| Prepare a statement of activities for the year ended June 30, 2017. THE RED QUESTIONS ONLY |

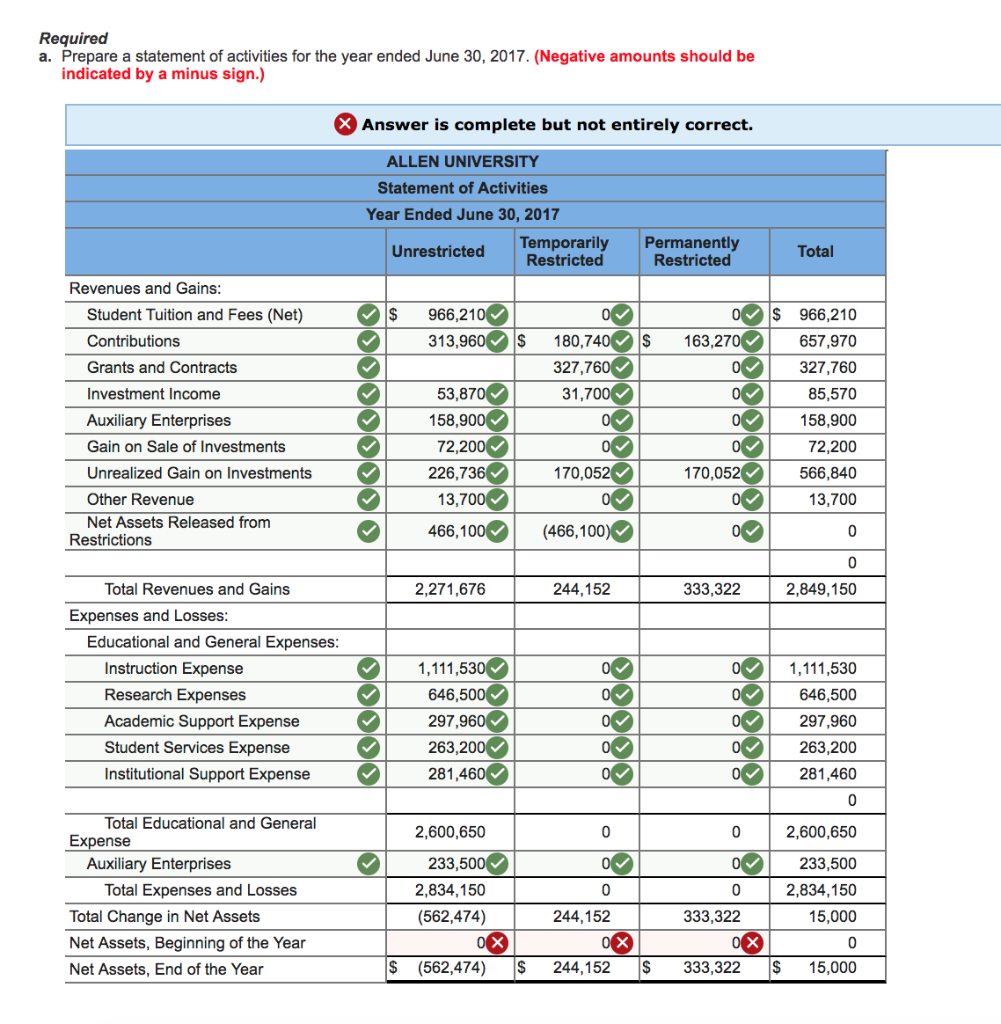

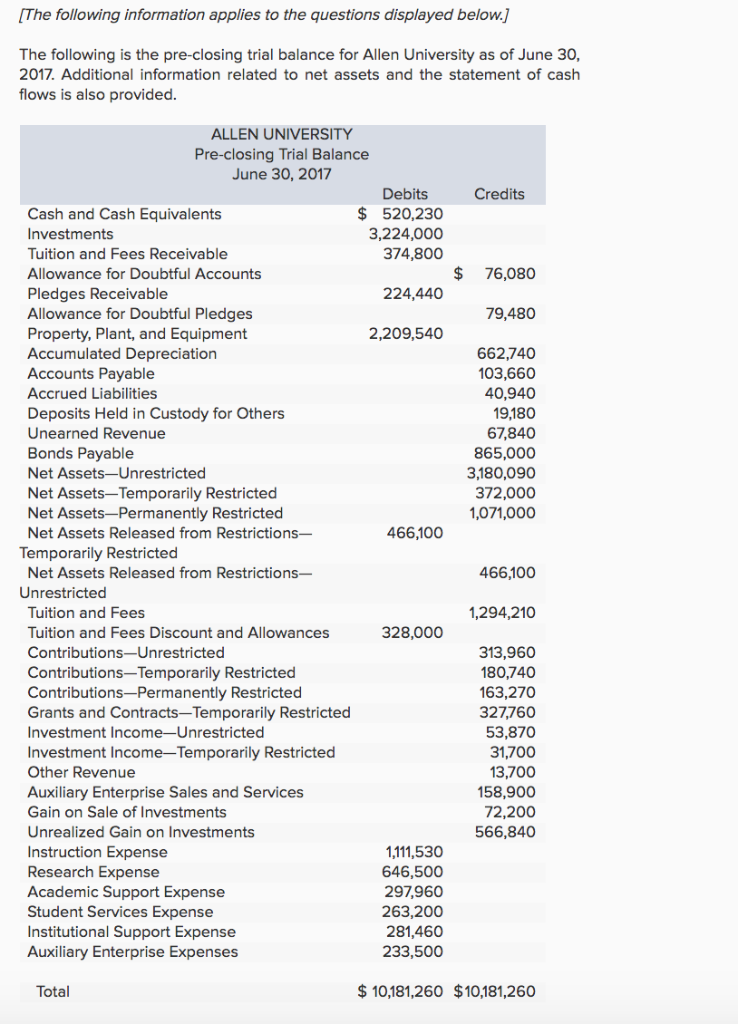

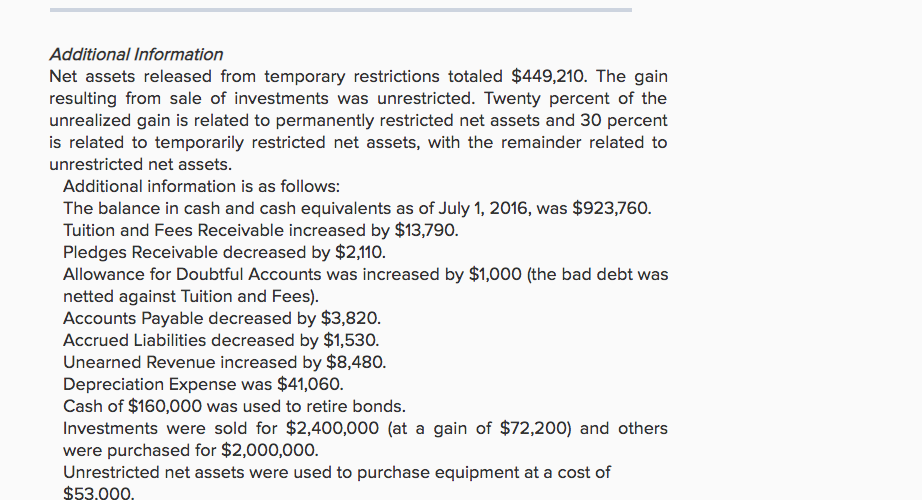

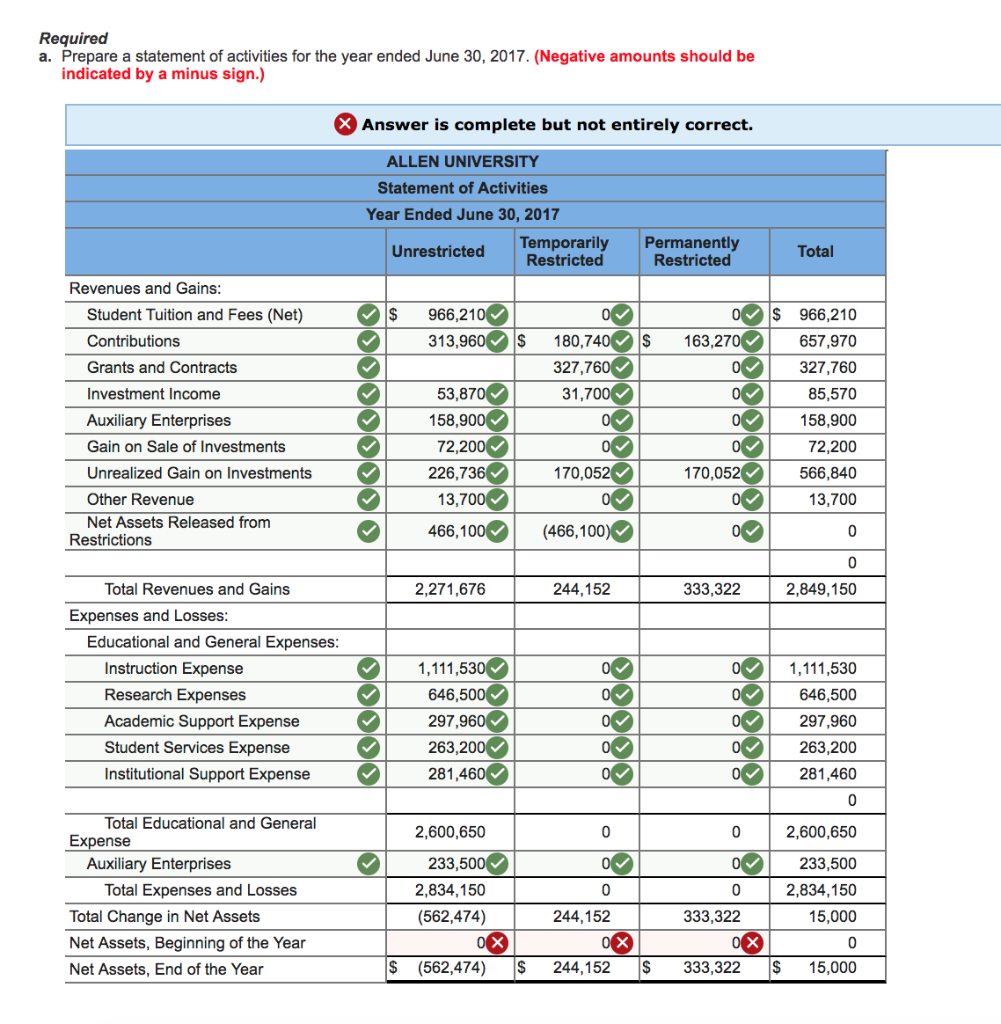

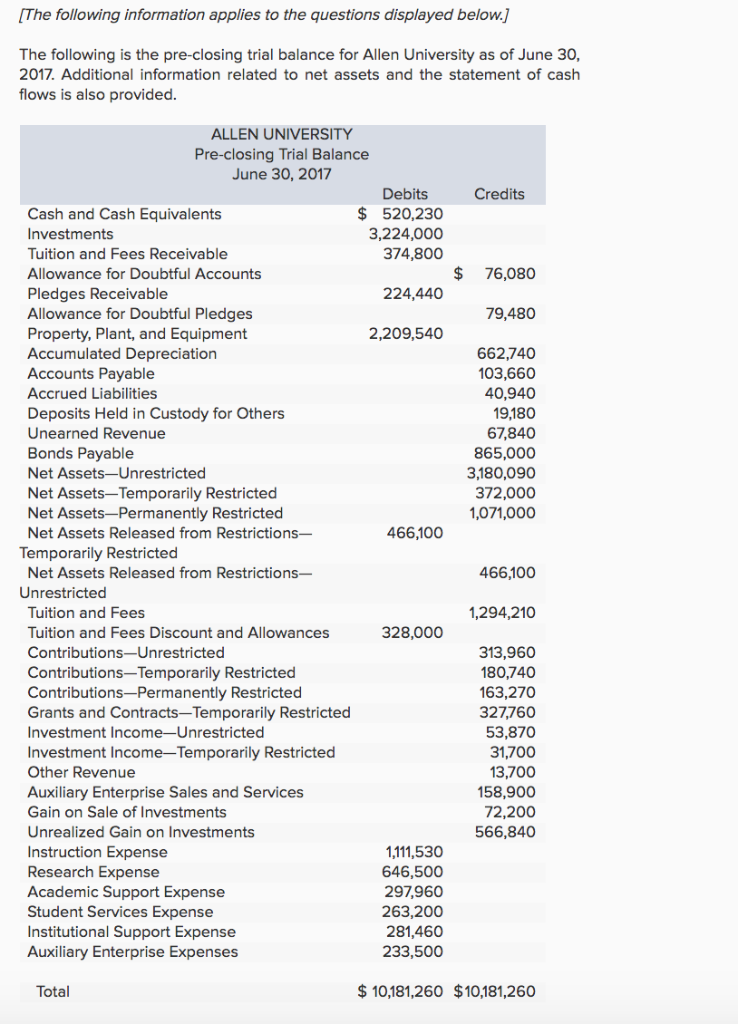

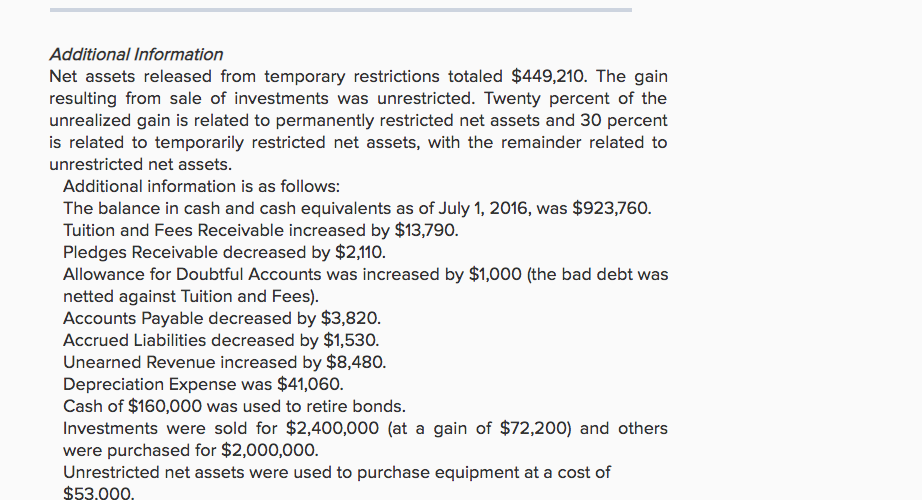

Required a. Prepare a statement of activities for the year ended June 30, 2017. (Negative amounts should be indicated by a minus sign.) Answer is complete but not entirely correct. ALLEN UNIVERSITY Statement of Activities Year Ended June 30, 2017 Unrestricted Temporarily Permanently Total Restricted Restricted Revenues and Gains: Student Tuition and Fees (Net)s 966,210 Contributions Grants and Contracts Investment Income Auxiliary Enterprises Gain on Sale of Investments Unrealized Gain on Investments226,736170,052 Other Revenue Net Assets Released from S 966,210 313,960s 180,740S 13657,970 327,760 85,570 158,900 72,200 170,052566,840 13,700 327,760 53,87 158,900 72,20 00 13,70 0 466,00(466,100) Restrictions Total Revenues and Gains 2,271,676 244,152 