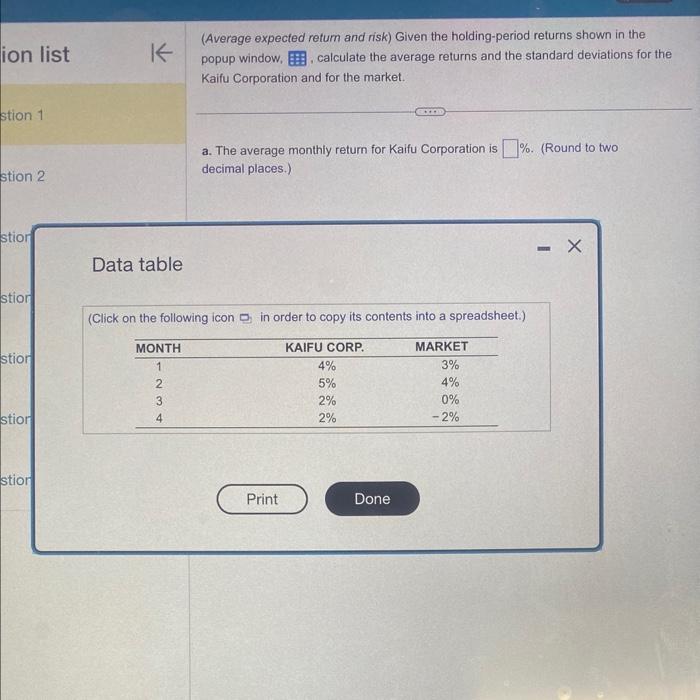

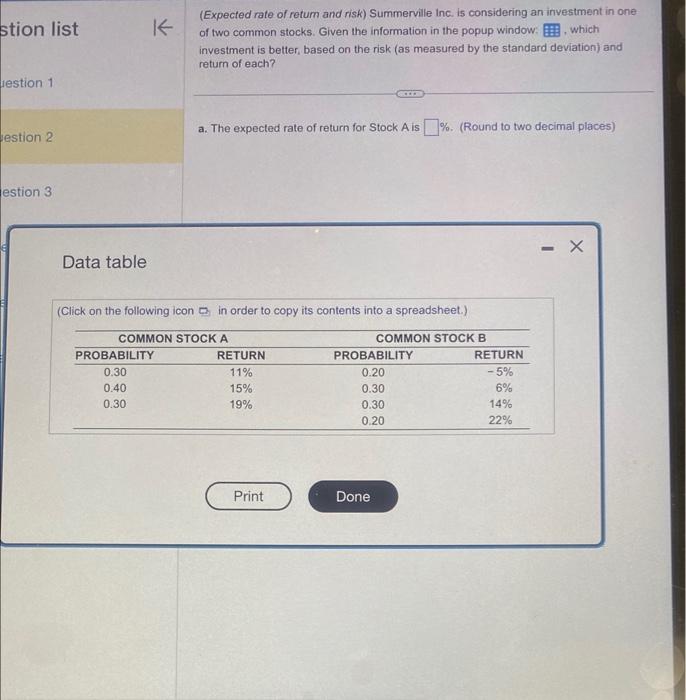

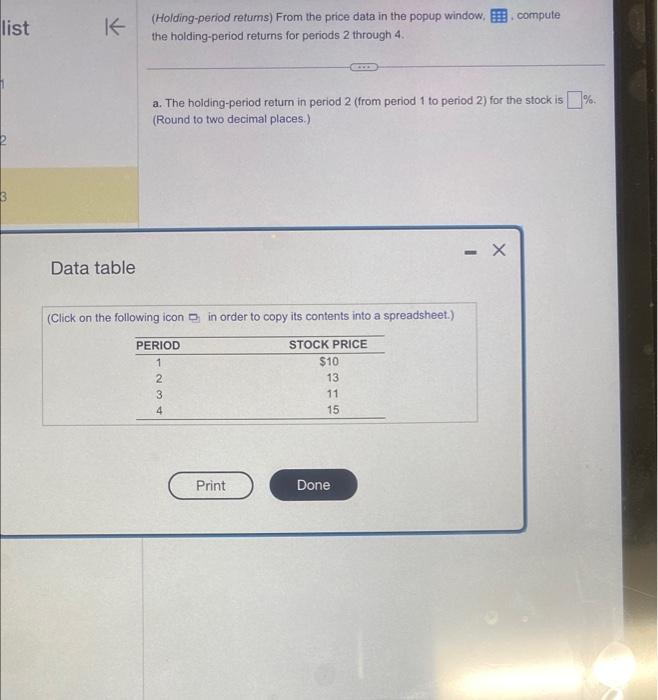

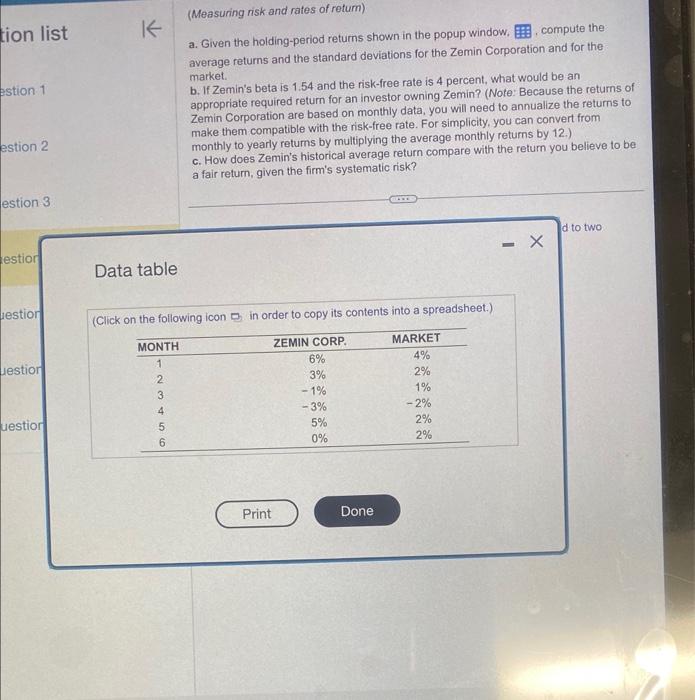

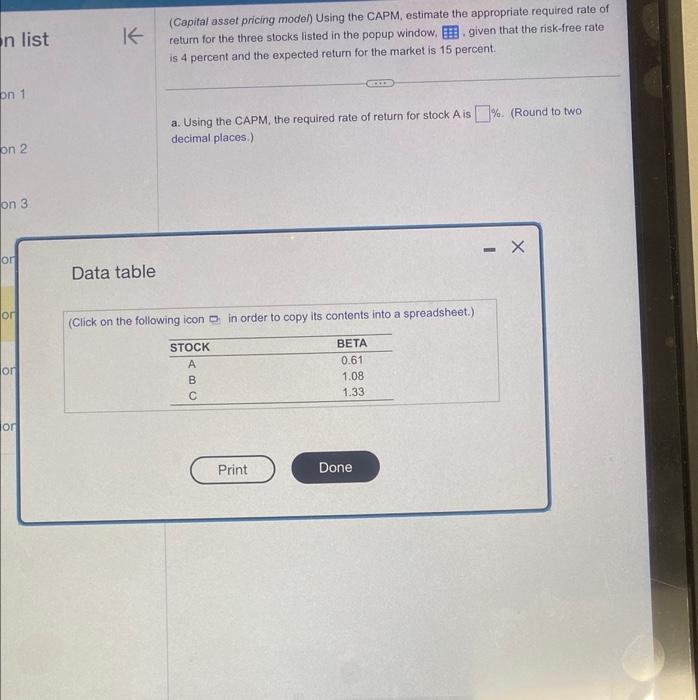

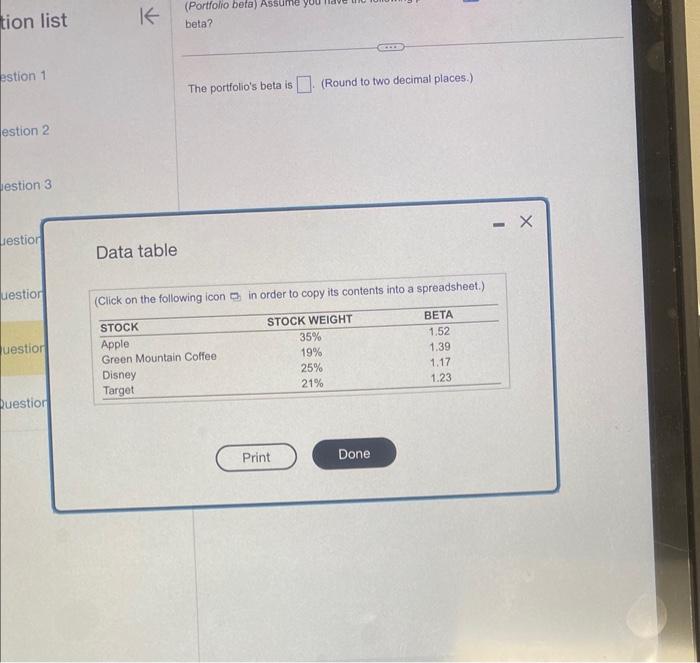

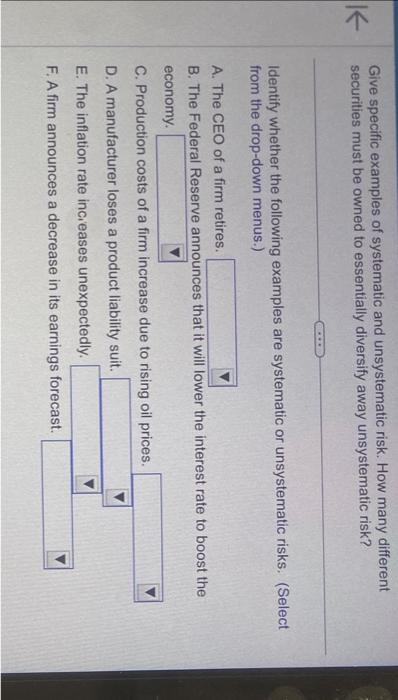

Data table (Click on the following icon D in order to copy its contents into a spreadsheet.) (Expected rate of retum and risk) Summerville inc. is considering an investment in one of two common stocks. Given the information in the popup window: , which investment is better, based on the risk (as measured by the standard deviation) and return of each? a. The expected rate of return for Stock A is \%. (Round to two decimal places) Data table (Click on the following icon Q in order to copy its contents into a spreadsheet.) (Holding-period retums) From the price data in the popup window. compute