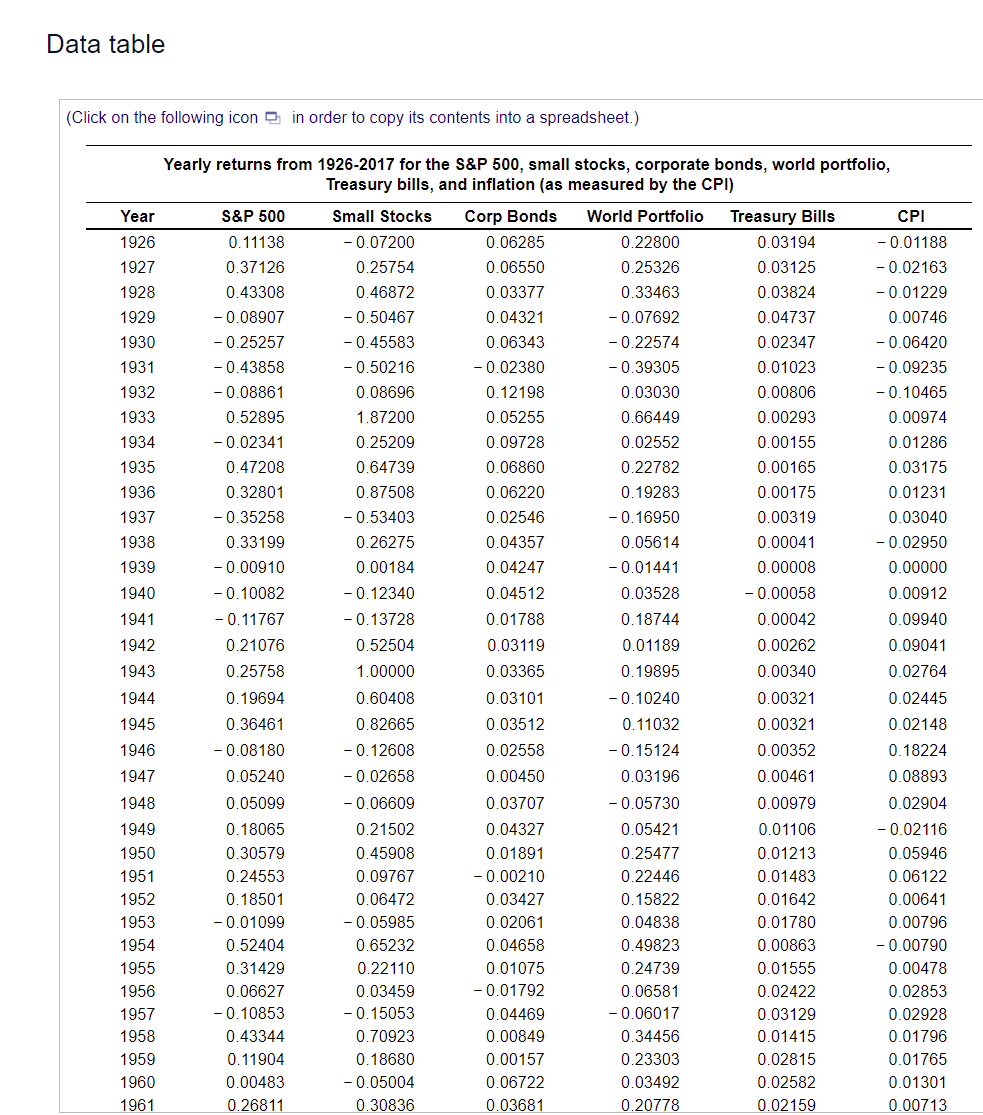

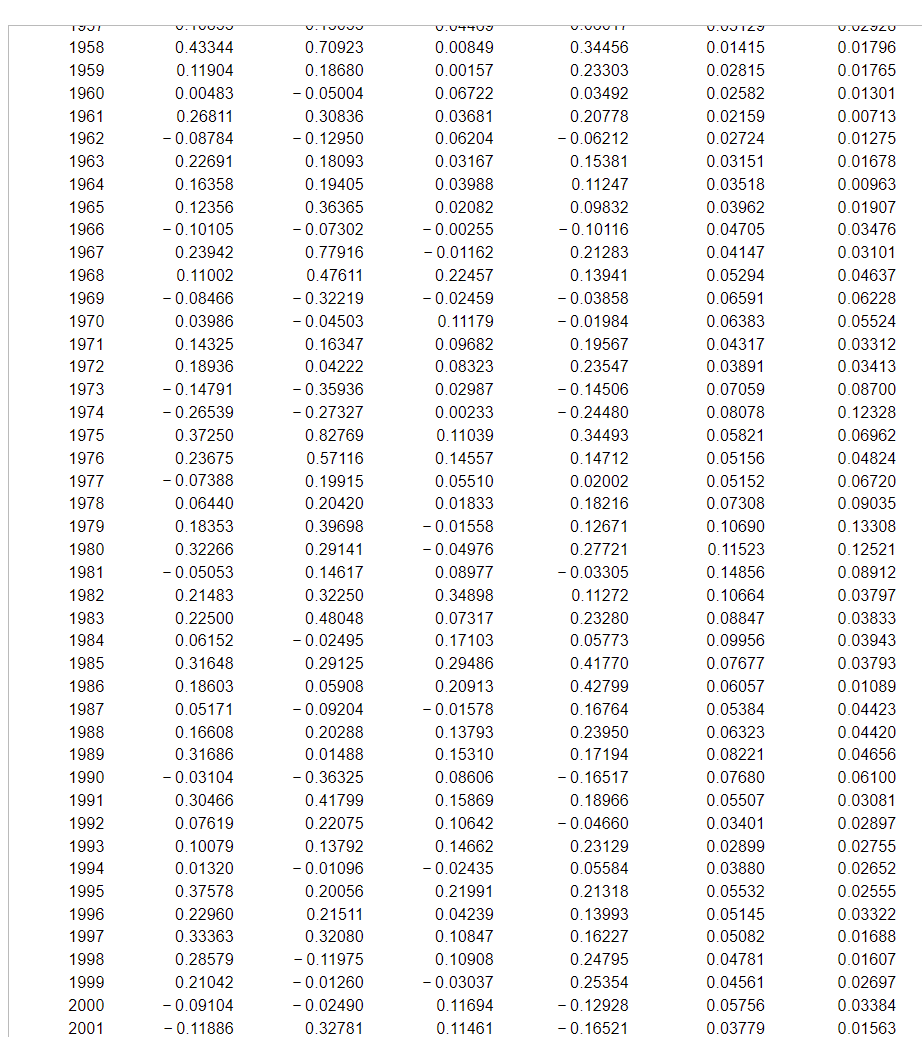

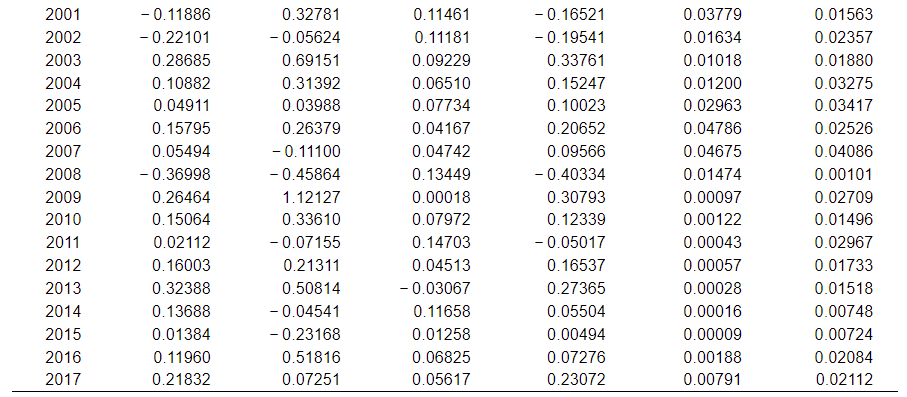

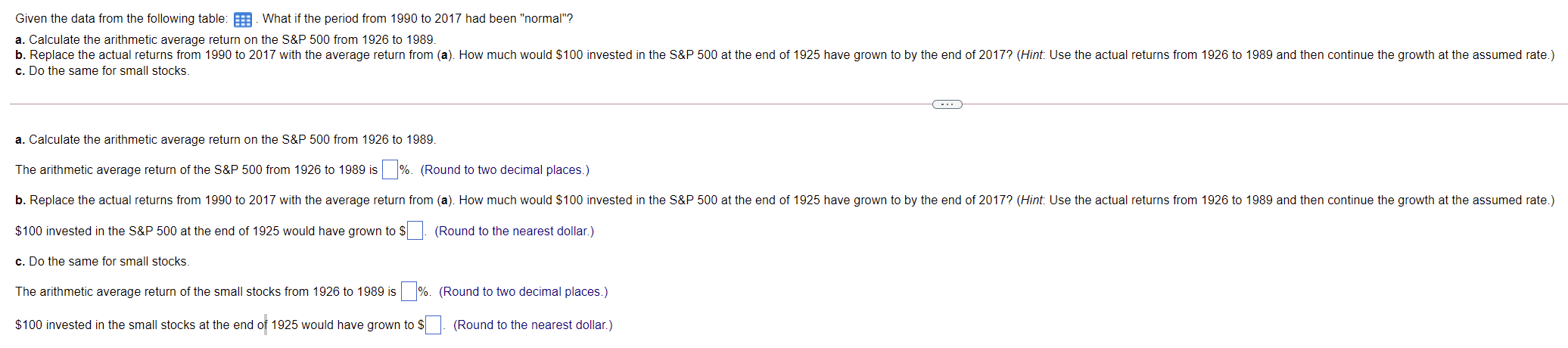

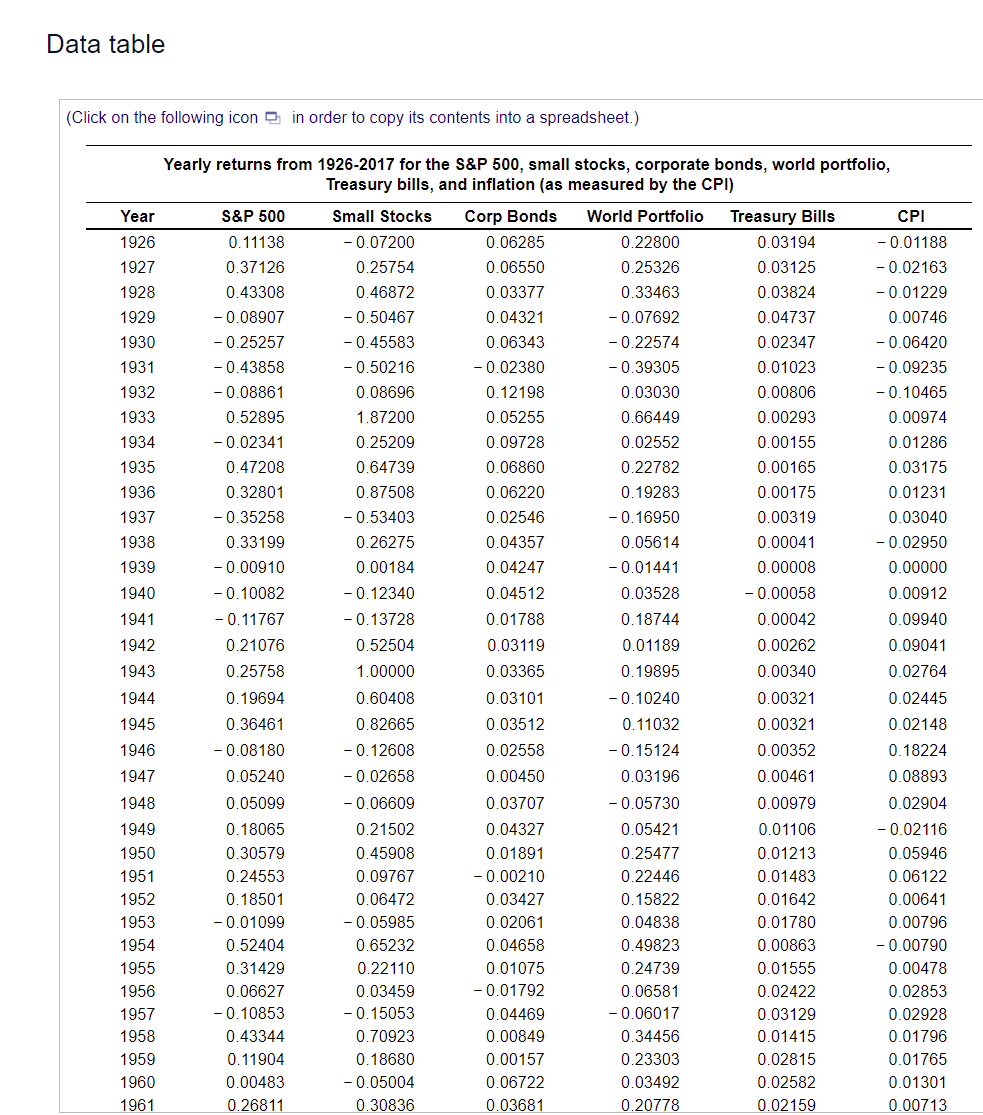

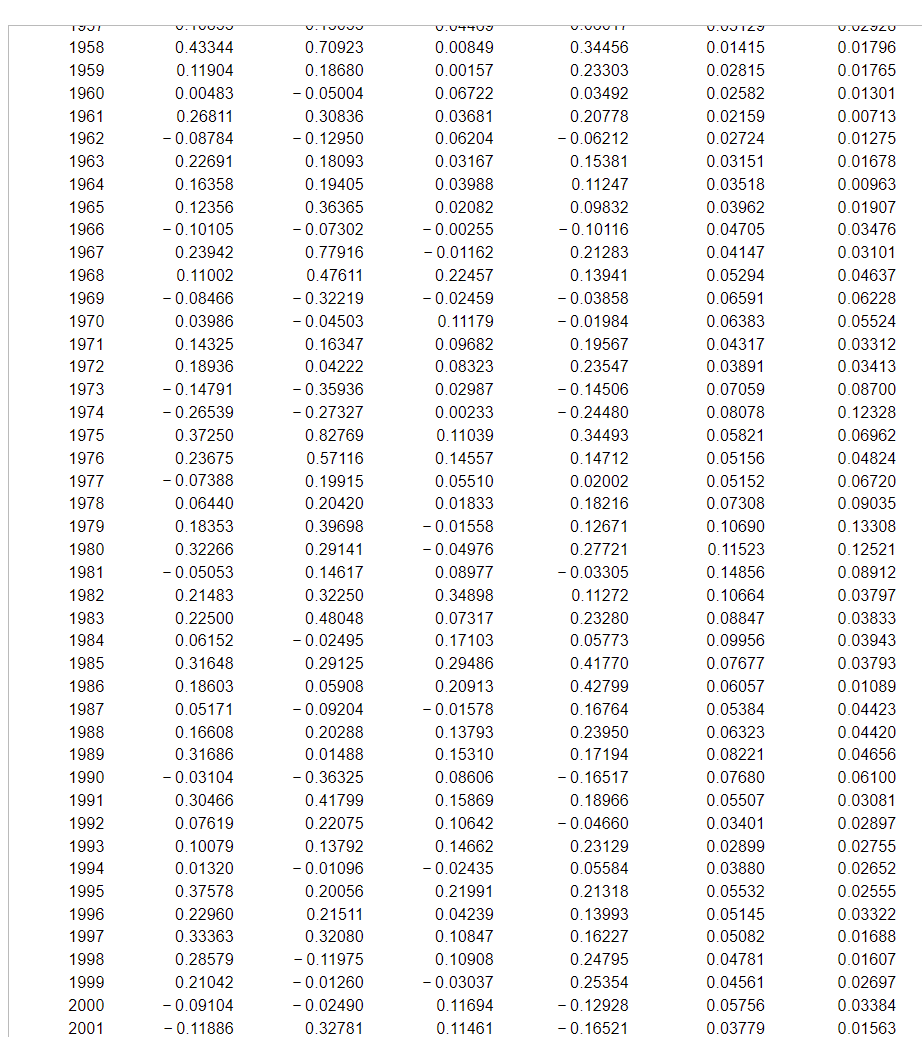

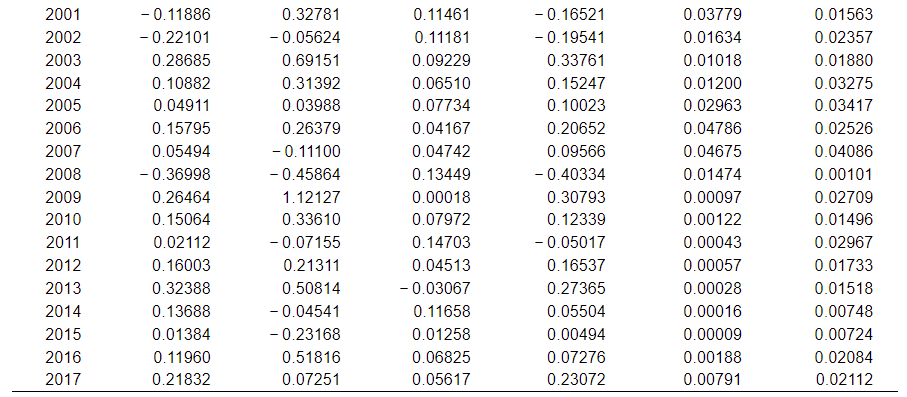

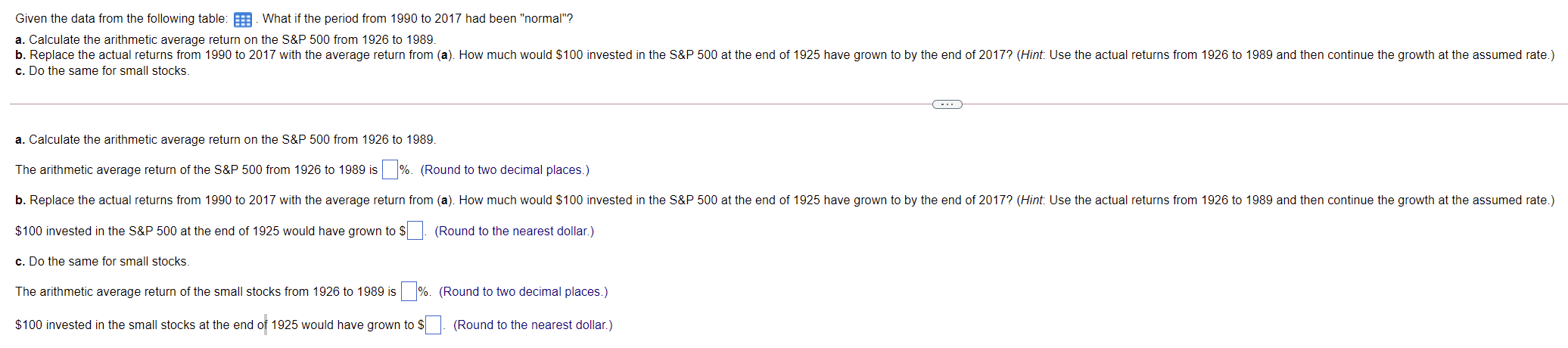

Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yearly returns from 1926-2017 for the S&P 500, small stocks, corporate bonds, world portfolio, Treasury bills, and inflation (as measured by the CPI) Year S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills CPI 1926 0.11138 -0.07200 0.06285 0.22800 0.03194 -0.01188 1927 0.37126 0.25754 0.06550 0.25326 0.03125 -0.02163 1928 0.43308 0.46872 0.03377 0.33463 0.03824 -0.01229 1929 -0.08907 -0.50467 0.04321 -0.07692 0.04737 0.00746 1930 -0.25257 -0.45583 0.06343 -0.22574 0.02347 -0.06420 1931 -0.43858 -0.50216 -0.02380 -0.39305 0.01023 -0.09235 1932 -0.08861 0.08696 0.12198 0.03030 0.00806 0.10465 1933 0.52895 1.87200 0.05255 0.66449 0.00293 0.00974 1934 -0.02341 0.25209 0.09728 0.02552 0.00155 0.01286 1935 0.47208 0.64739 0.06860 0.22782 0.00165 0.03175 1936 0.32801 0.87508 0.06220 0.19283 0.00175 0.01231 1937 -0.35258 -0.53403 0.02546 0.16950 0.00319 0.03040 1938 0.33199 0.26275 0.04357 0.05614 0.00041 -0.02950 1939 -0.00910 0.00184 0.04247 -0.01441 0.00008 0.00000 1940 -0.10082 -0.12340 0.04512 0.03528 -0.00058 0.00912 1941 -0.11767 -0.13728 0.01788 0.18744 0.00042 0.09940 1942 0.21076 0.52504 0.03119 0.01189 0.00262 0.09041 1943 0.25758 1.00000 0.03365 0.19895 0.00340 0.02764 1944 0.19694 0.60408 0.03101 -0.10240 0.00321 0.02445 1945 0.36461 0.82665 0.03512 0.11032 0.00321 0.02148 1946 -0.08180 -0.12608 0.02558 - 0.15124 0.00352 0.18224 1947 0.05240 -0.02658 0.00450 0.03196 0.00461 0.08893 1948 0.05099 -0.06609 0.03707 -0.05730 0.00979 0.02904 1949 0.18065 0.21502 0.04327 0.05421 0.01106 -0.02116 1950 0.30579 0.45908 0.01891 0.25477 0.01213 0.05946 1951 0.24553 0.09767 -0.00210 0.22446 0.01483 0.06122 1952 0.18501 0.06472 0.03427 0.15822 0.01642 0.00641 1953 -0.01099 -0.05985 0.02061 0.04838 0.01780 0.00796 1954 0.52404 0.65232 0.04658 0.49823 0.00863 0.00790 1955 0.31429 0.22110 0.01075 0.24739 0.01555 0.00478 1956 0.06627 0.03459 -0.01792 0.06581 0.02422 0.02853 1957 -0.10853 -0.15053 0.04469 -0.06017 0.03129 0.02928 1958 0.43344 0.70923 0.00849 0.34456 0.01415 0.01796 1959 0.11904 0.18680 0.00157 0.23303 0.02815 0.01765 1960 0.00483 -0.05004 0.06722 0.03492 0.02582 0.01301 1961 0.26811 0.30836 0.03681 0.20778 0.02159 0.00713 U.TUUUU V.VUUT! TJUT 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 0.43344 0.11904 0.00483 0.26811 -0.08784 0.22691 0.16358 0.12356 -0.10105 0.23942 0.11002 -0.08466 0.03986 0.14325 0.18936 -0.14791 -0.26539 0.37250 0.23675 0.07388 0.06440 0.18353 0.32266 -0.05053 0.21483 0.22500 0.06152 0.31648 0.18603 0.05171 0.16608 0.31686 -0.03104 0.30466 0.07619 0.10079 0.01320 0.37578 0.22960 0.33363 0.28579 0.21042 -0.09104 -0.11886 V.TV 0.70923 0.18680 -0.05004 0.30836 0.12950 0.18093 0.19405 0.36365 -0.07302 0.77916 0.47611 -0.32219 -0.04503 0.16347 0.04222 -0.35936 -0.27327 0.82769 0.57116 0.19915 0.20420 0.39698 0.29141 0.14617 0.32250 0.48048 -0.02495 0.29125 0.05908 0.09204 0.20288 0.01488 0.36325 0.41799 0.22075 0.13792 -0.01096 0.20056 0.21511 0.32080 - 0.11975 -0.01260 -0.02490 0.32781 V.04409 0.00849 0.00157 0.06722 0.03681 0.06204 