Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data table Budgeted balances at January 3 1 , 2 0 2 1 are as follows: Selected budgeted information for December 2 0 2 0

Data table

Budgeted balances at January are as follows:

Selected budgeted information for December follows:

Customer invoices are payable within days. From past experience, Slaggs's accountant

projects of invoices will be collected in the month invoiced, and will be collected in

the following month. Accounts payable relates only to the purchase of direct materials. Direct

materials are purchased on credit with of direct materials purchases paid during the

month of the purchase, and paid in the month following purchase.

Fixed manufacturing overhead costs include $ of depreciation costs and fixed

operating nonmanufacturing overhead costs include $ of depreciation costs. Direct

manufacturing labor and the remaining manufacturing and operating nonmanufacturing Variable manufacturing overhead is $ per direct manufacturing laborhour. There are also $ in

fixed manufacturing overhead costs budgeted for January Slaggs combines both variable and

fixed manufacturing overhead into a single rate based on direct manufacturing laborhours. Variable

marketing costs are allocated at the rate of $ per sales visit. The marketing plan calls for sales

visits during January Finally, there are $ in fixed operating nonmanufacturing costs

budgeted for January Slaggs' CEO expects to sell snowboards during January at an estimated retail price of

$ per board. Further, the CEO expects beginning inventory of snowboards and would

like to end January with snowboards in stock.

Other data include:

The inventoriable unit cost for ending finishedgoods inventory on December is $Revenue Budget

For January

Direct Materials Purchases Budget

For January Slaggs, Inc., manufactures and sells snowboards. Slaggs manufactures a single model, the

Pipex. In late Slaggs's management accountant gathered the following data to prepare

budgets for January :

Click the icon to view the budgeted balances and additional information pertaining to the

cash budget.

Click the icon to view the additional variable and fixed manufacturing cost information.

Click the icon to view the materials and labor requirements, the direct

materials inventories, and additional inventory information.

Click the icon to view the following selected January budgets: Revenue, Dire

material purchases, Direct manufacturing labor cost, Variable manufacturing overhead

and Ending inventory.

Read the requirements.

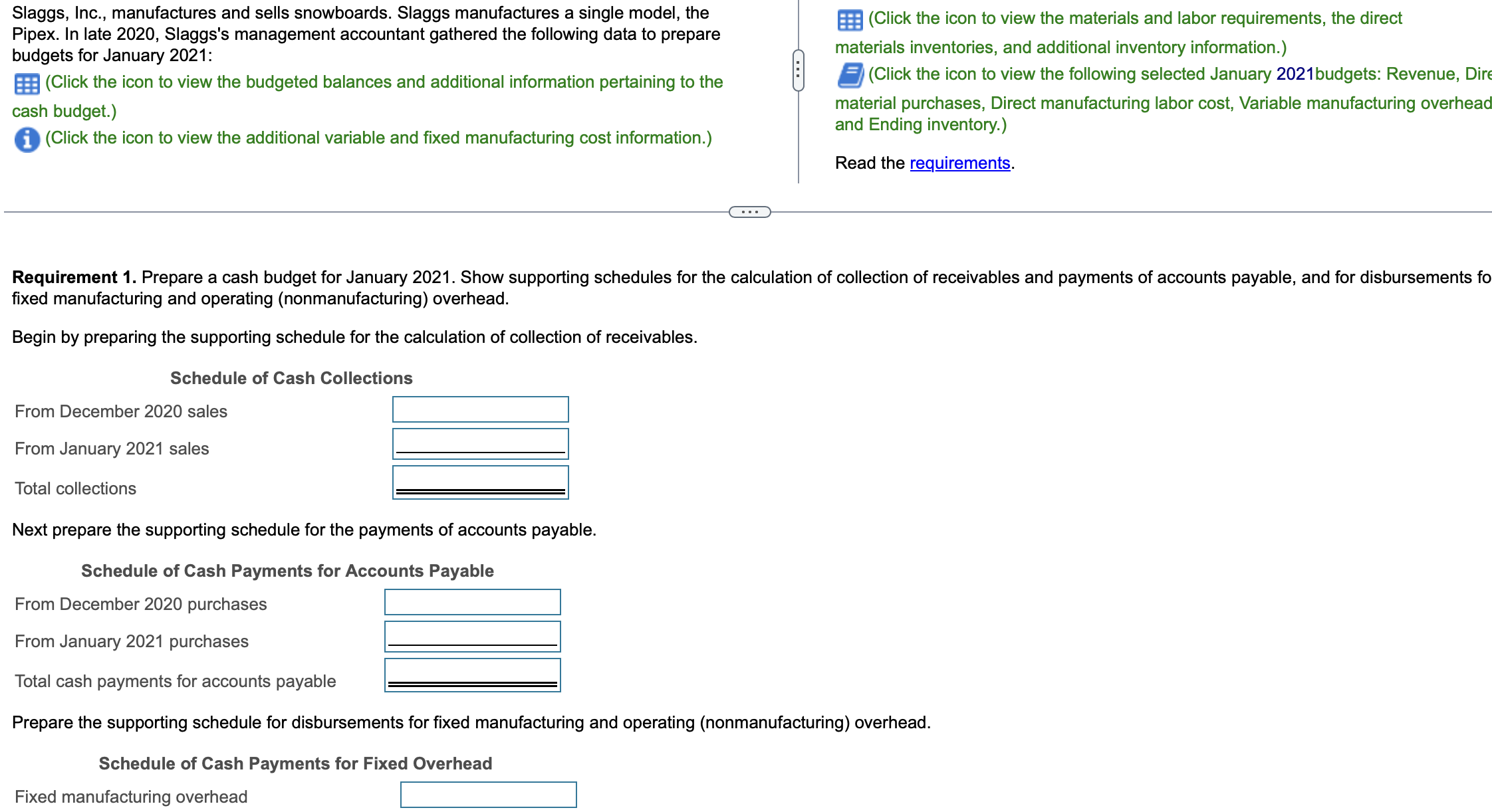

Requirement Prepare a cash budget for January Show supporting schedules for the calculation of collection of receivables and payments of accounts payable, and for disbursements fo

fixed manufacturing and operating nonmanufacturing overhead.

Begin by preparing the supporting schedule for the calculation of collection of receivables.

Schedule of Cash Collections

From December sales

From January sales

Total collections

Next prepare the supporting schedule for the payments of accounts payable.

Schedule of Cash Payments for Accounts Payable

From December purchases

From January purchases

Total cash payments for accounts payable

Prepare the supporting schedule for disbursements for fixed manufacturing and operating nonmanufacturing overhead.

Schedule of Cash Payments for Fixed Overhead

Fixed manufacturing overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started