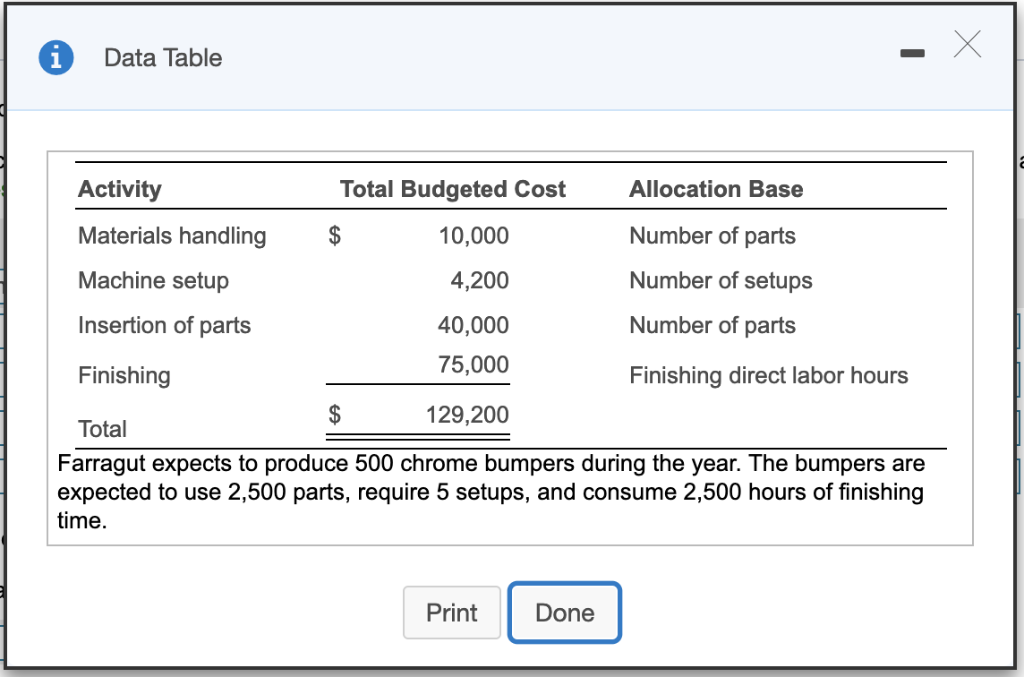

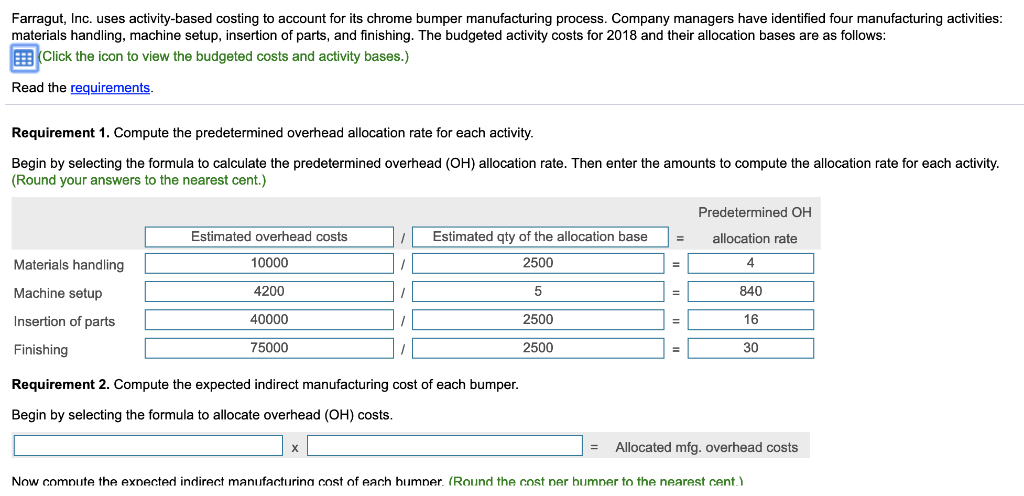

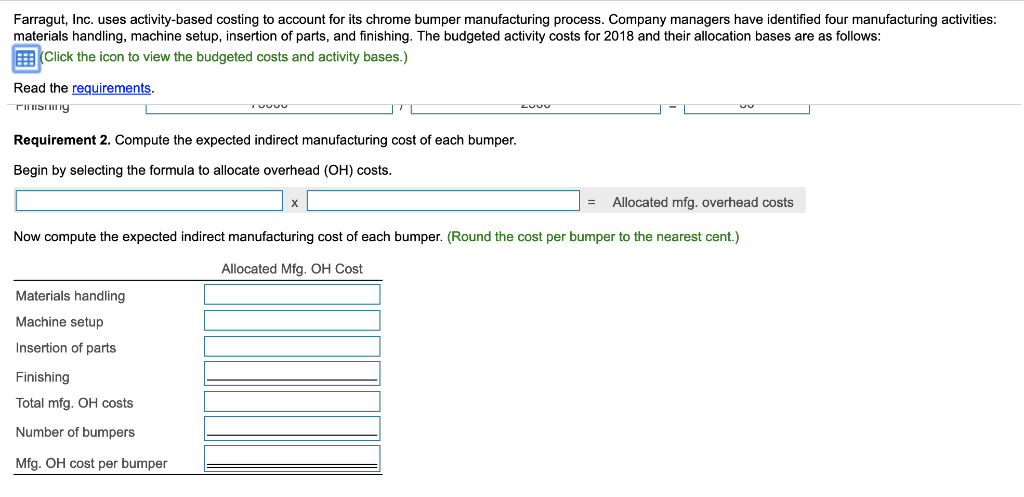

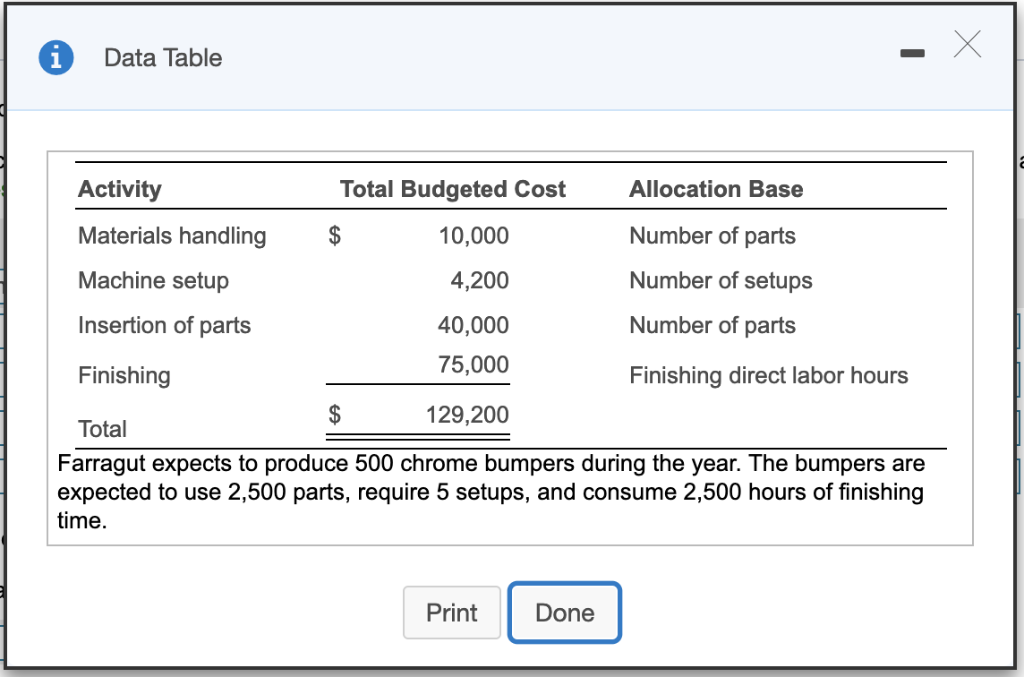

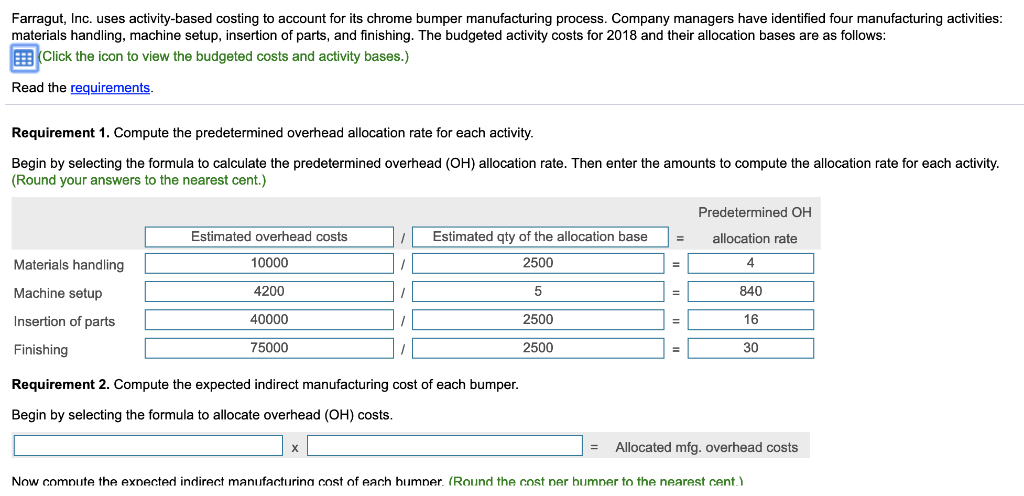

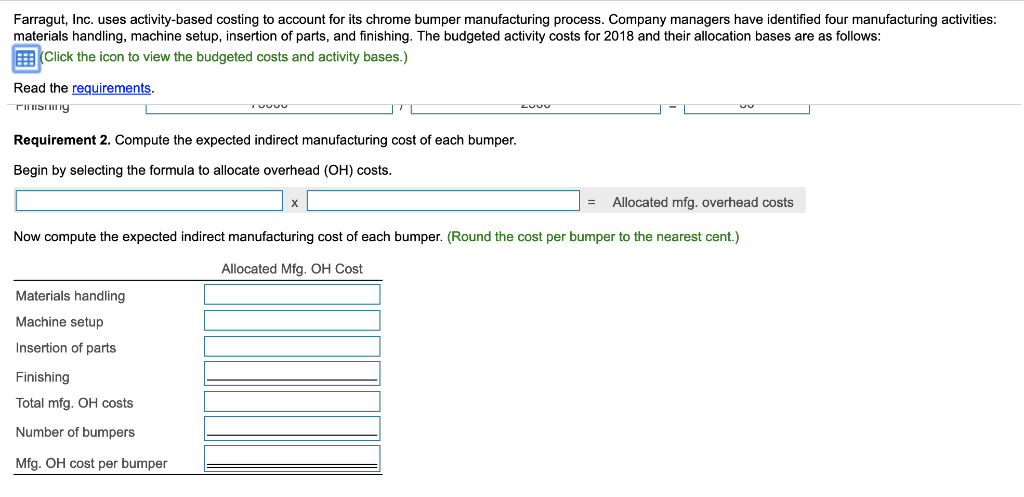

Data Table Activity Materials handling Machine setup Insertion of parts Finishing Total Total Budgeted Cost Allocation Base Number of parts Number of setups Number of parts Finishing direct labor hours $ 10,000 4,200 40,000 75,000 129,200 Farragut expects to produce 500 chrome bumpers during the year. The bumpers are expected to use 2,500 parts, require 5 setups, and consume 2,500 hours of finishing time rint Done Farragut, Inc. uses activity-based costing to account for its chrome bumper manufacturing process. Company managers have identified four manufacturing activities materials handling, machine