0.03167 0.03988 0.02082 -0.00255 -0.01162 0.22457 -0.02459 0.11179 0.09682 0.08323 0.02987 0.00233 0.11039 0.14557 0.05510 0.01833 -0.01558 -0.04976 0.08977 0.34898 0.07317 0.17103 0.29486 0.20913 -0.01578 0.13793 0.15310 0.08606 0.15869 0.10642 0.14662 -0.02435 0.21991 0.04239 0.10847 0.10908 -0.03037 0.11694 0.11461 0.34456 0.23303 0.03492 0.20778 -0.06212 0.15381 0.11247 0.09832 - 0.10116 0.21283 0.13941 -0.03858 -0.01984 0.19567 0.23547 -0.14506 -0.24480 0.34493 0.14712 0.02002 0.18216 0.12671 0.27721 -0.03305 0.11272 0.23280 0.05773 0.41770 0.42799 0.16764 0.23950 0.17194 -0.16517 0.18966 -0.04660 0.23129 0.05584 0.21318 0.13993 0.16227 0.24795 0.25354 -0.12928 -0.16521 V.UJIZO 0.01415 0.02815 0.02582 0.02159 0.02724 0.03151 0.03518 0.03962 0.04705 0.04147 0.05294 0.06591 0.06383 0.04317 0.03891 0.07059 0.08078 0.05821 0.05156 0.05152 0.07308 0.10690 0.11523 0.14856 0.10664 0.08847 0.09956 0.07677 0.06057 0.05384 0.06323 0.08221 0.07680 0.05507 0.03401 0.02899 0.03880 0.05532 0.05145 0.05082 0.04781 0.04561 0.05756 0.03779 V.UZIZU 0.01796 0.01765 0.01301 0.00713 0.01275 0.01678 0.00963 0.01907 0.03476 0.03101 0.04637 0.06228 0.05524 0.03312 0.03413 0.08700 0.12328 0.06962 0.04824 0.06720 0.09035 0.13308 0.12521 0.08912 0.03797 0.03833 0.03943 0.03793 0.01089 0.04423 0.04420 0.04656 0.06100 0.03081 0.02897 0.02755 0.02652 0.02555 0.03322 0.01688 0.01607 0.02697 0.03384 0.01563 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 - 0.11886 -0.22101 0.28685 0.10882 0.04911 0.15795 0.05494 -0.36998 0.26464 0.15064 0.02112 0.16003 0.32388 0.13688 0.01384 0.11960 0.21832 0.32781 -0.05624 0.69151 0.31392 0.03988 0.26379 -0.11100 -0.45864 1.12127 0.33610 -0.07155 0.21311 