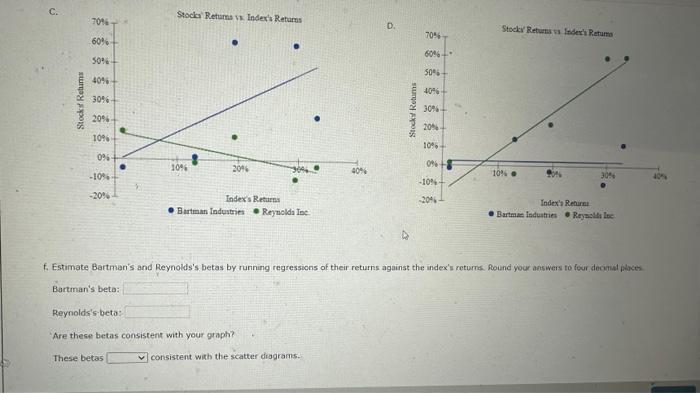

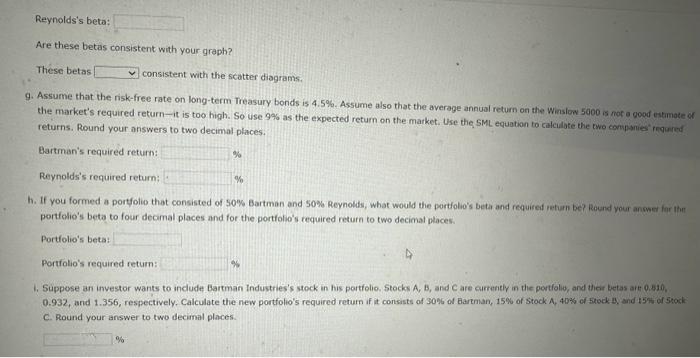

data are adjusted to include dividends. intermediate calculations. Use a minus sign to enter negative values, if any. return for 2015 because you do not haven 2014 data.) Round your answers to two decimal places. 3. Use the data to calculate annual rates of retum for Bartman, Reynalds, and the Wins 5 w 5000 Index. Then cakculate cach entitys averoge retum over the 5 n ar corresponds to the stocv.s function in tucel.) Round your anwes to fwo decimal places. Cakulate the coefficents of variation for Bartman, Alemolds, and the Winstow 5000 . Bound your answers 60 tao dectmal jiacm. Phound your answers to four decimal ploces... Bartman Industries Revnolds inc Window 5000 Round your answers to four decimal places. Choose the correct graph. The corfect groph is f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returnas found your answers to four decimal jaxteBartman's beta: Reynolds's beta: Are these betas consistent with your graph? These betas consistent with the sicatter dragrams. Are these betas consistent with your graph? These betas consistent with the scatter diagrams. 9. Assume that the risk-free rate on long-term Treasury bonds is 4.5%. Assume also that the average annual return on the Winslow 5000 is not a good estimate of the market's required return-it is too high. So use 9% as the expected return on the market. Use the 5ML equation to calcilate the two comp-aries" requikd returns. Round your answers to two decimal places. Bartman's required retum: Reynolds's required retum: h. If you formed a portfolio that consisted of 50% Bartman and 50% Reynolds, what would the portfolio's betar and requiref return be? Round your animed far thr portfolio's beta to four decimal places and for the portfolio's required return to two decimal places. Portfolio's beta: Portfolio's required return: 1. Suppose an investor wants to include Bartman Industries's stock in his partfolio. Stocks A, B, and C are currentiy in the portfolig, and thoi betas art 0.5A0, 0.932 , and 1.356, respectively. Calculate the new portfolio's required return if it contsists of 30\%6 of Bartman, 15\% of stock A, 40\% of 5tock 3 , and t 15% of 3 tock C. Round your answer to two decimal places. data are adjusted to include dividends. intermediate calculations. Use a minus sign to enter negative values, if any. return for 2015 because you do not haven 2014 data.) Round your answers to two decimal places. 3. Use the data to calculate annual rates of retum for Bartman, Reynalds, and the Wins 5 w 5000 Index. Then cakculate cach entitys averoge retum over the 5 n ar corresponds to the stocv.s function in tucel.) Round your anwes to fwo decimal places. Cakulate the coefficents of variation for Bartman, Alemolds, and the Winstow 5000 . Bound your answers 60 tao dectmal jiacm. Phound your answers to four decimal ploces... Bartman Industries Revnolds inc Window 5000 Round your answers to four decimal places. Choose the correct graph. The corfect groph is f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returnas found your answers to four decimal jaxteBartman's beta: Reynolds's beta: Are these betas consistent with your graph? These betas consistent with the sicatter dragrams. Are these betas consistent with your graph? These betas consistent with the scatter diagrams. 9. Assume that the risk-free rate on long-term Treasury bonds is 4.5%. Assume also that the average annual return on the Winslow 5000 is not a good estimate of the market's required return-it is too high. So use 9% as the expected return on the market. Use the 5ML equation to calcilate the two comp-aries" requikd returns. Round your answers to two decimal places. Bartman's required retum: Reynolds's required retum: h. If you formed a portfolio that consisted of 50% Bartman and 50% Reynolds, what would the portfolio's betar and requiref return be? Round your animed far thr portfolio's beta to four decimal places and for the portfolio's required return to two decimal places. Portfolio's beta: Portfolio's required return: 1. Suppose an investor wants to include Bartman Industries's stock in his partfolio. Stocks A, B, and C are currentiy in the portfolig, and thoi betas art 0.5A0, 0.932 , and 1.356, respectively. Calculate the new portfolio's required return if it contsists of 30\%6 of Bartman, 15\% of stock A, 40\% of 5tock 3 , and t 15% of 3 tock C. Round your answer to two decimal places