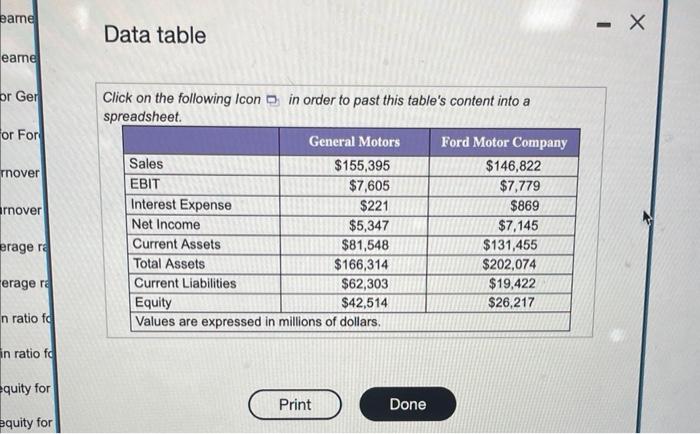

Data table Click on the following Icon in order to past this table's content into a sproadehant The times interest eamed rato for General Motors in (Round to fove decinw places) The times interest eamed ratio for Ford Motor Compacy it _[Round to four decimal places) The current ratio for General Motors is (Round to lour decimat places) The current ratio for Ford Molor Company is (Round to four decimal places.) The total asset tumover ratio for General Motors as (Round to four decimal places.) The total asset turnover fatio for Ford Motor Company in (Round to four decimal places.) The financial leverage rabo for General Motors is (Round to four decimisi places.) The financial leverage raso for Ford Motor Company is (Round to four deciral places) The profit margin rato for General Motors is \%. (Round to two decimal places.) The proft margin ratio for Ford Motor Company is 35. (Round to two decimal places) The retum on equity for General Motors is is. (Round to two decimal plases.) The retum on equify for Ford Motor Company is 1. (Round to two decimal places) Which company would you invest in, ether as a boncholder or as a stocithoiden? (Select from Fee drop-down meru) The best compeny to invest in appears to be The times interest eamed ratio for General Motors is (Round to four decimal places) The times interest eamed ratio for Ford Motor Company is (Round to fout decimal places) The current ratio for Ceneral Motors is (Round to four decimal places.) The current ratio for Ford Motor Company is (Round to four decimal places?) The total asset turnover ratio for General Mosors is (Round to four decimal places.) The total asset turnover ratio for Ford Motor Company is (Round to four decimal places) The financial leverage ratio for Genecal Motors is (Round to four decimal places.) The Enancial leverage ratio for Ford Motor Company is (Round to fout decimal places.) The profit margin ratio for General Molors is y. (Round to two decinal places). The proft margin rato for Ford Motor Company is 4. (Round to two decimal places.) The retum on equity for Genoral Motors is . The return on equity for Ford Motor Company is 5s. (Round to two decinal placess) Which company would you invest in, eithet as a bongholder or as a stockioldar? (5elect hom fhe drop-down menul) The best company to imvest in appears to be