0.50814 -0.04541 -0.23168 0.51816 0.07251 0.11461 0.11181 0.09229 0.06510 0.07734 0.04167 0.04742 0.13449 0.00018 0.07972 0.14703 0.04513 -0.03067 0.11658 0.01258 0.06825 0.05617 -0.16521 -0.19541 0.33761 0.15247 0.10023 0.20652 0.09566 -0.40334 0.30793 0.12339 -0.05017 0.16537 0.27365 0.05504 0.00494 0.07276 0.23072 0.03779 0.01634 0.01018 0.01200 0.02963 0.04786 0.04675 0.01474 0.00097 0.00122 0.00043 0.00057 0.00028 0.00016 0.00009 0.00188 0.00791 0.01563 0.02357 0.01880 0.03275 0.03417 0.02526 0.04086 0.00101 0.02709 0.01496 0.02967 0.01733 0.01518 0.00748 0.00724 0.02084 0.02112 Given the data from the following table: What if the period from 1990 to 2017 had been "normal"? a. Calculate the arithmetic average return on the S&P 500 from 1926 to 1989. b. Replace the actual returns from 1990 to 2017 with the average return from (a). How much would $100 invested in the S&P 500 at the end of 1925 have grown to by the end of 2017? (Hint: Use the actual returns from 1926 to 1989 and then continue the growth at the assumed rate.) c. Do the same for small stocks. a. Calculate the arithmetic average return on the S&P 500 from 1926 to 1989. The arithmetic average return of the S&P 500 from 1926 to 1989 is %. (Round to two decimal places.) b. Replace the actual returns from 1990 to 2017 with the average return from (a). How much would $100 invested in the S&P 500 at the end of 1925 have grown to by the end of 2017? (Hint: Use the actual returns from 1926 to 1989 and then continue the growth at the assumed rate.) $100 invested in the S&P 500 at the end of 1925 would have grown to $ . (Round to the nearest dollar.) c. Do the same for small stocks. The arithmetic average return of the small stocks from 1926 to 1989 is %. (Round to two decimal places.) $100 invested in the small stocks at the end of 1925 would have grown to $ (Round to the nearest dollar.