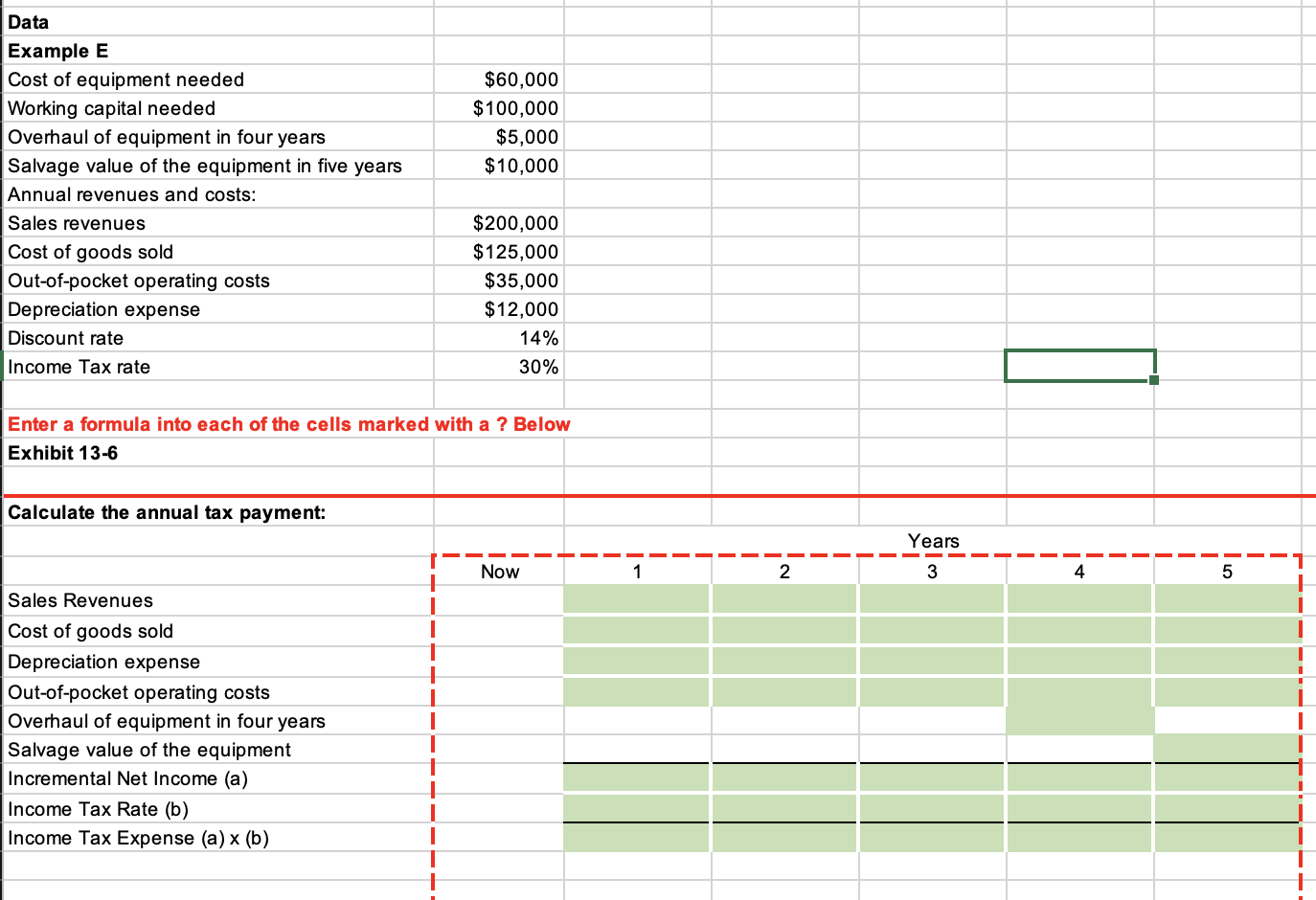

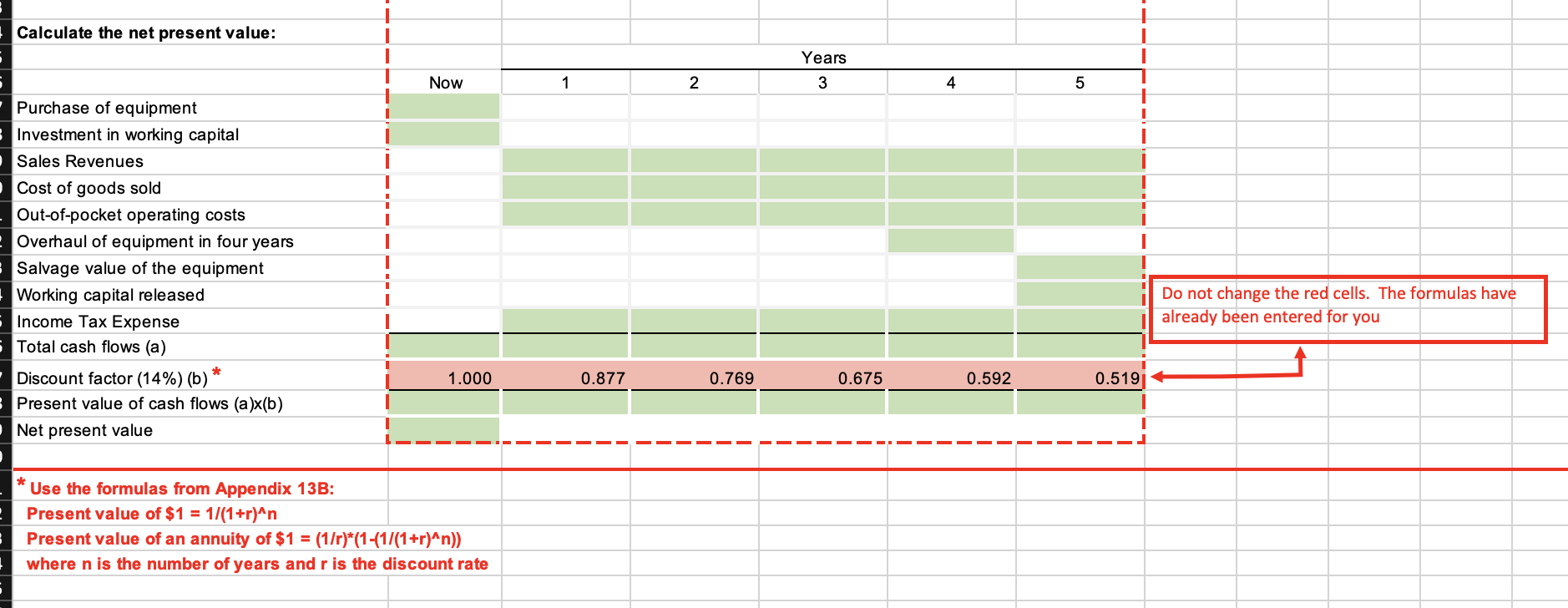

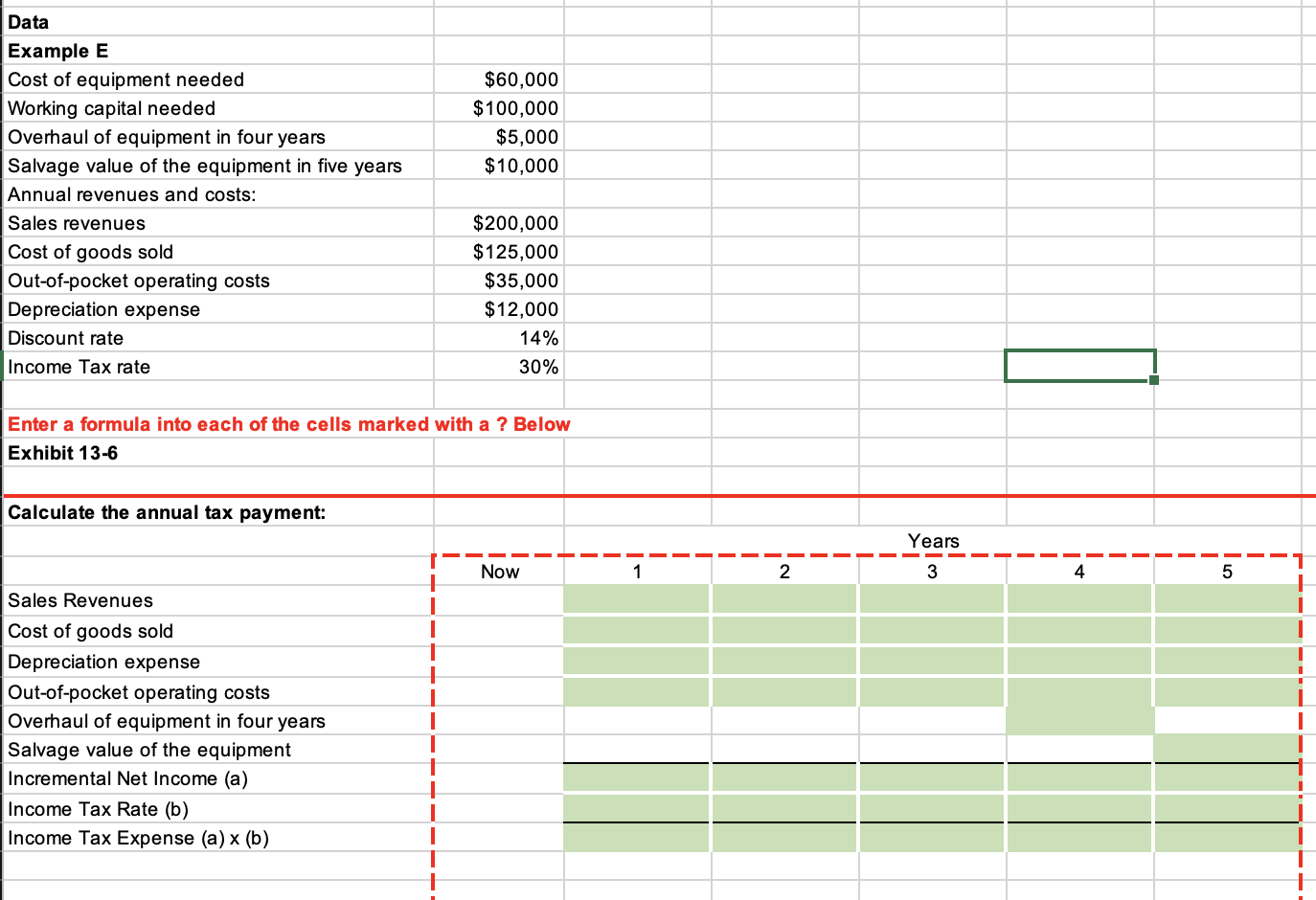

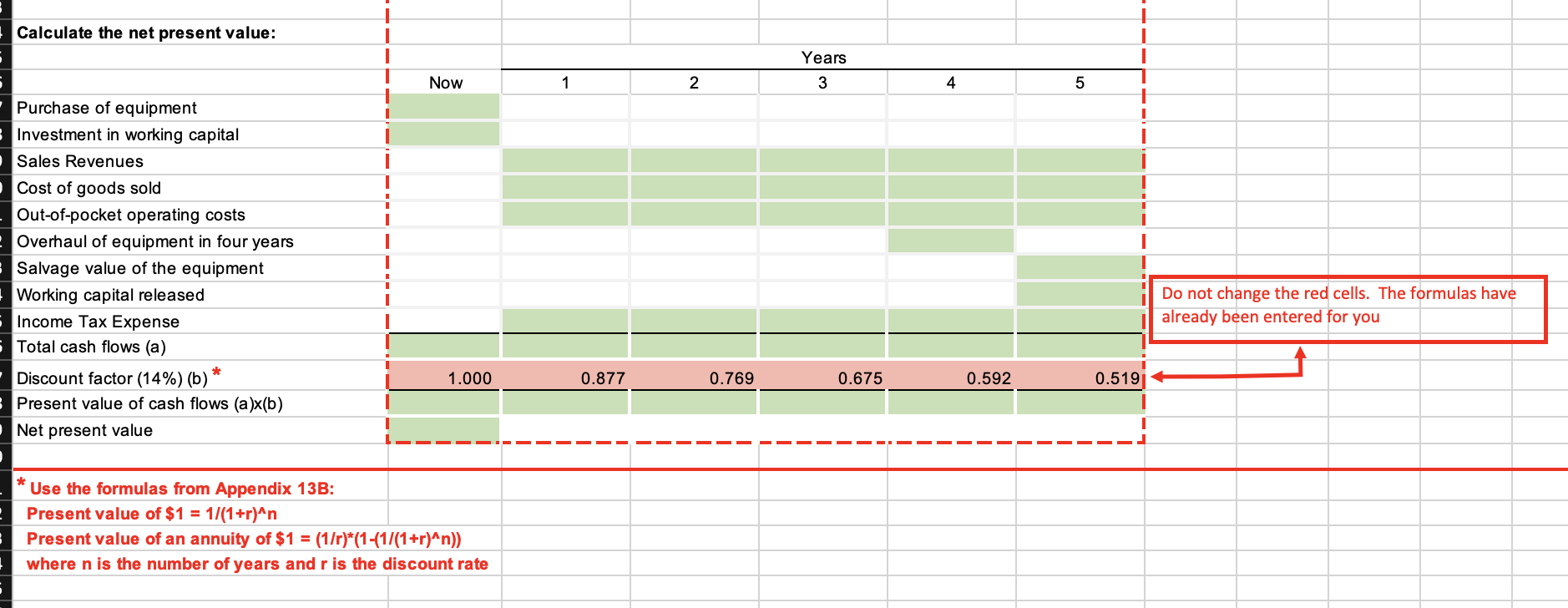

Data Example E \begin{tabular}{|l|r|r|r|} \hline Cost of equipment needed & $60,000 & \\ \hline Working capital needed & $100,000 & \\ \hline Overhaul of equipment in four years & $5,000 & \\ \hline Salvage value of the equipment in five years & $10,000 & \\ \hline Annual revenues and costs: & & & \\ \hline Sales revenues & $200,000 & \\ \hline Cost of goods sold & $125,000 & \\ \hline Out-of-pocket operating costs & $35,000 & \\ \hline Depreciation expense & $12,000 & \\ \hline Discount rate & 14% & \\ \hline Income Tax rate & 30% & \\ \hline \end{tabular} Enter a formula into