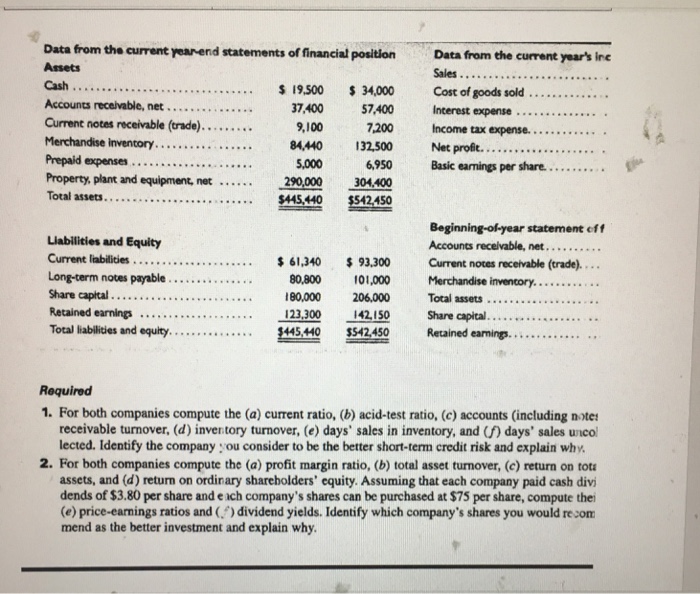

Data from the current yearend statements of financial position Data from the current year's ine Assets Cash Accounts receivable, net .. 19.500 37400 $7400 Incerest expense 9,100 34,000 Cost of goods sold ... .. 7,200 Income Prepaid expenses... 5,000 6,950 Basic earnings per share. Property, plant and equipment net290,000304.400 Total assets 542450 Beginning-of-year statement eftf Liabilities and Equity 180,000 206.000 Total assets.... Retained earnings... 14450 542450 Retained eaning.. Required 1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (including note receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales unco lected. Identify the company :ou consider to be the better short-term credit risk and explain why. 2. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on tot assets, and (d) return on ordinary sharebolders' equity. Assuming that each company paid cash divi dends of $3.80 per share and e ich company's shares can be purchased at $75 per share, compute thei (e) price-earnings ratios and () dividend yields. Identify which company's shares you would recom mend as the better investment and explain why. Data from the current yearend statements of financial position Data from the current year's ine Assets Cash Accounts receivable, net .. 19.500 37400 $7400 Incerest expense 9,100 34,000 Cost of goods sold ... .. 7,200 Income Prepaid expenses... 5,000 6,950 Basic earnings per share. Property, plant and equipment net290,000304.400 Total assets 542450 Beginning-of-year statement eftf Liabilities and Equity 180,000 206.000 Total assets.... Retained earnings... 14450 542450 Retained eaning.. Required 1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (including note receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales unco lected. Identify the company :ou consider to be the better short-term credit risk and explain why. 2. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on tot assets, and (d) return on ordinary sharebolders' equity. Assuming that each company paid cash divi dends of $3.80 per share and e ich company's shares can be purchased at $75 per share, compute thei (e) price-earnings ratios and () dividend yields. Identify which company's shares you would recom mend as the better investment and explain why