Answered step by step

Verified Expert Solution

Question

1 Approved Answer

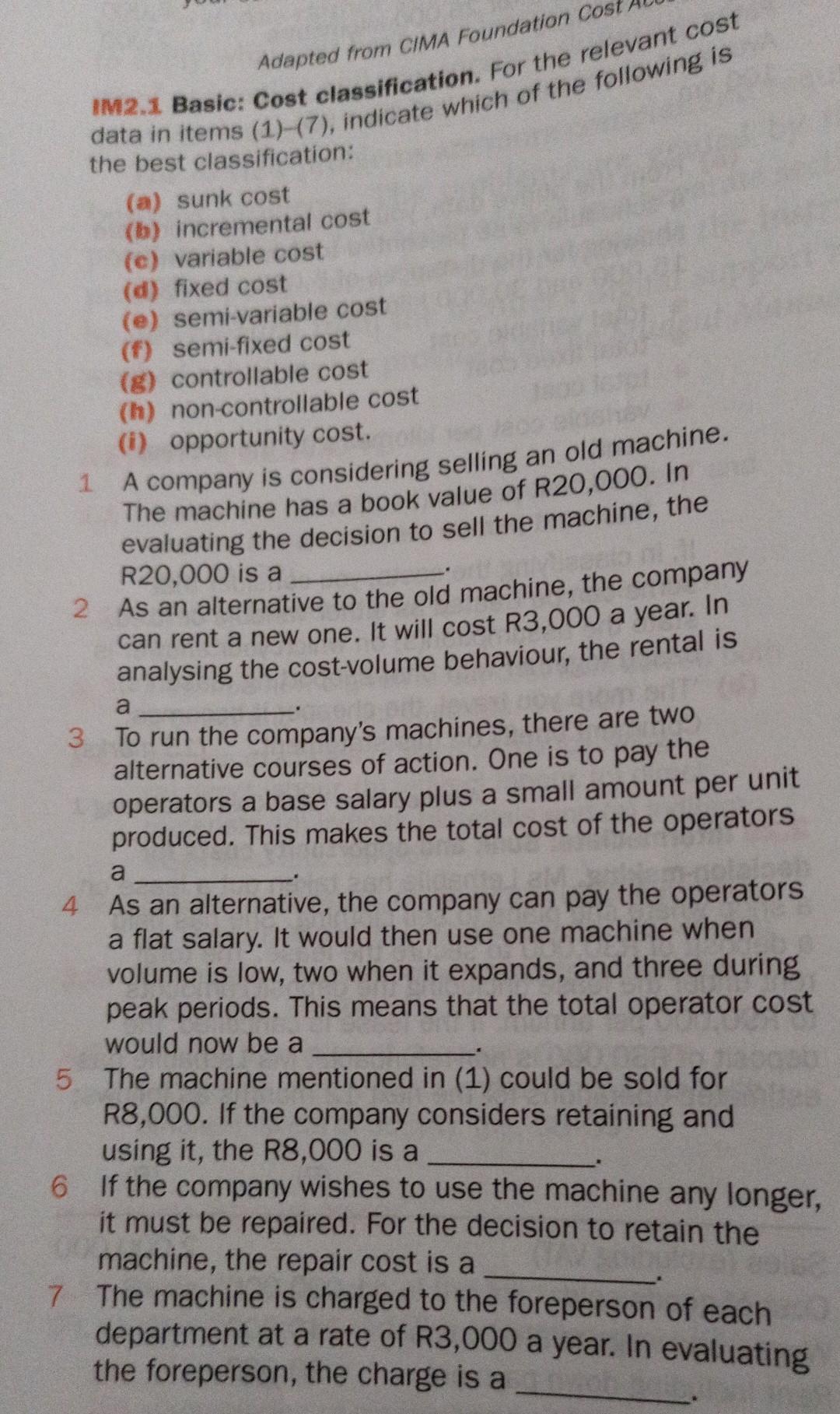

data in items (1)-(7), indicate wich. For the following is the best classification: (a) sunk cost (b) incremental cost (c) variable cost (d) fixed cost

data in items (1)-(7), indicate wich. For the following is the best classification: (a) sunk cost (b) incremental cost (c) variable cost (d) fixed cost (e) semi-variable cost (f) semi-fixed cost (g) controllable cost (h) non-controllable cost 1 A company is considering selling an old machine. (i) opportunity cost. The machine has a book value of R20,000. In evaluating the decision to sell the machine, the 2 As an alternative to the old machine, the company R20,000 is a can rent a new one. It will cost R3,000 a year. In analysing the cost-volume behaviour, the rental is a 3 To run the company's machines, there are two alternative courses of action. One is to pay the operators a base salary plus a small amount per unit produced. This makes the total cost of the operators a 4 As an alternative, the company can pay the operators a flat salary. It would then use one machine when volume is low, two when it expands, and three during peak periods. This means that the total operator cost would now be a 5 The machine mentioned in (1) could be sold for R8,000. If the company considers retaining and using it, the R8,000 is a If the company wishes to use the machine any longer, it must be repaired. For the decision to retain the machine, the repair cost is a The machine is charged to the foreperson of each department at a rate of R3,000 a year. In evaluating the foreperson, the charge is a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started