each of the cells marked with a ? Below Exhibit 13-6 Calculate the annual tax payment: Sales Revenues Depreciation expense Out-of-pocket operating costs Overhaul of equipment in four years Salvage value of the equipment Incremental Net Income (a) Income Tax Rate (b) Income Tax Expense (a) x (b) Calculate the net present value: Purchase of equipment Investment in working capital Sales Revenues Cost of goods sold Out-of-pocket operating costs Overhaul of equipment in four years Salvage value of the equipment Working capital released Income Tax Expense Total cash flows (a) Discount factor (14\%) (b) * Present value of cash flows (a)x(b) Net present value * Use the formulas from Appendix 13B: Present value of $1=1/(1+r)n Present value of an annuity of $1=(1/r)(1(1/(1+r)n)) where n is the number of years and r is the discount rate Data Example E \begin{tabular}{|l|r|r|r|} \hline Cost of equipment needed & $60,000 & \\ \hline Working capital needed & $100,000 & \\ \hline Overhaul of equipment in four years & $5,000 & \\ \hline Salvage value of the equipment in five years & $10,000 & \\ \hline Annual revenues and costs: & & & \\ \hline Sales revenues & $200,000 & \\ \hline Cost of goods sold & $125,000 & \\ \hline Out-of-pocket operating costs & $35,000 & \\ \hline Depreciation expense & $12,000 & \\ \hline Discount rate & 14% & \\ \hline Income Tax rate & 30% & \\ \hline \end{tabular} Enter a formula into each of the cells marked with a ? Below Exhibit 13-6 Calculate the annual tax payment: Sales Revenues Depreciation expense Out-of-pocket operating costs Overhaul of equipment in four years Salvage value of the equipment Incremental Net Income (a) Income Tax Rate (b) Income Tax Expense (a) x (b) Calculate the net present value: Purchase of equipment Investment in working capital Sales Revenues Cost of goods sold Out-of-pocket operating costs Overhaul of equipment in four years Salvage value of the equipment Working capital released Income Tax Expense Total cash flows (a) Discount factor (14\%) (b) * Present value of cash flows (a)x(b) Net present value * Use the formulas from Appendix 13B: Present value of $1=1/(1+r)n Present value of an annuity of $1=(1/r)(1(1/(1+r)n)) where n is the number of years and r is the discount rate