setup, insertion of parts, and finishing. The budgeted activity costs for 2018 and their allocation bases are as follows Click the icon to view the budgeted costs and activity bases.) Read the requirements Requirement 1. Compute the predetermined overhead allocation rate for each activity. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity Round your answers to the nearest cent.) Predetermined OH Estimated overhead costs 10000 4200 40000 75000 Estimated qty of the allocation baseallocation rate 2500 Materials handling Machine setup Insertion of parts Finishing Requirement 2. Compute the expected indirect manufacturing cost of each bumper Begin by selecting the formula to allocate overhead (OH) costs 4 840 16 30 2500 2500 Allocated mfg. overhead costs - Now comnute the exnected indirect manufacturina cost of each humner. (Round the cost ner bumner to the nearest cent.) Farragut, Inc. uses activity-based costing to account for its chrome bumper manufacturing process. Company managers have identified four manufacturing activities materials handling, machine setup, insertion of parts, and finishing. The budgeted activity costs for 2018 and their allocation bases are as follows: Click the icon to view the budgeted costs and activity bases.) Read the requirements. Requirement 2. Compute the expected indirect manufacturing cost of each bumper. Begin by selecting the formula to allocate overhead (OH) costs. Allocated mfg. overhead costs - Now compute the expected indirect manufacturing cost of each bumper. (Round the cost per bumper to the nearest cent.) Allocated Mfg. OH Cost Materials handling Machine setup Insertion of parts Finishing Total mfg. OH costs Number of bumpers Mfg. OH cost per bumper