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yearly returns from 1926-2017 for the S&P 500, small stocks, corporate bonds, world portfolio, Treasury bills, and inflation (as measured by the CPI) Year S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills CPI 1926 0.11138 -0.07200 0.06285 0.22800 0.03194 -0.01188 1927 0.37126 0.25754 0.06550 0.25326 0.03125 -0.02163 1928 0.43308 0.46872 0.03377 0.33463 0.03824 -0.01229 1929 -0.08907 -0.50467 0.04321 -0.07692 0.04737 0.00746 1930 -0.25257 -0.45583 0.06343 -0.22574 0.02347 -0.06420 1931 -0.43858 -0.50216 -0.02380 -0.39305 0.01023 -0.09235 1932 -0.08861 0.08696 0.12198 0.03030 0.00806 0.10465 1933 0.52895 1.87200 0.05255 0.66449 0.00293 0.00974 1934 -0.02341 0.25209 0.09728 0.02552 0.00155 0.01286 1935 0.47208 0.64739 0.06860 0.22782 0.00165 0.03175 1936 0.32801 0.87508 0.06220 0.19283 0.00175 0.01231 1937 -0.35258 -0.53403 0.02546 0.16950 0.00319 0.03040 1938 0.33199 0.26275 0.04357 0.05614 0.00041 -0.02950 1939 -0.00910 0.00184 0.04247 -0.01441 0.00008 0.00000 1940 -0.10082 -0.12340 0.04512 0.03528 -0.00058 0.00912 1941 -0.11767 -0.13728 0.01788 0.18744 0.00042 0.09940 1942 0.21076 0.52504 0.03119 0.01189 0.00262 0.09041 1943 0.25758 1.00000 0.03365 0.19895 0.00340 0.02764 1944 0.19694 0.60408 0.03101 -0.10240 0.00321 0.02445 1945 0.36461 0.82665 0.03512 0.11032 0.00321 0.02148 1946 -0.08180 -0.12608 0.02558 - 0.15124 0.00352 0.18224 1947 0.05240 -0.02658 0.00450 0.03196 0.00461 0.08893 1948 0.05099 -0.06609 0.03707 -0.05730 0.00979 0.02904 1949 0.18065 