Answered step by step

Verified Expert Solution

Question

1 Approved Answer

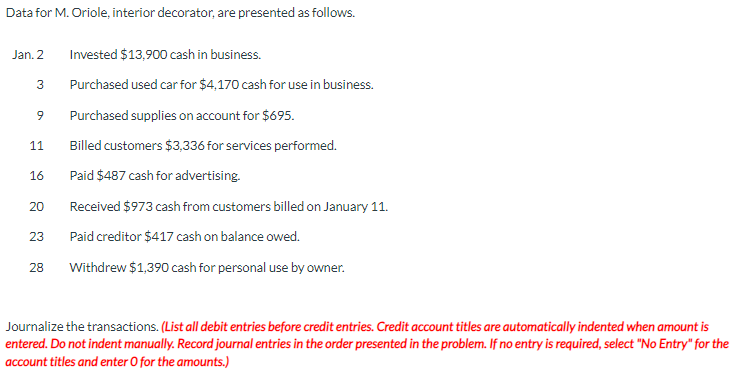

Data for M. Oriole, interior decorator, are presented as follows. Jan. 2 Invested $13,900 cash in business. 3 9 11 16 20 23 28

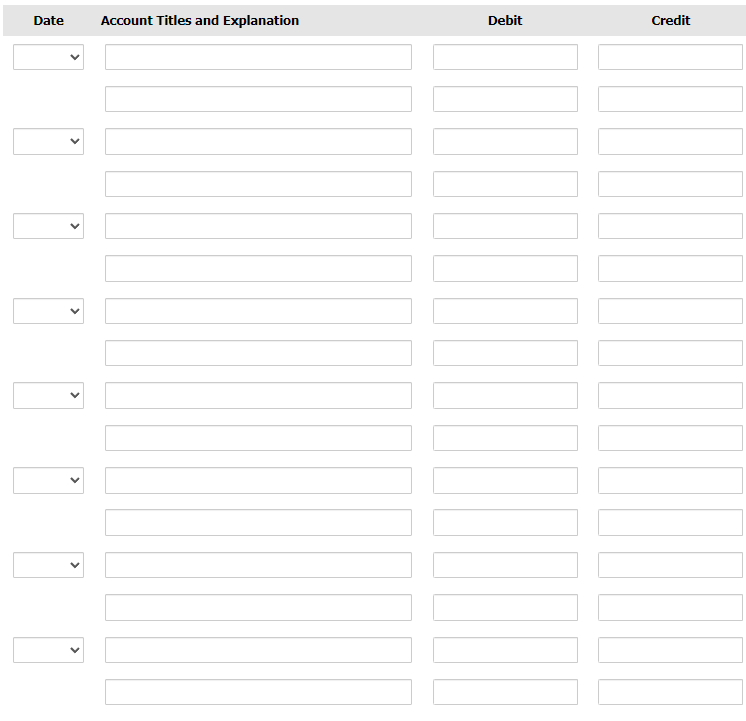

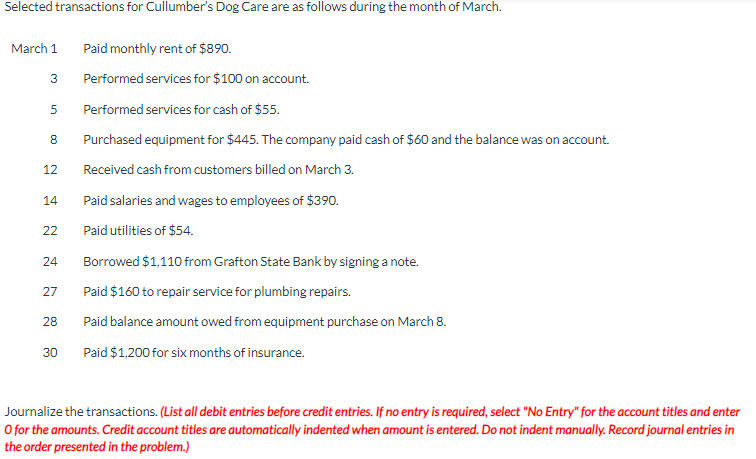

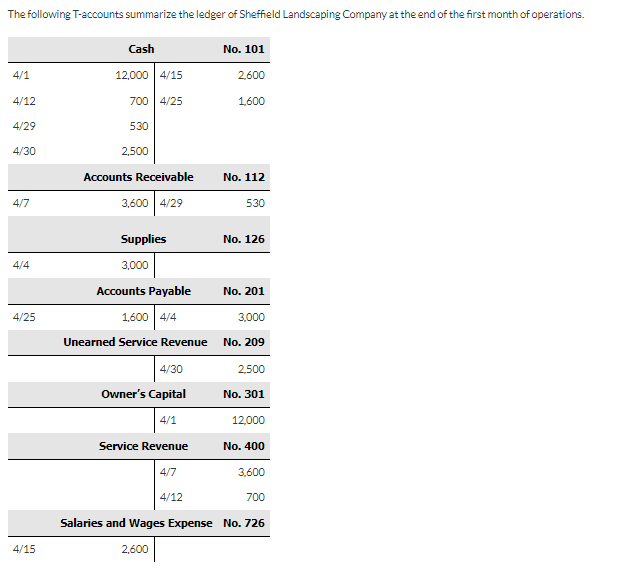

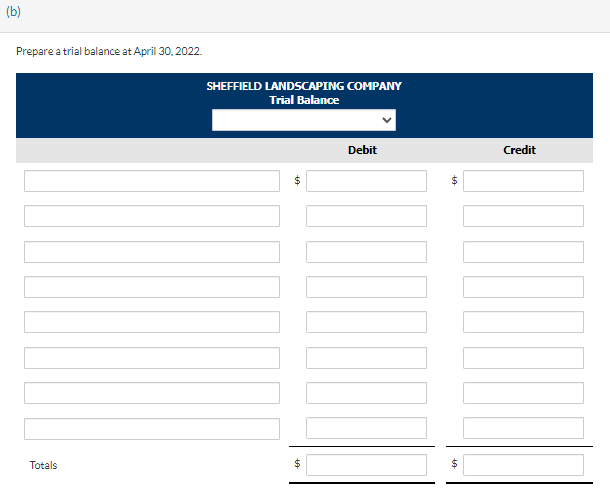

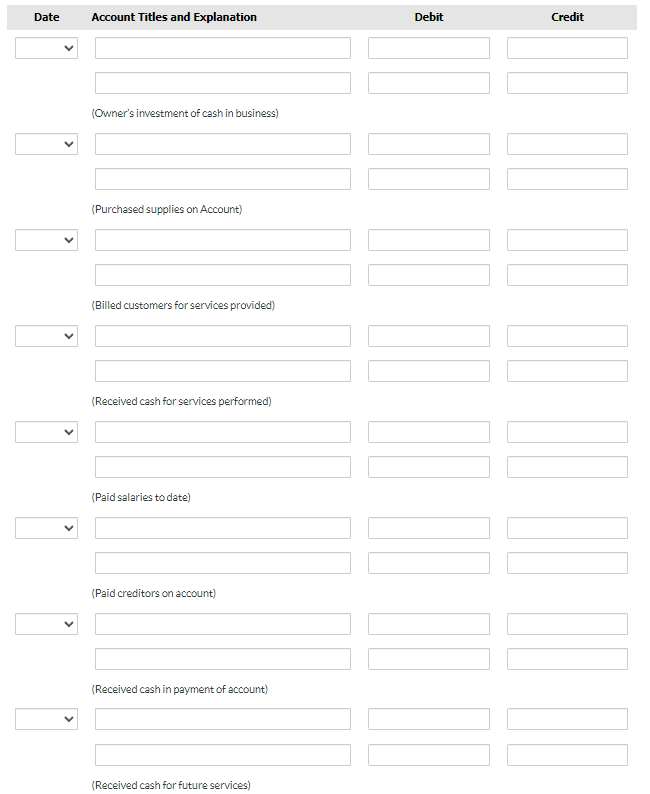

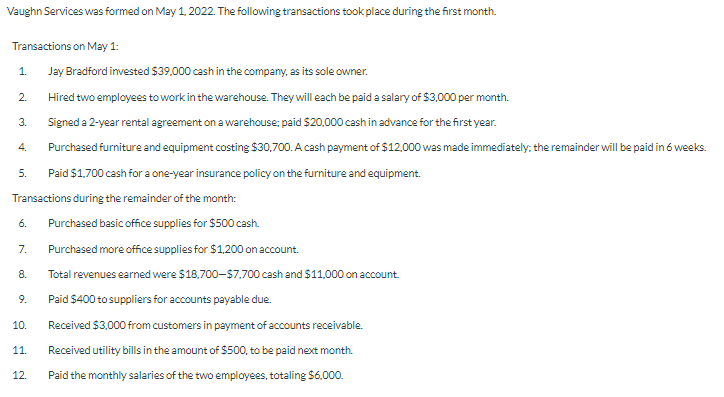

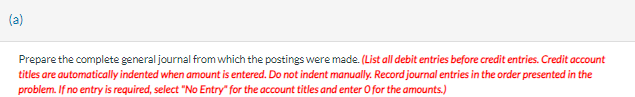

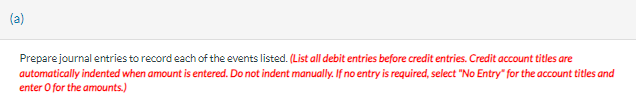

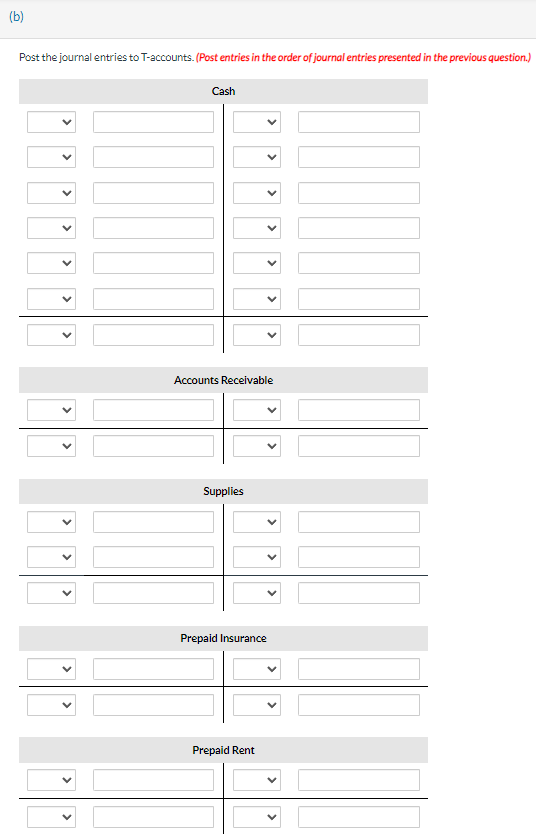

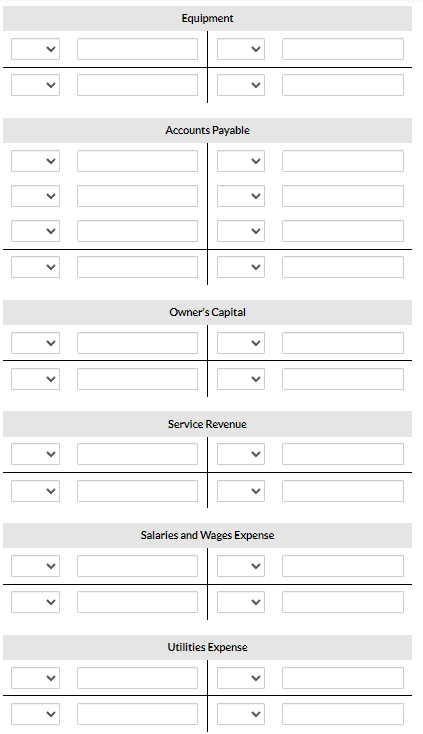

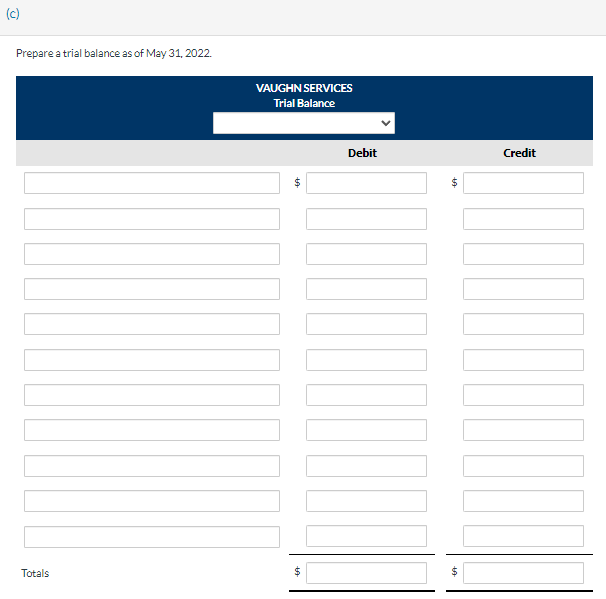

Data for M. Oriole, interior decorator, are presented as follows. Jan. 2 Invested $13,900 cash in business. 3 9 11 16 20 23 28 Purchased used car for $4,170 cash for use in business. Purchased supplies on account for $695. Billed customers $3,336 for services performed. Paid $487 cash for advertising. Received $973 cash from customers billed on January 11. Paid creditor $417 cash on balance owed. Withdrew $1,390 cash for personal use by owner. Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation < < < Debit Credit Accounts Payable Accounts Receivable Advertising Expense Buildings Cash Equipment Gasoline Expense Insurance Expense Land Maintenance and Repairs Expense Miscellaneous Expense Mortgage Payable No Entry Notes Payable Notes Receivable Owner's Capital Owner's Drawings Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Service Revenue Supplies Supplies Expense Unearned Service Revenue Utilities Expense Vehicle Selected transactions for Cullumber's Dog Care are as follows during the month of March. March 1 Paid monthly rent of $890. 3 5 8 12 14 22 24 27 28 30 Performed services for $100 on account. Performed services for cash of $55. Purchased equipment for $445. The company paid cash of $60 and the balance was on account. Received cash from customers billed on March 3. Paid salaries and wages to employees of $390. Paid utilities of $54. Borrowed $1,110 from Grafton State Bank by signing a note. Paid $160 to repair service for plumbing repairs. Paid balance amount owed from equipment purchase on March 8. Paid $1,200 for six months of insurance. Journalize the transactions. (List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit |||| Credit The following T-accounts summarize the ledger of Sheffield Landscaping Company at the end of the first month of operations. 4/1 4/12 4/29 4/30 4/7 4/4 4/25 4/15 Cash 12,000 4/15 700 4/25 530 2,500 Accounts Receivable 3,600 4/29 Supplies 3,000 Accounts Payable 1,600 4/4 Unearned Service Revenue 4/30 Owner's Capital 4/1 Service Revenue 4/7 2,600 4/12 No. 101 2,600 1,600 No. 112 530 No. 126 No. 201 3,000 No. 209 2,500 No. 301 12,000 No. 400 3,600 700 Salaries and Wages Expense No. 726 (b) Prepare a trial balance at April 30, 2022. Totals SHEFFIELD LANDSCAPING COMPANY Trial Balance $ $ Debit 100 +A $ Credit Date Account Titles and Explanation (Owner's investment of cash in business) (Purchased supplies on Account) (Billed customers for services provided) (Received cash for services performed) (Paid salaries to date) (Paid creditors on account) (Received cash in payment of account) (Received cash for future services) Debit ]][[[|]] DUD Credit [[[[[[[[ ]] [] Vaughn Services was formed on May 1, 2022. The following transactions took place during the first month. Transactions on May 1: Jay Bradford invested $39,000 cash in the company, as its sole owner. Hired two employees to work in the warehouse. They will each be paid a salary of $3,000 per month. Signed a 2-year rental agreement on a warehouse; paid $20,000 cash in advance for the first year. Purchased furniture and equipment costing $30,700. A cash payment of $12,000 was made immediately; the remainder will be paid in 6 weeks. Paid $1,700 cash for a one-year insurance policy on the furniture and equipment. Transactions during the remainder of the month: Purchased basic office supplies for $500 cash. Purchased more office supplies for $1,200 on account. Total revenues earned were $18,700-$7,700 cash and $11,000 on account. Paid $400 to suppliers for accounts payable due. Received $3,000 from customers in payment of accounts receivable. Received utility bills in the amount of $500, to be paid next month. 12. Paid the monthly salaries of the two employees, totaling $6,000. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. (a) Prepare the complete general journal from which the postings were made. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry for the account titles and enter O for the amounts.) (a) Prepare journal entries to record each of the events listed. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Debit I Credit (b) Post the journal entries to T-accounts. (Post entries in the order of journal entries presented in the previous question.) < < < > < Cash Accounts Receivable Supplies Prepaid Insurance Prepaid Rent < Equipment Accounts Payable Owner's Capital Service Revenue Salaries and Wages Expense Utilities Expense (c) Prepare a trial balance as of May 31, 2022. Totals VAUGHN SERVICES Trial Balance $ $ Debit 64 Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The TAc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started