333,322 2,849,150 Expenses and Losses Educational and General Expenses Instruction Expense Research Expenses Academic Support Expense Student Services Expense Institutional Support Expense281,460 1,111,530 646,500 297,960 263,200 1,111,530 646,500 297,960 263,200 281,460 0 0 Total Educational and General 2,600,650 2,600,650 Expense 233,500 2,834,150 15,000 Auxiliary Enterprises 233 2,834,150 (562,474) 0 333,322 0 $ (562,474) S 244,152 S333,322 otal Expenses and Losses Total Change in Net Assets Net Assets, Beginning of the Year Net Assets, End of the Year 244,152 15,000 The following information applies to the questions displayed below.] The following is the pre-closing trial balance for Allen University as of June 30, 2017. Additional information related to net assets and the statement of cash flows is also provided. ALLEN UNIVERSITY Pre-closing Trial Balance June 30, 2017 Debits $ 520,230 3,224,000 374,800 Credits Cash and Cash Equivalents Investments Tuition and Fees Receivable Allowance for Doubtful Accounts Pledges Receivable Allowance for Doubtful Pledges Property, Plant, and Equipment Accumulated Depreciation Accounts Payable Accrued Liabilities Deposits Held in Custody for Others Unearned Revenue Bonds Payable Net Assets-Unrestricted Net Assets-Temporarily Restricted Net Assets-Permanently Restricted Net Assets Released from Restrictions $ 76,080 224,440 79,480 2,209,540 662,740 103,660 40,940 9180 67,840 865,000 3,180,090 372,000 1,071,000 466,100 Temporarily Restricted Net Assets Released from Restrictions- 466,100 Unrestricted 1,294,210 Tuition and Fees Tuition and Fees Discount and Allowances Contributions-Unrestricted Contributions-Temporarily Restricted Contributions-Permanently Restricted Grants and Contracts-Temporarily Restricted Investment Income-Unrestricted Investment Income-Temporarily Restricted Other Revenue Auxiliary Enterprise Sales and Services Gain on Sale of Investments Unrealized Gain on Investments Instruction Expense Research Expense Academic Support Expense Student Services Expense Institutional Support Expense Auxiliary Enterprise Expenses 328,000 313,960 180,740 163,270 327,760 53,870 31,700 13,700 158,900 72,200 566,840 1,111,530 646,500 297,960 263,200 281,460 233,500 Total $10,181,260 $10,181,260 Additional Information Net assets released from temporary restrictions totaled $449,210. The gain resulting from sale of investments was unrestricted. Twenty percent of the unrealized gain is related to permanently restricted net assets and 30 percent is related to temporarily restricted net assets, with the remainder related to unrestricted net assets. Additional information is as follows: The balance in cash and cash equivalents as of July 1, 2016, was $923,760. Tuition and Fees Receivable increased by $13,790. Pledges Receivable decreased by $2,110. Allowance for Doubtful Accounts was increased by $1,000 (the bad debt was netted against Tuition and Fees). Accounts Payable decreased by $3,820. Accrued Liabilities decreased by $1,530. Unearned Revenue increased by $8,480. Depreciation Expense was $41,060. Cash of $160,000 was used to retire bonds. Investments were sold for $2,400,000 (at a gain of $72,200) and others were purchased for $2,000,000. Unrestricted net assets were used to purchase equipment at a cost of $53.000