0.21502 0.04327 0.05421 0.01106 -0.02116 1950 0.30579 0.45908 0.01891 0.25477 0.01213 0.05946 1951 0.24553 0.09767 -0.00210 0.22446 0.01483 0.06122 1952 0.18501 0.06472 0.03427 0.15822 0.01642 0.00641 1953 -0.01099 -0.05985 0.02061 0.04838 0.01780 0.00796 1954 0.52404 0.65232 0.04658 0.49823 0.00863 0.00790 1955 0.31429 0.22110 0.01075 0.24739 0.01555 0.00478 1956 0.06627 0.03459 -0.01792 0.06581 0.02422 0.02853 1957 -0.10853 -0.15053 0.04469 -0.06017 0.03129 0.02928 1958 0.43344 0.70923 0.00849 0.34456 0.01415 0.01796 1959 0.11904 0.18680 0.00157 0.23303 0.02815 0.01765 1960 0.00483 -0.05004 0.06722 0.03492 0.02582 0.01301 1961 0.26811 0.30836 0.03681 0.20778 0.02159 0.00713 U.TUUUU V.VUUT! TJUT 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 0.43344 0.11904 0.00483 0.26811 -0.08784 0.22691 0.16358 0.12356 -0.10105 0.23942 0.11002 -0.08466 0.03986 0.14325 0.18936 -0.14791 -0.26539 0.37250 0.23675 0.07388 0.06440 0.18353 0.32266 -0.05053 0.21483 0.22500 0.06152 0.31648 0.18603 0.05171 0.16608 0.31686 -0.03104 0.30466 0.07619 0.10079 0.01320 0.37578 0.22960 0.33363 0.28579 0.21042 -0.09104 -0.11886 V.TV 0.70923 0.18680 -0.05004 0.30836 0.12950 0.18093 0.19405 0.36365 -0.07302 0.77916 0.47611 -0.32219 -0.04503 0.16347 0.04222 -0.35936 -0.27327 0.82769 0.57116 0.19915 0.20420 0.39698 0.29141 0.14617 0.32250 0.48048 -0.02495 0.29125 0.05908 0.09204 0.20288 0.01488 0.36325 0.41799 0.22075 0.13792 -0.01096 0.20056 0.21511 0.32080 - 0.11975 -0.01260 -0.02490 0.32781 V.04409 0.00849 0.00157 0.06722 0.03681 0.06204 0.03167 0.03988 0.02082 -0.00255 -0.01162 0.22457 -0.02459 0.11179 0.09682 0.08323 0.02987 0.00233 0.11039 0.14557 0.05510 0.01833 -0.01558 -0.04976 0.08977 0.34898 