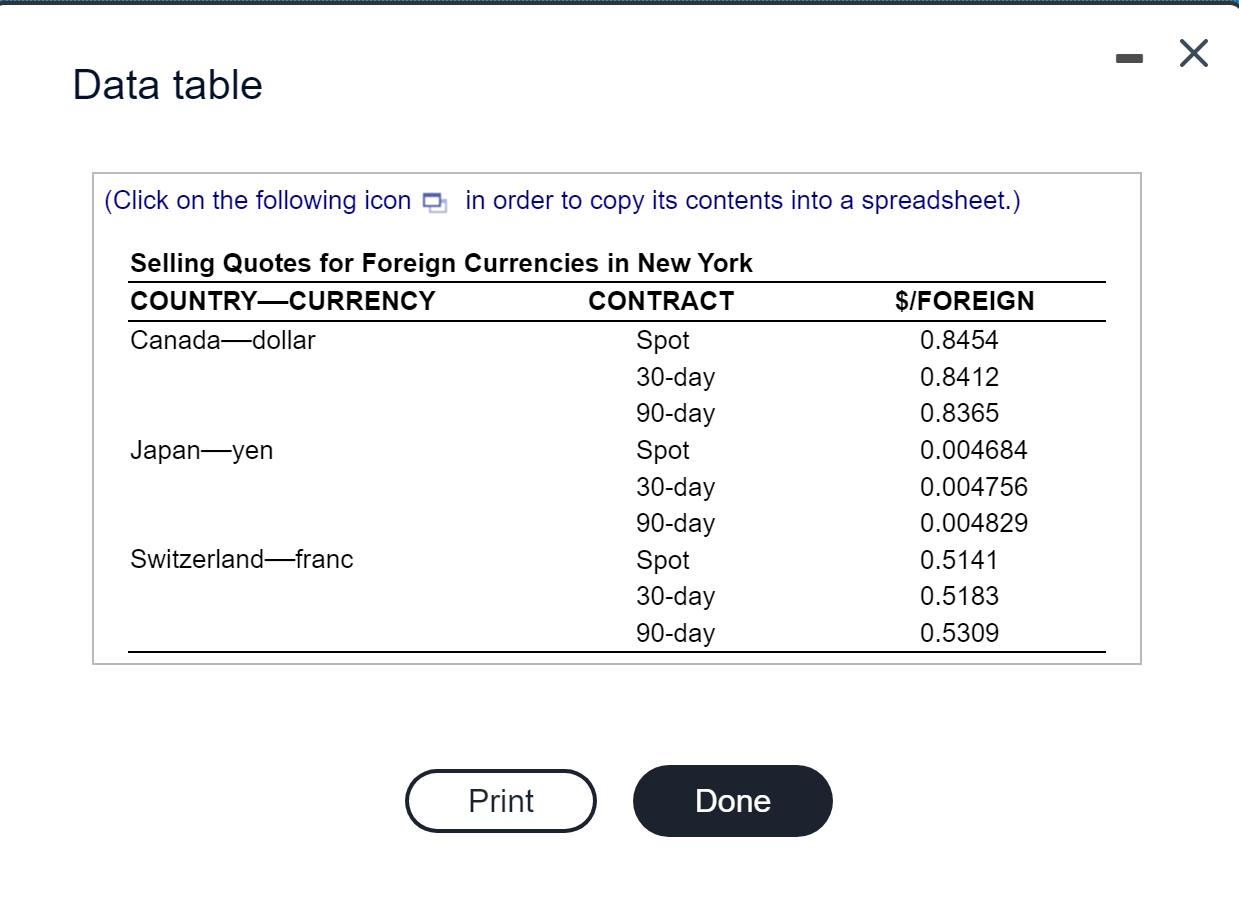

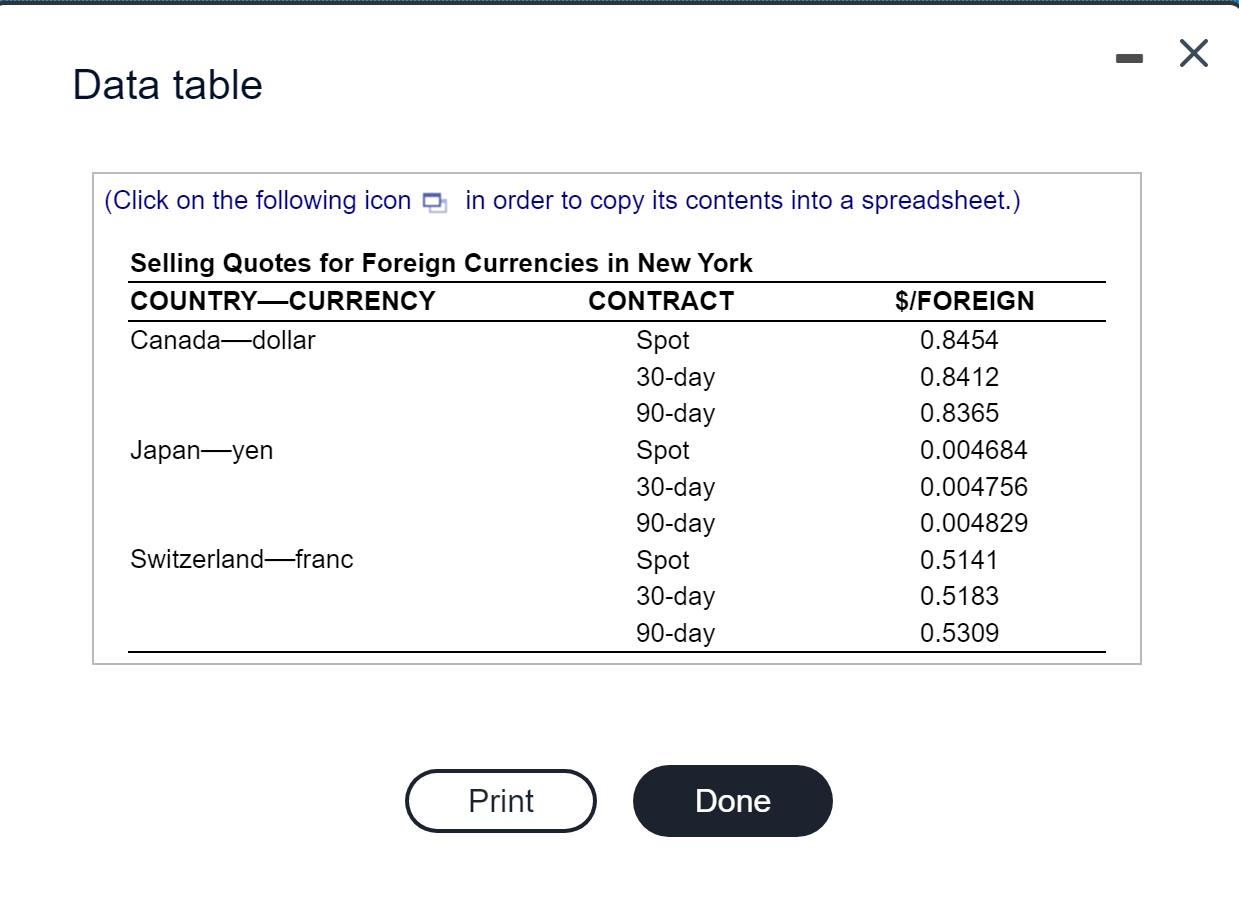

Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Selling Quotes for Foreign Currencies in New York COUNTRY/CURRENCY CONTRACT Canada-dollar Spot 30-day 90-day Japan-yen Spot 30-day 90-day Switzerland-franc Spot 30-day 90-day $/FOREIGN 0.8454 0.8412 0.8365 0.004684 0.004756 0.004829 0.5141 0.5183 0.5309 Print Done e. An American business needs to pay (i) 35,000 Canadian dollars, (ii) 1.2 million yen, and (iii) 50,000 Swiss francs to businesses abroad. What are the dollar payments to the respective countries? f. An American business pays $35,000, $5,000, and $12,000 to suppliers in, respectively, Japan, Switzerland, and Canada. How much, in local currencies, do the suppliers receive? Ignore contractual processing costs and international currency exchange fees. g. Compute the indirect quotes for the spot and forward Canadian dollar contracts. h. You own $10,000. The dollar spot rate in Tokyo is 216.7902. The yen rate in New York is given in the preceding table. Are arbitrage profits possible? Set up an arbitrage scheme with your capital. What is the gain (loss) in dollars? i. Compute the Canadian dollar/yen spot rate from the data in the preceding table. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Selling Quotes for Foreign Currencies in New York COUNTRY/CURRENCY CONTRACT Canada-dollar Spot 30-day 90-day Japan-yen Spot 30-day 90-day Switzerland-franc Spot 30-day 90-day $/FOREIGN 0.8454 0.8412 0.8365 0.004684 0.004756 0.004829 0.5141 0.5183 0.5309 Print Done e. An American business needs to pay (i) 35,000 Canadian dollars, (ii) 1.2 million yen, and (iii) 50,000 Swiss francs to businesses abroad. What are the dollar payments to the respective countries? f. An American business pays $35,000, $5,000, and $12,000 to suppliers in, respectively, Japan, Switzerland, and Canada. How much, in local currencies, do the suppliers receive? Ignore contractual processing costs and international currency exchange fees. g. Compute the indirect quotes for the spot and forward Canadian dollar contracts. h. You own $10,000. The dollar spot rate in Tokyo is 216.7902. The yen rate in New York is given in the preceding table. Are arbitrage profits possible? Set up an arbitrage scheme with your capital. What is the gain (loss) in dollars? i. Compute the Canadian dollar/yen spot rate from the data in the preceding table