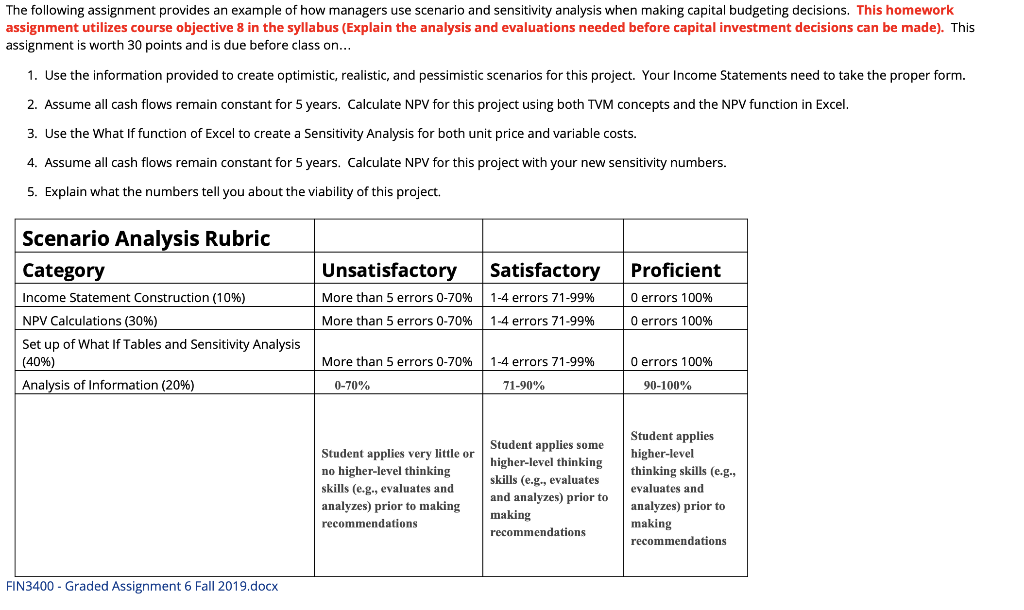

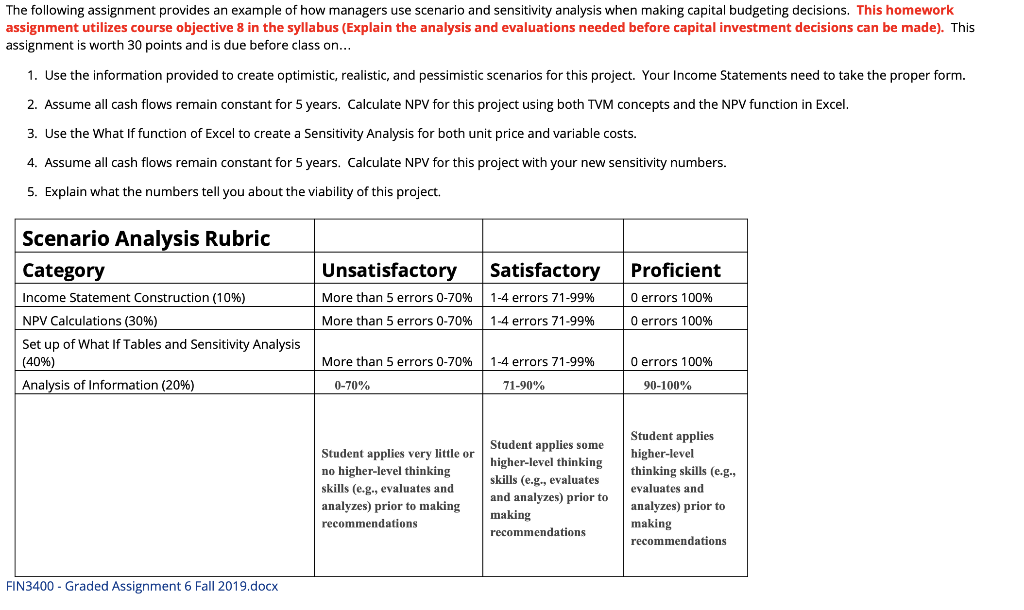

The following assignment provides an example of how managers use scenario and sensitivity analysis when making capital budgeting decisions. This homework assignment utilizes course objective 8 in the syllabus (Explain the analysis and evaluations needed before capital investment decisions can be made). This assignment is worth 30 points and is due before class on... 1. Use the information provided to create optimistic, realistic, and pessimistic scenarios for this project. Your Income Statements need to take the proper form. 2. Assume all cash flows remain constant for 5 years. Calculate NPV for this project using both TVM concepts and the NPV function in Excel. 3. Use the What If function of Excel to create a Sensitivity Analysis for both unit price and variable costs. 4. Assume all cash flows remain constant for 5 years. Calculate NPV for this project with your new sensitivity numbers. 5. Explain what the numbers tell you about the viability of this project. Proficient Scenario Analysis Rubric Category Income Statement Construction (10%) NPV Calculations (30%) Set up of What If Tables and Sensitivity Analysis (40%) Analysis of Information (20%) Unsatisfactory More than 5 errors 0-70% More than 5 errors 0-70% Satisfactory 1-4 errors 71-99% 1-4 errors 71-99% O errors 100% O errors 100% 1-4 errors 71-99% O errors 100% More than 5 errors 0-70% 0-70% 71-90% 90-100% Student applies very little or no higher-level thinking skills (e.g., evaluates and analyzes) prior to making recommendations Student applies some highe thinking skills (e.g., evaluates and analyzes) prior to making recommendations Student applies higher-level thinking skills (e.g., evaluates and analyzes) prior to making recommendations FIN3400 - Graded Assignment 6 Fall 2019.docx The following assignment provides an example of how managers use scenario and sensitivity analysis when making capital budgeting decisions. This homework assignment utilizes course objective 8 in the syllabus (Explain the analysis and evaluations needed before capital investment decisions can be made). This assignment is worth 30 points and is due before class on... 1. Use the information provided to create optimistic, realistic, and pessimistic scenarios for this project. Your Income Statements need to take the proper form. 2. Assume all cash flows remain constant for 5 years. Calculate NPV for this project using both TVM concepts and the NPV function in Excel. 3. Use the What If function of Excel to create a Sensitivity Analysis for both unit price and variable costs. 4. Assume all cash flows remain constant for 5 years. Calculate NPV for this project with your new sensitivity numbers. 5. Explain what the numbers tell you about the viability of this project. Proficient Scenario Analysis Rubric Category Income Statement Construction (10%) NPV Calculations (30%) Set up of What If Tables and Sensitivity Analysis (40%) Analysis of Information (20%) Unsatisfactory More than 5 errors 0-70% More than 5 errors 0-70% Satisfactory 1-4 errors 71-99% 1-4 errors 71-99% O errors 100% O errors 100% 1-4 errors 71-99% O errors 100% More than 5 errors 0-70% 0-70% 71-90% 90-100% Student applies very little or no higher-level thinking skills (e.g., evaluates and analyzes) prior to making recommendations Student applies some highe thinking skills (e.g., evaluates and analyzes) prior to making recommendations Student applies higher-level thinking skills (e.g., evaluates and analyzes) prior to making recommendations FIN3400 - Graded Assignment 6 Fall 2019.docx