0.07317 0.17103 0.29486 0.20913 -0.01578 0.13793 0.15310 0.08606 0.15869 0.10642 0.14662 -0.02435 0.21991 0.04239 0.10847 0.10908 -0.03037 0.11694 0.11461 0.34456 0.23303 0.03492 0.20778 -0.06212 0.15381 0.11247 0.09832 - 0.10116 0.21283 0.13941 -0.03858 -0.01984 0.19567 0.23547 -0.14506 -0.24480 0.34493 0.14712 0.02002 0.18216 0.12671 0.27721 -0.03305 0.11272 0.23280 0.05773 0.41770 0.42799 0.16764 0.23950 0.17194 -0.16517 0.18966 -0.04660 0.23129 0.05584 0.21318 0.13993 0.16227 0.24795 0.25354 -0.12928 -0.16521 V.UJIZO 0.01415 0.02815 0.02582 0.02159 0.02724 0.03151 0.03518 0.03962 0.04705 0.04147 0.05294 0.06591 0.06383 0.04317 0.03891 0.07059 0.08078 0.05821 0.05156 0.05152 0.07308 0.10690 0.11523 0.14856 0.10664 0.08847 0.09956 0.07677 0.06057 0.05384 0.06323 0.08221 0.07680 0.05507 0.03401 0.02899 0.03880 0.05532 0.05145 0.05082 0.04781 0.04561 0.05756 0.03779 V.UZIZU 0.01796 0.01765 0.01301 0.00713 0.01275 0.01678 0.00963 0.01907 0.03476 0.03101 0.04637 0.06228 0.05524 0.03312 0.03413 0.08700 0.12328 0.06962 0.04824 0.06720 0.09035 0.13308 0.12521 0.08912 0.03797 0.03833 0.03943 0.03793 0.01089 0.04423 0.04420 0.04656 0.06100 0.03081 0.02897 0.02755 0.02652 0.02555 0.03322 0.01688 0.01607 0.02697 0.03384 0.01563 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 - 0.11886 -0.22101 0.28685 0.10882 0.04911 0.15795 0.05494 -0.36998 0.26464 0.15064 0.02112 0.16003 0.32388 0.13688 0.01384 0.11960 0.21832 0.32781 -0.05624 0.69151 0.31392 0.03988 0.26379 -0.11100 -0.45864 1.12127 0.33610 -0.07155 0.21311 0.50814 -0.04541 -0.23168 0.51816 0.07251 0.11461 0.11181 0.09229 0.06510 0.07734 0.04167 0.04742 0.13449 0.00018 0.07972 0.14703 0.04513 -0.03067 0.11658 0.01258 0.06825 