Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Operating cash inflows Strong

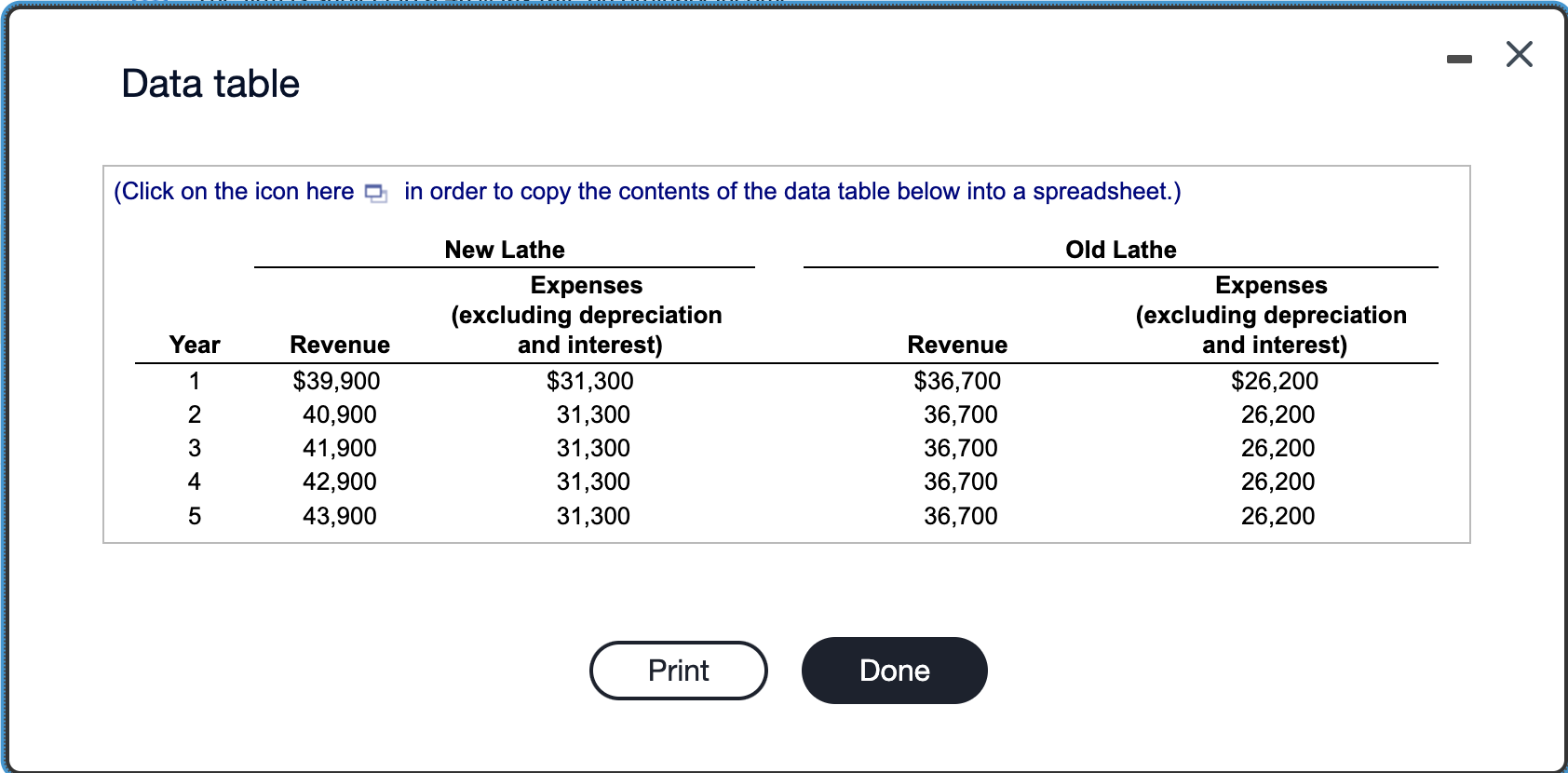

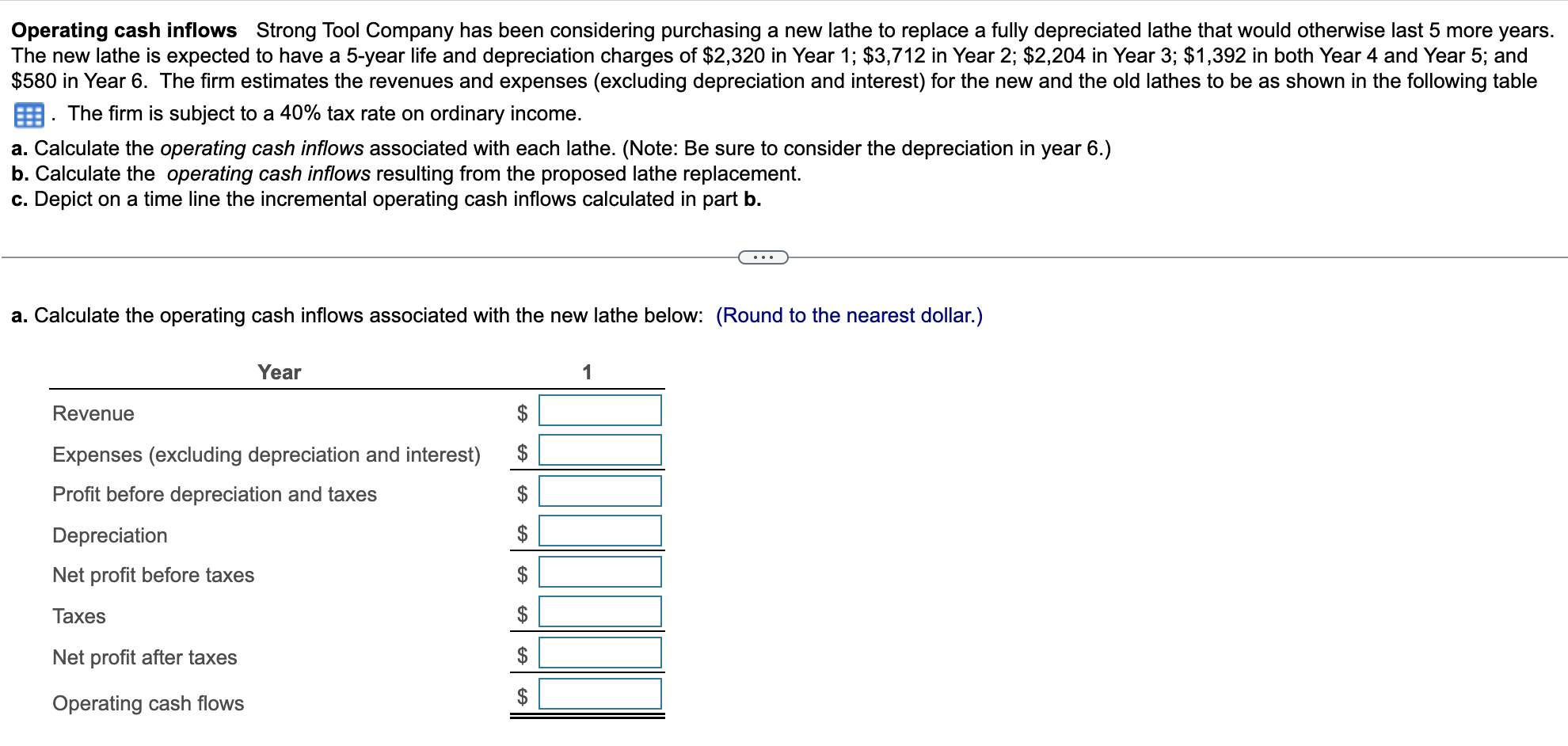

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Operating cash inflows Strong Tool Company has been considering purchasing a new lathe to replace a fully depreciated lathe that would otherwise last 5 more years. The new lathe is expected to have a 5-year life and depreciation charges of $2,320 in Year 1; $3,712 in Year 2; $2,204 in Year 3; $1,392 in both Year 4 and Year 5; and $580 in Year 6 . The firm estimates the revenues and expenses (excluding depreciation and interest) for the new and the old lathes to be as shown in the following table The firm is subject to a 40% tax rate on ordinary income. a. Calculate the operating cash inflows associated with each lathe. (Note: Be sure to consider the depreciation in year 6 .) b. Calculate the operating cash inflows resulting from the proposed lathe replacement. c. Depict on a time line the incremental operating cash inflows calculated in part b. a. Calculate the operating cash inflows associated with the new lathe below: (Round to the nearest dollar.)

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Operating cash inflows Strong Tool Company has been considering purchasing a new lathe to replace a fully depreciated lathe that would otherwise last 5 more years. The new lathe is expected to have a 5-year life and depreciation charges of $2,320 in Year 1; $3,712 in Year 2; $2,204 in Year 3; $1,392 in both Year 4 and Year 5; and $580 in Year 6 . The firm estimates the revenues and expenses (excluding depreciation and interest) for the new and the old lathes to be as shown in the following table The firm is subject to a 40% tax rate on ordinary income. a. Calculate the operating cash inflows associated with each lathe. (Note: Be sure to consider the depreciation in year 6 .) b. Calculate the operating cash inflows resulting from the proposed lathe replacement. c. Depict on a time line the incremental operating cash inflows calculated in part b. a. Calculate the operating cash inflows associated with the new lathe below: (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started