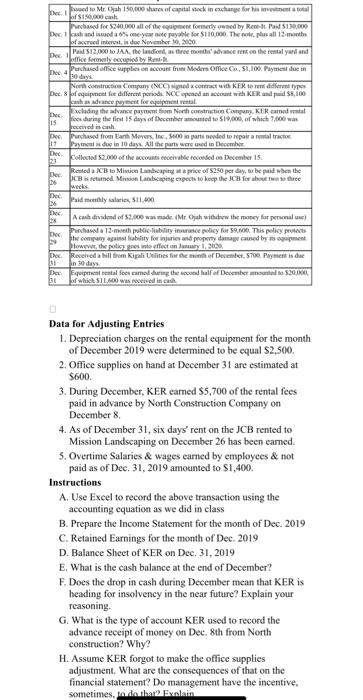

Data for Adjusting Entries 1. Depreciation charges on the rental equiprnent for the month of December 2019 were determined to be equal $2,500. 2. Office supplies on hand at December 31 are estimated at $600. 3. During December, KER earned $5,700 of the rental fees paid in advance by North Construction Company on December 8 . 4. As of December 31, six days' rent on the JCB rented to Mission Landscaping on December 26 has been earned. 5. Overtime Salaries \& wages earned by employees \& not paid as of Dec. 31,2019 amotanted to $1,400. Instructions A. Use Excel to record the above transaction using the accounting equation as we did in class B. Prepare the Income Statement for the month of Dec. 2019 C. Retained Earnings for the month of Dec. 2019 D. Balance Sheet of KER on Dec. 31, 2019 E. What is the cash balance at the end of December? F. Does the drop in cash during December mean that KER is heading for insolvency in the near future? Explain your reasoning. G. What is the type of account KER used to record the advance receipt of money on Dec. 8th from North construction? Why? H. Assume KER forgot to make the office supplies adjustment. What are the consequences of that on the financial statement? Do management have the incentive, Data for Adjusting Entries 1. Depreciation charges on the rental equiprnent for the month of December 2019 were determined to be equal $2,500. 2. Office supplies on hand at December 31 are estimated at $600. 3. During December, KER earned $5,700 of the rental fees paid in advance by North Construction Company on December 8 . 4. As of December 31, six days' rent on the JCB rented to Mission Landscaping on December 26 has been earned. 5. Overtime Salaries \& wages earned by employees \& not paid as of Dec. 31,2019 amotanted to $1,400. Instructions A. Use Excel to record the above transaction using the accounting equation as we did in class B. Prepare the Income Statement for the month of Dec. 2019 C. Retained Earnings for the month of Dec. 2019 D. Balance Sheet of KER on Dec. 31, 2019 E. What is the cash balance at the end of December? F. Does the drop in cash during December mean that KER is heading for insolvency in the near future? Explain your reasoning. G. What is the type of account KER used to record the advance receipt of money on Dec. 8th from North construction? Why? H. Assume KER forgot to make the office supplies adjustment. What are the consequences of that on the financial statement? Do management have the incentive