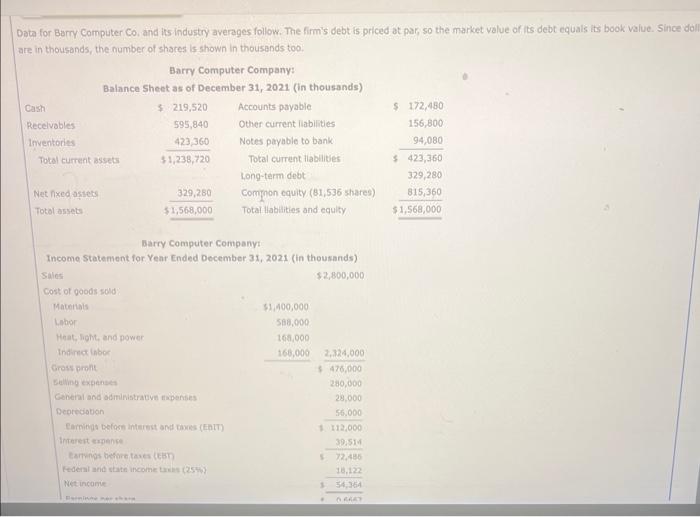

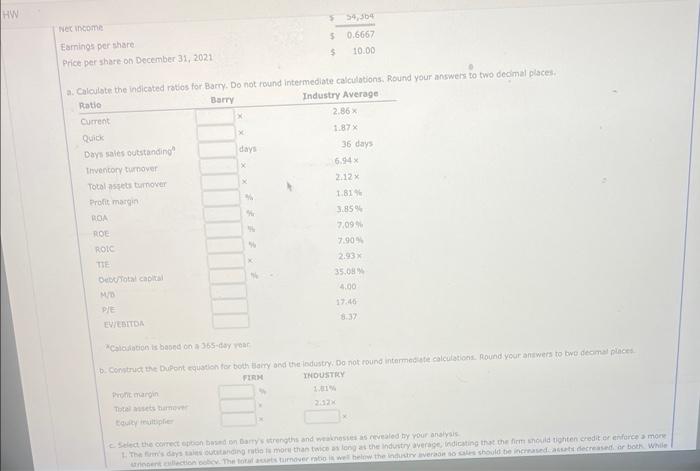

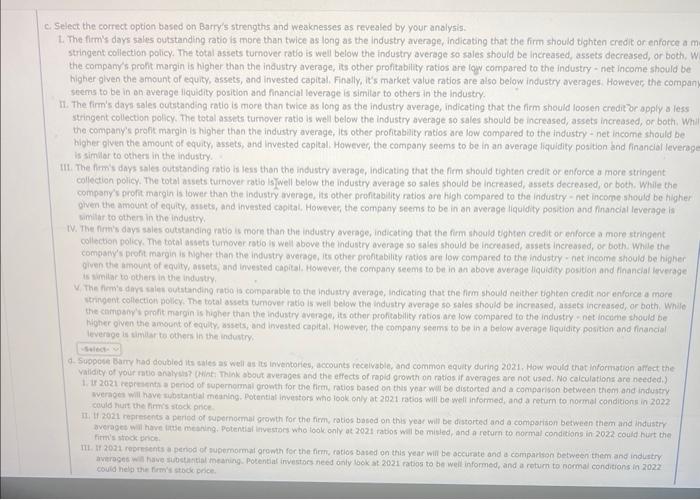

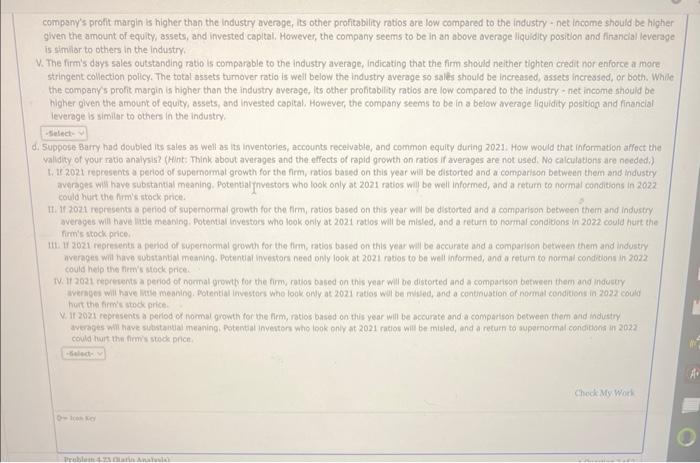

Data for Barry Computer Co, and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since do are in thousands, the number of shares is shown in thousands too. Barry Computer Company income Statement for Year Ended December 3., 2021 (in thousands) *Calobiacion is beped on A 365 -titay roar Select the correct option bosed on Barry's strengths and weaknesses as revealed by your analysi's. L. The firm's days sales outstanding ratio is more than twice as long as the industry average, indicating that the firm should tighten credit or enforce a : stringent collection policy. The total assets turnover rato is well below the industry average so sales stould be increased, assets decreased, or both, the company's profit margin is higher than the incustry average, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. Finally, it's market value ratios are also below industry averages. However, the compa seems to be in on average liquidity position and financial leverage is similar to others in the industry. II. The firm's days sales outstanding ratio is more than twice as long as the industry average, indicating that the firm should loosen credit'oc apply a less stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets increased, or both. the company's profit margin is higher than the industry average, its other prohitability natios are low compared to the industry - net income should be higher glven the amount of equity, assets, and invested capltal. However, the company seems to be in an average liquidity position and financial leveray is simular to others in the industry. IIt. The firm's doys sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit or enforce o more stringent. collection policy. The total assets turnover ratio lsgell below the industry average so sales should be increased, assets decreased, or both. While the company's profit margin is lower than the industry averege, its other prontablity ratios ore high compared to the industry - net income should be higher given the amount of equity, ossets, and invested copital. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. TV. The firmis days sales outstanding ratio is more than the industry overage, indicating that the firm should tighten credit or enforce a more stringent collecton policy. The total assets tumover ratio is well above the industry overage so sales should be increased, assets increased, or both. While the company's proft, margin is Aigher than the industry average, its other proftabiity rotios are low compared to the industry * not income should be higher Qiven the amount of equity, assets, and invested capital. Howover, the company seems to be in an above average liquidity position and financial leverage is similiar to others in the industry, V. The fim'e davs sales outstanding rabo is comparable to the indvity averoge, indicating that the fim should neither tighten credit nor enfarce a more whingent collection policy. The botal assets tumever ratlo is well below the industry averape so sales should be increased, asse6s increused, or both. While the chimpan's profit margin is higher than the industry average, its other profitoblity ratios ane low compared to the industry - het income should be Higher oiven the amont of equily, assets, and invested capital. However, the company seems to be in a below averoge liquidity posithin and financial leverage is similar to others in the industry. d. Suopoce Barry had doubied its sales as well as its inventories, accounts recelvable, and common equity during 2021 . How would that information affect the Yaility of your natio analysb? (Wilet Think abovt averages and the effects of rapld growth on ratios if averagos are not used. No calculations are needed.) 