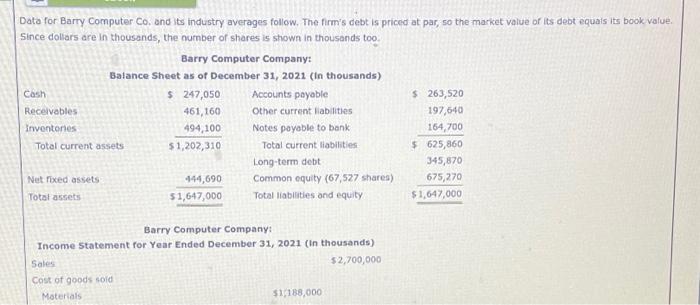

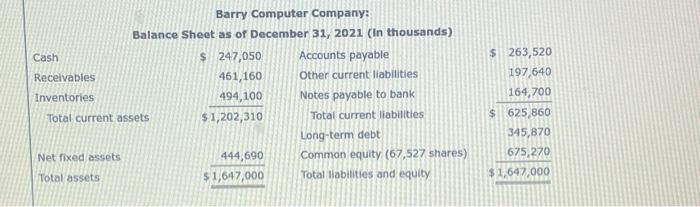

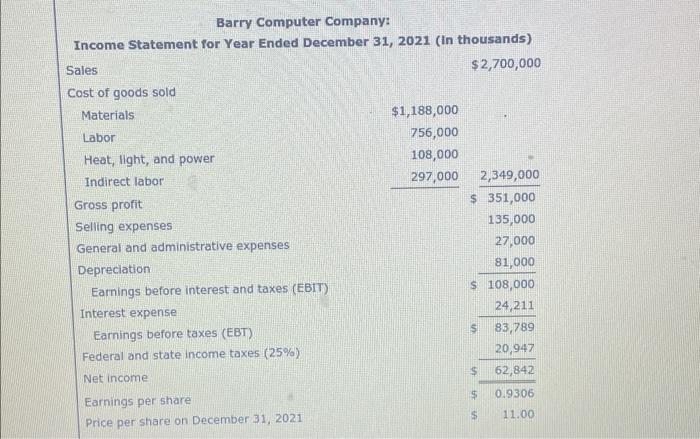

Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, the number of shares is shown in thousands too. Cash Receivables Inventories Barry Computer Company: Balance Sheet as of December 31, 2021 (In thousands) Accounts payable Other current liabilities Notes payable to bank Total current liabilities Total current assets Net fixed assets Total assets $ 247,050 461,160 494,100 $ 1,202,310 Sales Cost of goods sold Materials 444,690 $1,647,000 Long-term debt Common equity (67,527 shares) Total liabilities and equity Barry Computer Company: Income Statement for Year Ended December 31, 2021 (in thousands) $ 2,700,000 $1,188,000 $ 263,520 197,640 164,700 $ 625,860 345,870 675,270 $1,647,000

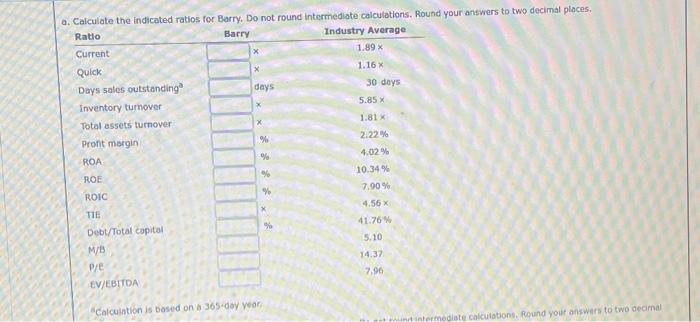

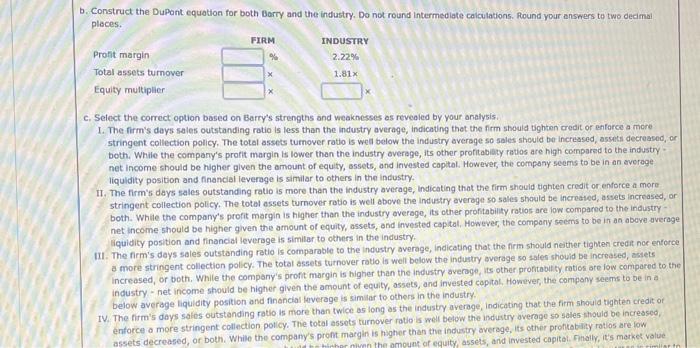

Data for Barry Computer Co. and its industry averages follow, The firm's debt is priced at par, so the market value of its debt equais its book value. since dollars are in thousands, the number of shares is shown in thousands too. Barry Computer Company: Balance Sheet as of December 31.2021 (In thousands) Barry Computer Company: Income Statement for Year Ended December 31, 2021 (In thousands) Sales $2,700,000 Cost of goods sold Moterials $1,188,000 Barry Computer Company: Balance Sheet as of December 31, 2021 (In thousands) Cash Recelvabies Inventories Total current assets Net fixed assets Total assets \$. 247,050 461,160 $1,202,310494,100 $1,647,000444,690 Accounts payable Other current liabilities Notes payable to bank Total current liabilities Long-term debt Common equity (67,527 shares) Total iabilities and equity \$ 263,520 197,640 \$ 625,860164,700 345,870 $1,647,000675,270 Barry Computer Company: Income Statement for Year Ended December 31, 2021 (In thousands) "Calculation is based on a 365 -doy vear. b. Construct the Dupont equotion for both Berry and the industry. Do not round intermediate calculations. Round your answers to two dedmal places. c. Select the correct option based on Barry's strengths and weaknesses as reveaied by your analysis: 1. The firm's days sales outstanding ratio is less than the industry average, indicating that the firm shoula bighten credit or enforce a more stringent collection policy. The total assets turnover ratio is wed below the industry average so sales should be increased, assits decreased, or both. While the company's profit margin is lower than the industry overage, its other profitabilaty ratios are high compared to the industry. net income should be higher given the amount of equity, ossets, and invested capital. However, the company seems to be in an everage liquidity position and financial leverage is similar to others in the incustry. II. The firm's days sales outstanding ratio is more than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total essets turnover ratio is well above the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry overage, its other profitability ratios are iow companed to the industrynet income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an above average liquidity position and financial leveroge is simitar to others in the industry. III. The firm's days sales outstanding ratio is comparable to the industry average, indicating that the firm should nesther tighten credr nor enforcel a more stringent collection policy. The total assets turnover ratio is well bolow the industry average so sales shouid be increased, astets increased, or both. While the company's profit margin is higher than the industry overage, its other profitabilty ratios are fow compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company scems to be in a below average liquidity position and financial leverage is similar to others in the industry. IV. The firm's doys sales outstanding ratio is more than twice as long as the industry average, indicating that the firm should tighten credit of enforce a more stringent collection poticy. The total assots turnover ratio is weli betow the induistry average so sales ithould be incressed, assets decreased, of both. While the company's proft margin is higher than the industry average, its cther proficobaity rotios are fow