the holding-period returns for periods 2 through 4 . a. The holding-period retum in period 2 (from period 1 to period 2) for the stock is (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) (Measuring risk and rates of retum) a. Given the holding-period returns shown in the popup window, compute the average returns and the standard deviations for the Zemin Corporation and for the b. If Zemin's beta is 1.54 and the risk-free rate is 4 percent, what would be an market. appropriate required retum for an investor owning Zemin? (Note: Because the returns of Zemin Corporation are based on monthly data, you will need to annualize the returns to make them compatible with the risk-free rate. For simplicity, you can convert from monthly to yearly retums by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe to be a fair return, given the firm's systematic risk? Data table (Click on the following icon b in order to copy its contents into a spreadsheet.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) The portfolio's beta is (Round to two decimal places.) Data table ICliek on the following icon Th in order to copy its contents into a spreadsheet.) Give specific examples of systematic and unsystematic risk. How many different securities must be owned to essentially diversify away unsystematic risk? Identify whether the following examples are systematic or unsystematic risks. (Select from the drop-down menus.) A. The CEO of a firm retires. B. The Federal Reserve announces that it will lower the interest rate to boost the economy. C. Production costs of a firm increase due to rising oil prices. D. A manufacturer loses a product liability suit. E. The inflation rate incieases unexpectedly. F. A firm announces a decrease in its earnings forecast