Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data Sales Limited (Data Sales) was incorporated in January 2009. It has 180,000 shares on issue which are owned by 20 unrelated shareholders who

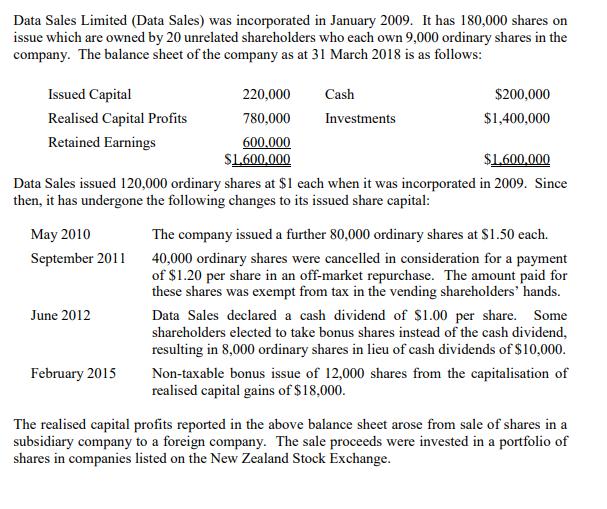

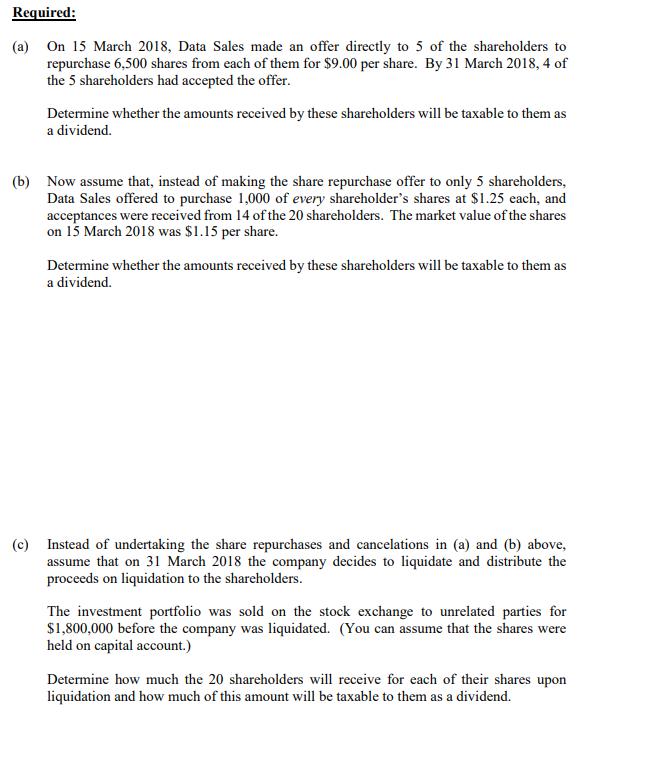

Data Sales Limited (Data Sales) was incorporated in January 2009. It has 180,000 shares on issue which are owned by 20 unrelated shareholders who each own 9,000 ordinary shares in the company. The balance sheet of the company as at 31 March 2018 is as follows: Issued Capital Realised Capital Profits Retained Earnings May 2010 September 2011 June 2012 220,000 780,000 600,000 $1.600.000 February 2015 Cash $1.600.000 Data Sales issued 120,000 ordinary shares at $1 each when it was incorporated in 2009. Since then, it has undergone the following changes to its issued share capital: Investments $200,000 $1,400,000 The company issued a further 80,000 ordinary shares at $1.50 each. 40,000 ordinary shares were cancelled in consideration for a payment of $1.20 per share in an off-market repurchase. The amount paid for these shares was exempt from tax in the vending shareholders' hands. Data Sales declared a cash dividend of $1.00 per share. Some shareholders elected to take bonus shares instead of the cash dividend, resulting in 8,000 ordinary shares in lieu of cash dividends of $10,000. Non-taxable bonus issue of 12,000 shares from the capitalisation of realised capital gains of $18,000. The realised capital profits reported in the above balance sheet arose from sale of shares in a subsidiary company to a foreign company. The sale proceeds were invested in a portfolio of shares in companies listed on the New Zealand Stock Exchange. Required: (a) On 15 March 2018, Data Sales made an offer directly to 5 of the shareholders to repurchase 6,500 shares from each of them for $9.00 per share. By 31 March 2018, 4 of the 5 shareholders had accepted the offer. Determine whether the amounts received by these shareholders will be taxable to them as a dividend. (b) Now assume that, instead of making the share repurchase offer to only 5 shareholders, Data Sales offered to purchase 1,000 of every shareholder's shares at $1.25 each, and acceptances were received from 14 of the 20 shareholders. The market value of the shares on 15 March 2018 was $1.15 per share. Determine whether the amounts received by these shareholders will be taxable to them as a dividend. (c) Instead of undertaking the share repurchases and cancelations in (a) and (b) above, assume that on 31 March 2018 the company decides to liquidate and distribute the proceeds on liquidation to the shareholders. The investment portfolio was sold on the stock exchange to unrelated parties for $1,800,000 before the company was liquidated. (You can assume that the shares were held on capital account.) Determine how much the 20 shareholders will receive for each of their shares upon liquidation and how much of this amount will be taxable to them as a dividend.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

According to the information given the amounts received by the shareholders who accepted the offer t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started