Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data: Name of Customer Total Remarks Chan Nurseries $30000 70% over 90 days; 30% 61-90 days Stephen's Landscaping 20000 40% 31-60 days; 60% under 30

Data:

Data:

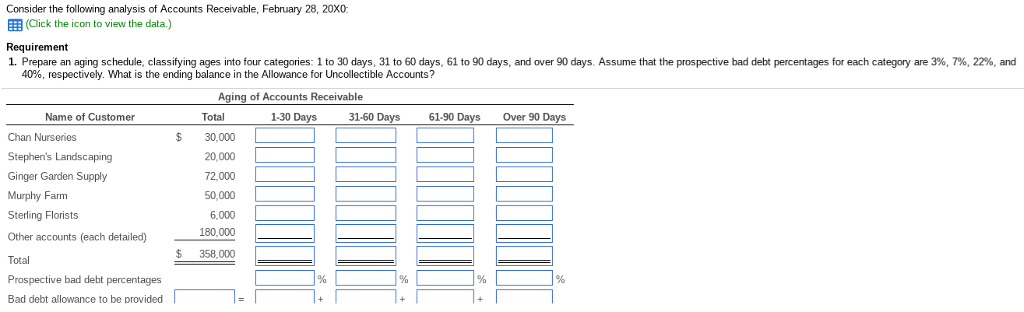

Name of Customer Total Remarks Chan Nurseries $30000 70% over 90 days; 30% 61-90 days Stephen's Landscaping 20000 40% 31-60 days; 60% under 30 days Ginger Garden Supply 72000 40% 61-90 days; 60% 31-60 days Murphy Farm 50000 All under 30 days Sterling Florists 6000 20% 61-90 days; 80% 1-30 days Other accounts 180,000 75% 1-30 days; 10% 31-60 days; 10% 61-90 days; 5% over 90 days

Total $358,000

Consider the following analysis of Accounts Receivable, February 28, 20X0: EEB (Click the icon to view the data.) Requirement 1. Prepare an aging schedule, classifying ages into four categories: 1 to 30 days, 31 to 60 days, 61 to 90 days, and over 90 days Assume that the prospective bad debt percentages for each category are 3% 7% 22%, and 40%, respectively. What is the ending balance in the Allowance for Uncollectible Accounts? Aging of Accounts Receivable Name of Customer Total 1-30 Days 31-60 Days 61-90 Days Over 90 Days $ 30,000 20,000 72,000 Chan Nurseries Stephen's Landscaping Ginger Garden Supply Murphy Farm Sterling Florists Other accounts (each detailed) 400,000 Total Prospective bad debt Bad debt allowance to be provided 6,000 180,000 358,000 percentagesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started