0.05617 -0.16521 -0.19541 0.33761 0.15247 0.10023 0.20652 0.09566 -0.40334 0.30793 0.12339 -0.05017 0.16537 0.27365 0.05504 0.00494 0.07276 0.23072 0.03779 0.01634 0.01018 0.01200 0.02963 0.04786 0.04675 0.01474 0.00097 0.00122 0.00043 0.00057 0.00028 0.00016 0.00009 0.00188 0.00791 0.01563 0.02357 0.01880 0.03275 0.03417 0.02526 0.04086 0.00101 0.02709 0.01496 0.02967 0.01733 0.01518 0.00748 0.00724 0.02084 0.02112 Given the data from the following table: What if the period from 1990 to 2017 had been "normal"? a. Calculate the arithmetic average return on the S&P 500 from 1926 to 1989. b. Replace the actual returns from 1990 to 2017 with the average return from (a). How much would $100 invested in the S&P 500 at the end of 1925 have grown to by the end of 2017? (Hint: Use the actual returns from 1926 to 1989 and then continue the growth at the assumed rate.) c. Do the same for small stocks. a. Calculate the arithmetic average return on the S&P 500 from 1926 to 1989. The arithmetic average return of the S&P 500 from 1926 to 1989 is %. (Round to two decimal places.) b. Replace the actual returns from 1990 to 2017 with the average return from (a). How much would $100 invested in the S&P 500 at the end of 1925 have grown to by the end of 2017? (Hint: Use the actual returns from 1926 to 1989 and then continue the growth at the assumed rate.) $100 invested in the S&P 500 at the end of 1925 would have grown to $ . (Round to the nearest dollar.) c. Do the same for small stocks. The arithmetic average return of the small stocks from 1926 to 1989 is %. (Round to two decimal places.) $100 invested in the small stocks at the end of 1925 would have grown to $ (Round to the nearest dollar.)