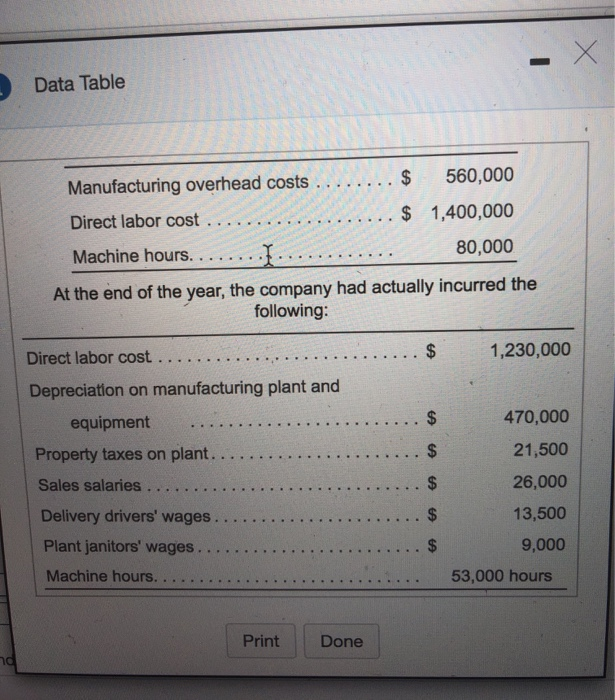

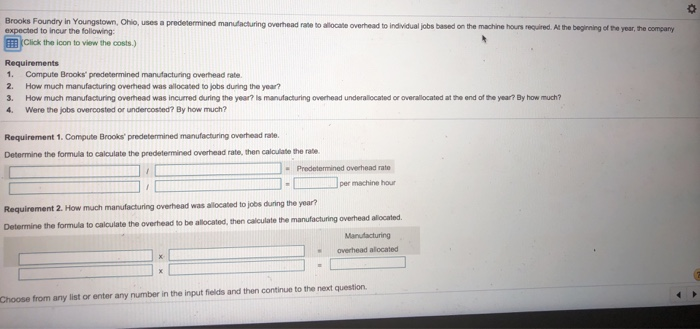

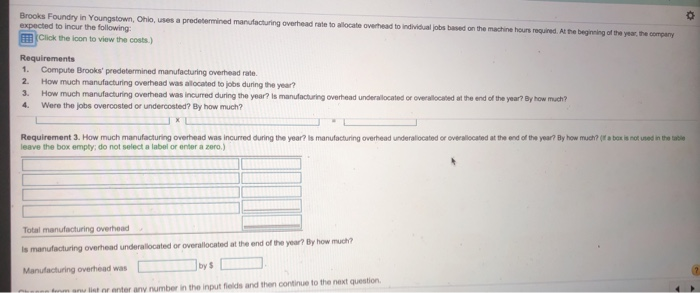

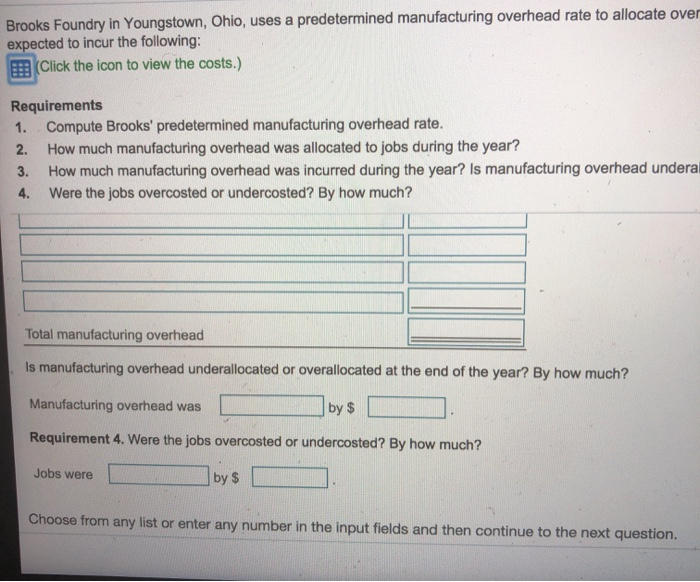

Data Table 560,000 $ Manufacturing overhead costs $ 1,400,000 Direct labor cost ... 80,000 Machine hours. At the end of the year, the company had actually incurred the following: 1,230,000 $ Direct labor cost... Depreciation on manufacturing plant and $ 470,000 equipment 21,500 Property taxes on plant.... 26,000 Sales salaries... Delivery drivers' wages... 13,500 $ Plant janitors' wages.. ... $ 9,000 Machine hours. 53,000 hours Print Done Brooks Foundry in Youngstown, Ohio, uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. At the beginning of the year, the company expected to incur the following FClick the icon to view the costs.) Requirements 1. Compute Brooks' predetermined manufacturing overhead rate. How much manufacturing overhead was allocated to jobs during the year? How much manufacturing overhead was incurred during the year? Is manufacturing overhead underallocated or overallocated at the end of the year? By how much? 2. 3. 4. Were the jobs overcosted or undercosted? By how much? Requirement 1. Compute Brooks predetermined manufacturing overhead rate Determine the formula to calculate the predetermined overhead rate, then caloulate the rate. Predetermined overhead rate per machine hour Requirement 2. How much manufacturing overhead was allocated to jobs during the year? Determine the formula to calculate the overhead to be allocated, then calculate the manufacturing overhead allocated. Manufacturing overhead alocated Choose from any list or enter any number in the input fields and then continue to the next question Brooks Foundry in Youngstown, Ohio, uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. At the beginning of the year, the company expected to incur the following: miClick the lcon to view the costs.) Requirements 1 Compute Brooks' predetermined manufacturing overhead rate. How much manufacturing overhead was alocated to jobs during the year? How much manufacturing overhead was incured during the year? Is manufacturing overhead underalocated or overallocated at the end of the year? By how much? 2. 3. 4. Were the jobs overcosted or undercosted? By how much? Requirement 3. How much manufacturing overhead was incurred during the year? Is manufacturing overhead underalocated or overallocated at the end of the year? By how much? ( a box is not used in the table leave the box empty: do not select a label or enter a zero.) Total manufacturing overhead Is manufacturing overhead underalocated or overallocated at the end of the year? By how much? by $ Manufacturing overhead was number in the input fieldds and then continue to the next question Cteen frm anu list or enter anv predetermined manufacturing overhead rate to allocate over Brooks Foundry in Youngstown, Ohio, uses a expected to incur the following: (Click the icon to view the costs.) Requirements Compute Brooks' predetermined manufacturing overhead rate. How much manufacturing overhead was allocated to jobs during the year? 1. 2. How much manufacturing overhead was incurred during the year? Is manufacturing overhead underal 3. 4 Were the jobs overcosted or undercosted? By how much? Total manufacturing overhead Is manufacturing overhead underallocated or overallocated at the end of the year? By how much? Manufacturing overhead was by $ Requirement 4. Were the jobs overcosted or undercosted? By how much? Jobs were by $ Choose from any list or enter any number in the input fields and then continue to the next