1. ir 2021 resinients a peniog of supernomnal growth for the firm, ratios based on this yoar wall be distorted and a compansion between them and industy. werages will have substantial meaning. Potentiat investors who look only at 2021 ratios will be well informed, and a return to normal conditions in 2022 . could hurt the frm's stock pnce. II. H 2021 represents a puriod of supernoemul growth for the fiem, rotios based on this year will be datorted and a comparias between them and industry firm's stock inch. II. If 2021 reprnsents a period of supemormal oromth for the firm, rotlos based on this year will be sccurate and a compartson between them and induatry averoges will have siodecustial meaning. Potential investors need only look at 2021 ntas to be weil informed, and a rotum to normal conditions in 2022 . could hebs the frm's stock apice. company's profit margin is higher than the industry average, its other profitabilify ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an above average llquidity position and financial leverage is similior to others in the industry. Q. The firm's dyys sales outstanding ratio is comparable to the industry average, indicating that the firm should neither tighten credit nor enforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets incressed, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital, However, the company seems to be in a below average liquidity positiog and financial leverage is similar to others in the industry. d. 5uppose Barry had doubled its sales as well as its inventories, accounts recelvable, and common equity during 2021. How would that information affoct the validity of your notio analysis? (Aint: Think about averages and the effects of rapid growth on natios if averages are not used. No calculations are neededi) 1. If 2021 represtnts a period of supernormal growth for the firm, natios based on this year will be distorted and a comparizon between them and industry averages will have substantial meaning, Potental Gnvestors who look only at 2021 ratios will be well informed, and a return to normal conditions in 2022 could hairt the firm's stock price. II. If 2021 represents a peniod of supemornal growth for the firm, ratios based on this year will be distorted and a comparison between them and industry avereges will have litble meaning. Potential lovestars who look only at 2021 ratios will be misled, and a return to harmal condibons in 2022 could hurt the firm's stock price. III. If 2021 reoresents a period of supernormal growh for the firm, ratios based on this year will be accurate and a comparison between them and industiy nverages wil have substanbal meaning. Potential linvestons need only look at 2021 ratios to be weil informed, and as return to normal conditions in 2022 could help the nem's utock price. TV. If 2021 represents a penos of normal growtb for the firmy, ratios bused on this year will be distorted and a comparison between them and industy wernges will have irrie meaning. Botential investars whe look orly at 2021 ratios wil be milled, and a continuation of nommat conditions in 2022 could hust than firm's stodk price. v. If 2022 reprisents a period of normal growth for the firm, ratios based on thik year will be accurate and a compartion between thern and industry averoges will have sibstanjal meaning. Fotertal inyertors who look only at 2021 ratios will be misled, and a return to supernormal condibons in 2022 could theit thin firmis stock phich