Data from the financial statements of Beautiful Candle Company included the following: E (Click the icon to view the data.) Read the requirements. Requirements

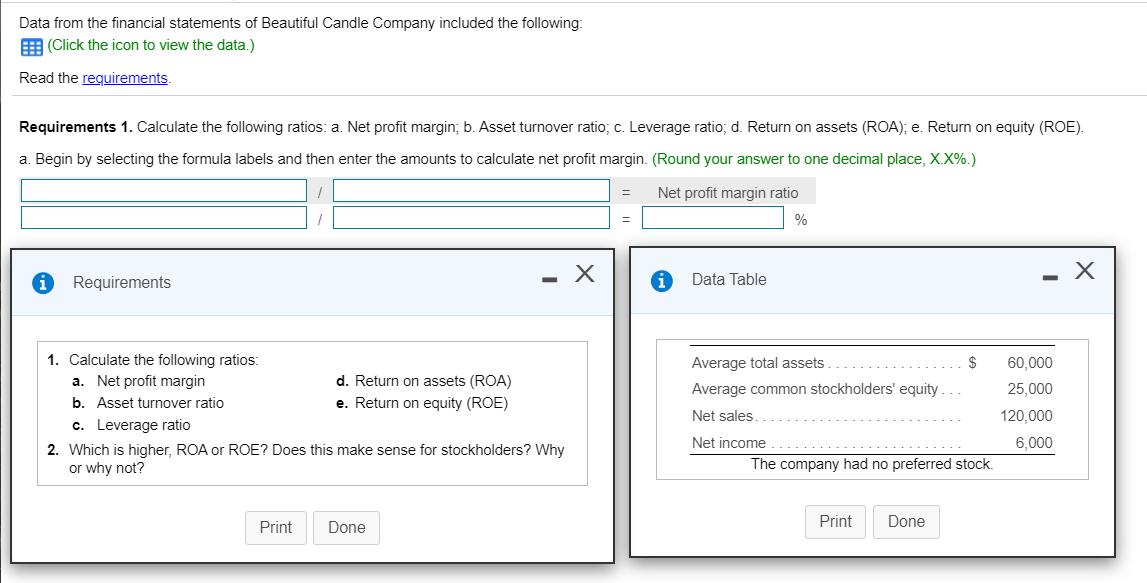

Data from the financial statements of Beautiful Candle Company included the following: E (Click the icon to view the data.) Read the requirements. Requirements 1. Calculate the following ratios: a. Net profit margin; b. Asset turnover ratio; c. Leverage ratio; d. Return on assets (ROA); e. Return on equity (ROE). a. Begin by selecting the formula labels and then enter the amounts to calculate net profit margin. (Round your answer to one decimal place, X.X%.) Net profit margin ratio % Requirements Data Table 1. Calculate the following ratios: Average total assets $ 60,000 a. Net profit margin b. Asset turnover ratio d. Return on assets (ROA) e. Return on equity (ROE) Average common stockholders' equity 25,000 Net sales. 120,000 c. Leverage ratio Net income 6,000 2. Which is higher, ROA or ROE? Does this make sense for stockholders? Why or why not? The company had no preferred stock. Print Done Print Done

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 Computation of the following ratios ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started